11 Nov Premarket Prep GBPNZD 11112020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Only trade off M30/M15 for entries. M30, time-based, or look for exits after 2 hours (4 TPOs). Unless the entry is really late.

Compared against Weekly Trading Plan

- Price trading below the body of W1 Bear Engulf from last week (which isn’t valued as much due to the elections)

Non-conjecture observations of the market

- Price action

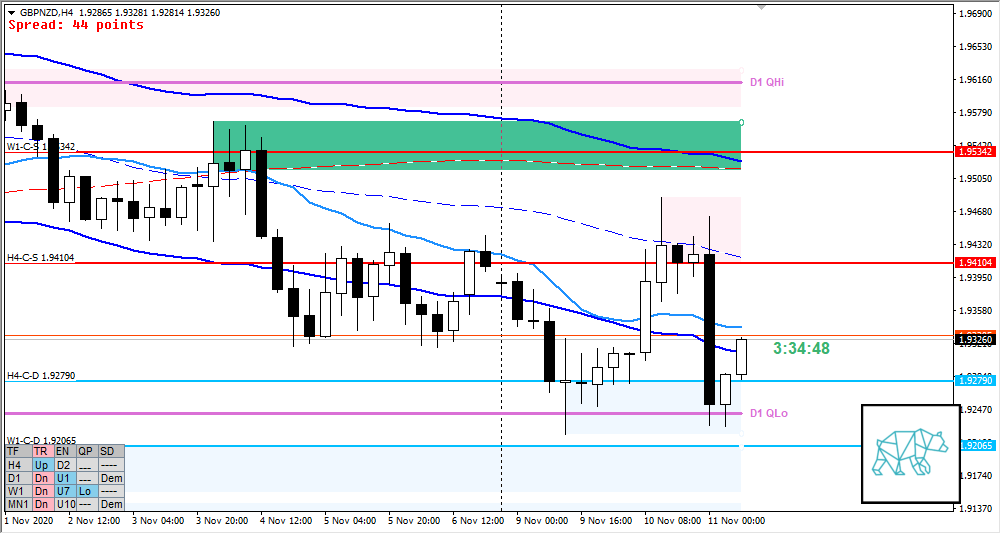

- Yesterday closed as D1 bull engulf but this morning completely retraced so best guess is D1 Phase 1 / 3

- H4-C‑S 1.94070 got taken out and formed a consolidation with a huge sell off (possibly repositioning due to Monetary policy statement) this morning giving H4-C‑S 1.94104 returning back to originating area and closing within H4-C‑D 1.92790 just above D1 QLo

- H4 Inside bar (Marubozu) created reacting off D1 QLo

- ADR exhausted during HK 172%

- Market Profile

- After Monday traded below bracketing range price traded higher but failed to sustain and we are back where we started. Larger time frame balancing perhaps.

- ADR: 1357

- ASR: 970

- 25

- Day

- Yesterday’s High 1.94830

- Yesterday’s Low 1.92758

Sentiment

- Locations

- H4-C‑D 1.92790 above D1 QLo inside H4 QLo

- W1-C‑D 1.92790 supporting below

- H4-C‑S 1.94104 within value below VAH with LTF supply

- H4-C‑D 1.92790 above D1 QLo inside H4 QLo

- Sentiment

- LN open

- Below Value, outside range

- Open distance to value

- 0.8xASR

- Sentiment

- Moderate / large imbalance but due to a possible consolidation on D1 we can focus on trading the extremes of the D1 range. The newly formed H4 inside bar Marubozu would speak to that as well as the sell off during HK. Nonetheless, due to the political situation I will act with caution and also focus on risk guidelines.

- LN open

- Clarity (1–5, 5 being best)

- 2

- Hypo 1 — Swing Reversal Long

- H4-C‑D 1.92790 within H4 QLo

- Preferred: a close above H4 QLo, IB extension up (momentum), monitor for sustained auction and VAA

- Con: big possibility of not having good R/R and it seems the best entry would have been premarket.

- Hypo 2 — Return to Value (Short)

- Preferred: PA confirmation around VAL (H4 C‑Sup nearby, H4 VWAP), failed auction perhaps

- Con: It would have crossed up over M30 VWAP and for price to then cross back down relatively soon it might be less opportune… Might just watch paint dry for the remainder of the session until the later hours. If it holds below M30 VWAP we could see a better opportunity.

Additional notes

- Wednesday

- NZD — Monetary policy statement

- Already done in the morning

- NZD — Monetary policy statement

- Thursday

- BOE Gov Bailey speaks

- Friday

- ECB President Lagarde / BOE Gov Bailey / Fed Chair Powell speaks

ZOIs for Possible Shorts

- H4-C‑S 1.94104

ZOIs for Possible Long

- H4-C‑D 1.92790

- W1-C‑D 1.92065

Mindful Trading

- Feeling good.

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments