19 Nov Premarket Prep GBPNZD 11192020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

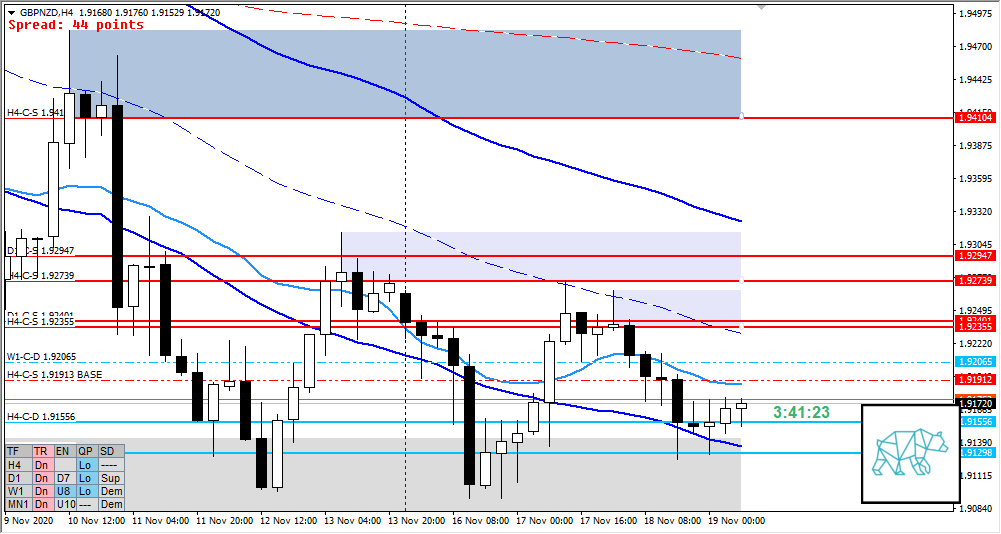

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Don’t take trades where SL placement is suboptimal. Instead, reassess for a better entry if possible.

Compared against Weekly Trading Plan

- Price arrived at and is trading diving deeper into demand W1-C‑D 1.92065 but still have 2 days to go

Non-conjecture observations of the market

- Price action

- D1 Phase 1 / 3

- H4 DBD after rejecting D1-C‑S 1.92401 (H4 50MA in DT) forming new H4 supply H4-C‑S 1.92355

- Move down formed a base at H4-C‑S 1.91913 BASE (@ H4 VWAP)

- Arrival at D1-C‑D 1.91298 followed by H4 consolidation

- Market Profile

- Tight VA created. 3 day bracketing range.

- ADR: 1395

- ASR: 978

- 25

- Day

- Yesterday’s High 1.92661

- Yesterday’s Low 1.91254

Sentiment

- Locations

- Sentiment

- LN open

- Below Value, Outside Range

- Open distance to value

- 0.1xASR

- Sentiment

- H4 just closed higher forming H4-C‑D 1.91556 and a H1 RBR and now another potential base with long lower wick. Although LTF is showing a lot of signs of phase 1 / 3. Since we are at the bottom of the overall range the sentiment is more bullish. Which would be enhanced through a value acceptance (which would also bring price back up to the base) and path is clear (on medium tf) to overhead supply. Some congestion on LTF though. Profile would indicate a potential continuation which the VAA would negate. Price seems to ticking around faster than usual.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Swing Reversal (long)

- Preferred: VAA (with enough VA left although hard with VA being so tight). IB extension up and sustained auction and taking out of LTF supply.

- Hypo 2 — Return to Value (Short)

- Preferred: Strong Bearish PA, IB extension down taking out LTF demand and closing within D1 Demand.

Additional notes

- Thursday & Friday

- ECB President Lagarde Speaks

ZOIs for Possible Shorts

- D1-C‑S 1.92947

- H4-C‑S 1.92739

- D1-C‑S 1.92401

- H4-C‑S 1.92355

- H4-C‑S 1.91913 BASE

ZOIs for Possible Long

- H4-C‑D 1.91435

- D1-C‑D 1.91298

Mindful Trading

- Feeling okay. Personal life a little in the way. Also just generally feeling a little more cautious these last few days and I have learned to listen to my gut. Being flat is a position as well.

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments