#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Don’t take trades where SL placement is suboptimal. Instead, reassess for a better entry if possible.

Compared against Weekly Trading Plan

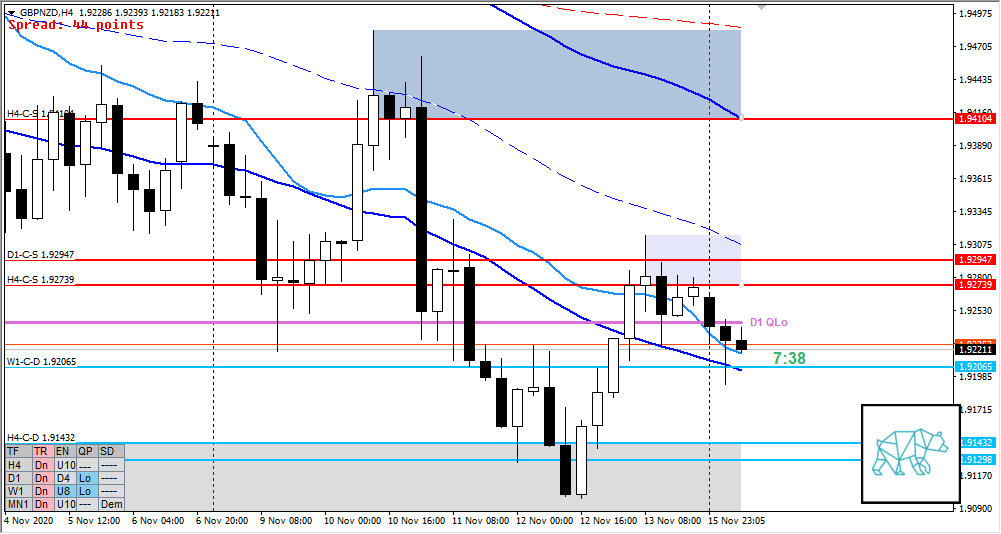

- Price arrived at and is trading just above W1-C‑D 1.92065

Non-conjecture observations of the market

- Price action

- Weak D1 Three Inside Up at D1/H4 C‑Dem returning back at D1-C‑S 1.92947 which proved reactive again forming an Inside bar

- Arrival at H4-C‑S 1.92739 with no clean break away (testing supply twice) trading within D1 QLo just above H4 VWAP after testing H4 QLo and D1-C‑D 1.91857 (at W1-C‑D 1.92065) proved reactive

- Market Profile

- Brackets expanding distance with currently price trading below Friday’s VA

- ADR: 1503

- ASR: 955

- 25

- Day

- Yesterday’s High 1.93147

- Yesterday’s Low 1.91817

Sentiment

- Locations

- H4-C‑S 1.92739 at VAL (LTF Supply as well), D1-C‑S 1.92947 VAH (not far above (tighter VA)

- Wide ADR exhaustions

- Sentiment

- LN open

- Below Value, Outside Range

- Open distance to value

- 0.4xASR

- Sentiment

- After a reaction off newly formed D1-C‑D 1.91857 H4 closed as a possible Base so there might be more downside on the short term ast here was no follow-through to the move. Preferably a return to value play would be best. With relative close proximity to VA, even though outside range, we could see a continuation to the leg down as well.

- LN open

- Clarity (1–5, 5 being best)

- 3

- Hypo 1 — Return to Value (short)

- VAL + H4 C‑Sup + LTF supply

- Preferred: PA reversal within IB + extension down (momentum)

- Hypo 2 — Continuation (short)

- Preferred: IB closing below W1 C‑dem preferably taking out LTF demand with IB extending down (preferably on momentum)

- Hypo 3 — VAA (risky)

- If there is a VAA we could see a move (slow initiative activity) moving deeper into overhead supply although this move is not favored.

Additional notes

- Tuesday

- BOE Gov Bailey Speaks

- Thursday & Friday

- ECB President Lagarde Speaks

ZOIs for Possible Shorts

- H4-C‑S 1.94104

- D1-C‑S 1.92947

- H4-C‑S 1.92739

ZOIs for Possible Long

- W1-C‑D 1.92065

- D1-C‑D 1.91857

- H4-C‑D 1.91432

- D1-C‑D 1.91298

Mindful Trading

- Slightly tired

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING