27 Oct Premarket Prep GBPNZD 10272020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Only trade off M30/M15 for entries. M30, time-based, or look for exits after 2 hours (4 TPOs). Unless the entry is really late.

Compared against Weekly Trading Plan

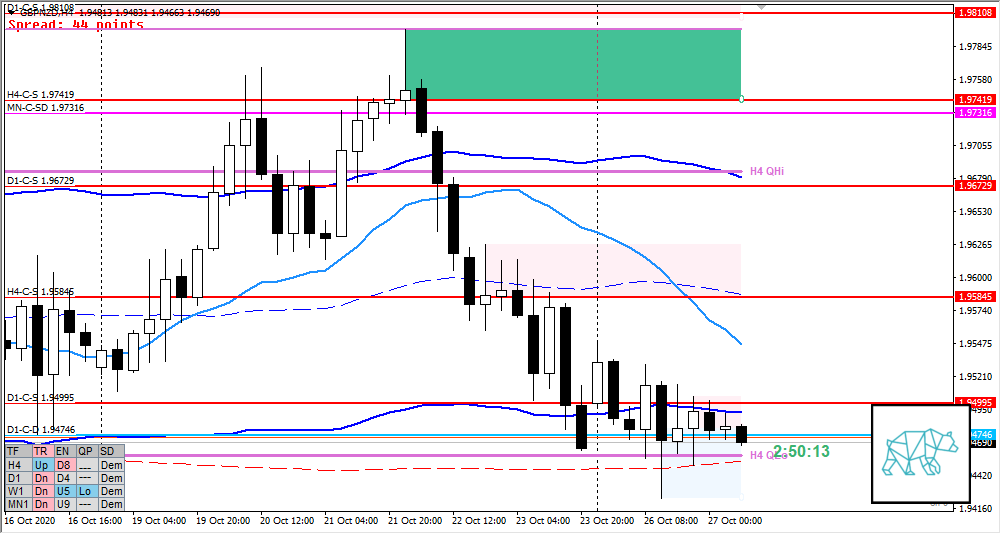

- Price trading below MN C‑Sup again (as well as last month’s body) after having been tested multiple times

- W1 consolidation / possible phase 3

Non-conjecture observations of the market

- Price action

- D1 Bear Engulf with a very long buying wick with C‑sup at previous H4 C‑sup now giving D1-C‑S 1.94995

- Mid D1 swing

- Possible H4 Phase 1 just above H4 QLo and D1 C‑dem

- D1 Bear Engulf with a very long buying wick with C‑sup at previous H4 C‑sup now giving D1-C‑S 1.94995

- Market Profile

- After multi-day bracketing we have 3 VA’s formed below one and other

- ADR: 1347

- ASR: 1083

- 28

- Day

- Yesterday’s High 1.95354

- Yesterday’s Low 1.94236

- Currently within value, possibility for some balancing

Sentiment

- Locations

- D1-C‑S 1.94995 at VAH

- LTF supply right above VAH and below VAL

- ADR 0.5 Low within H4 QLo

- Sentiment

- LN open

- Within Value

- Open distance to value

- N.A.

- Sentiment

- Balancing market. With an open within value we could possibly trade off nearby LTF SD ZOIs. With possible H4 phase 1, it is implied that opportunities long would be safer, but with a balancing market it might take a while. Though be careful for a forceful move up this week. Furthermore, I will monitor the relevance of ADR 0.5 and exhaustion being this far out from value.

- Due to the new formation of D1 Bear Engulf, although weak due to buying wick, that could be because of the initial reaction of previous D1 demand. The weekly is consolidating but looking slightly more bearish than bullish. As always with a balancing market will have to see what direction the other market participants chose first. Then piggy-back ride!!! 🙂

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Value Rejection Failure

- LTF SD ZOI + PA reversal + potential failed auction

- Hypo 2 — Value Rejection Up

- Sustained auction up but due to nearby supplies we would see a low/medium initiative day

Additional notes

- Since we are nearing the end of the month I am not looking to take any risky trades. So might sit out and observe instead.

ZOIs for Possible Shorts

- H4-C‑S 1.95845

- D1-C‑S 1.94995

ZOIs for Possible Long

- D1-C‑D 1.94746

Mindful Trading

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments