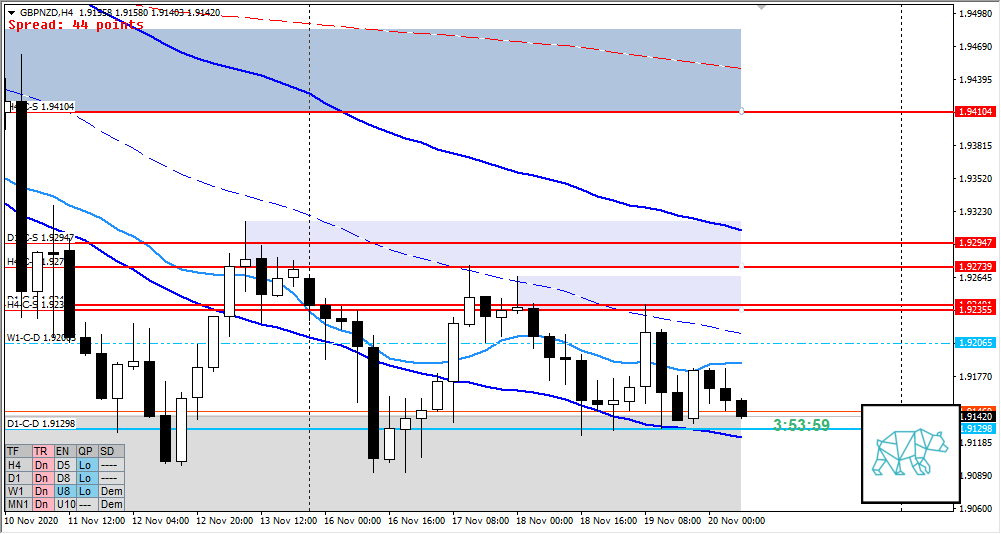

20 Nov Premarket Prep GBPNZD 11202020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Don’t take trades where SL placement is suboptimal. Instead, reassess for a better entry if possible.

Compared against Weekly Trading Plan

- Price arrived at and is trading diving deeper into demand W1-C‑D 1.92065 but still have 2 days to go

Non-conjecture observations of the market

- Price action

- D1 Phase 1 / 3 (more likely 1 but with overall markets repositioning I will wait for a break from range) continues with newly formed inside bar with long selling wick (after reacting off D1-C‑S 1.92401) at the bottom of the range

- H4 Phase 1 / 3, H4 50MA at H4/D1 supplies has held up well as did underlying demand. Both tested multiple times. Triangle formation narrowing nearing apex.

- Market Profile

- Wide VA created. Bracketing continues.

- ADR: 1412

- ASR: 972

- 25

- Day

- Yesterday’s High @ D1-C‑S 1.92404

- Yesterday’s Low @ D1-C‑D 1.91298

Sentiment

- Locations

- Overall ranging market. Trade extremes.

- Sentiment

- LN open

- Below Value, Inside Range

- Open distance to value

- 0.1xASR

- Sentiment

- Moderate Imbalance. Overall market is ranging though. Price trading at M30 QLo above D1-C‑D 1.91298 and due to close proximity to VAL we might see another scenario like yesterday play out with which I will look for more confirmation using the M15/H1 combo. Having said that since we have been ranging for a while and VAs been expanding and retracing, as well as possible nearing the apex of a triangle, and it being a Friday, we might see a break. Might…

- LN open

- Clarity (1–5, 5 being best)

- 3

- Hypo 1 — Swing Reversal (long)

- Preferred: Bullish PA, IB extension up, sustained auction, early value acceptance

- Hypo 2 — Return to Value

- Preferred: deep close into D1 demand with sustained auction after IB extension down.

Additional notes

- Thursday & Friday

- ECB President Lagarde Speaks

ZOIs for Possible Shorts

- D1-C‑S 1.92947

- H4-C‑S 1.92739

- D1-C‑S 1.92401

- H4-C‑S 1.92355

ZOIs for Possible Long

- D1-C‑D 1.91298

Mindful Trading

- Feeling okay. Didn’t really have the full focus on trading this week (apart from Monday) due to personal life getting in the way. Practising feeling okay to not trade is still one of my Monthly goals. Feel I am doing pretty good with this. The markets aren’t going anywhere. Today, I might have to skip again.

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments