21 Oct Premarket Prep GBPNZD 10212020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

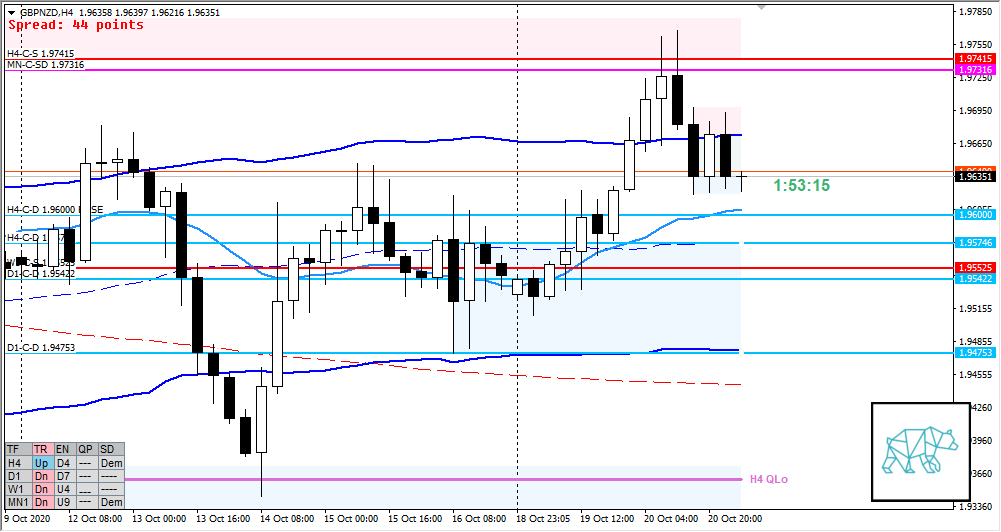

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Only trade off M30/M15 for entries. M30, time-based, or look for exits after 2 hours (4 TPOs). Unless the entry is really late.

Compared against Weekly Trading Plan

- MN C‑Sup reactive again, however been tested 3–4 times now

- W1 extended above last week’s range returned back to range, above its body

Non-conjecture observations of the market

- Price action

- D1 pushed higher into MN C‑Sup and took out D1 supply on the way. Closed higher but with long selling wick.

- H4 Bear Engulf formed giving H4-C‑S 1.97059 at MN C‑Sup (above UKC in a range) after testing overhead H4-C‑S 1.97415. Slight follow-through to the move away from supply, followed by consolidation.

- Market Profile

- Overlapping brackets again, with price at the top of the bracket

- ADR: 1322

- ASR: 1135

- 29

- Day

- Yesterday’s High 1.97683

- Yesterday’s Low 1.96188

- Currently below value, outside range

Sentiment

- Locations

- H4-C‑D 1.96000 BASE at ADR 0.5 low and H4 VWAP in Range, H4-C‑D 1.95746 below near ADR exhaustion low

- MN C‑Sup and H4-C‑S 1.97415 at VAH, ADR 0.5 high and Exhaustion

- H4-C‑S 1.97059 at VAL

- Sentiment

- LN open

- Below Value, outside range

- Open distance to value

- 0.5xASR

- Sentiment

- Moderate imbalance. Due to H4-C‑S 1.97059 being at VAL and other C‑sups at VAH I am weary to go for a VAA and am more in favor for a return to value play. Although some news on Brexit came out again and might have an impact. As we did test MN C‑Sup multiple times now and D1 looking slightly bullish we might see a continuation to the move up. The consolidation on H4 kinda made a move down found some demand and since open we have only been shooting up. Will focus on reading order flow to guide my decision-making since I kinda lack clarity in overall narrative.

- LN open

- Clarity (1–5, 5 being best)

- 2

- Hypo 1 — Return to Value (short)

- PA reversal at VAL

- Preferred: IB extension down, sustained auction.

- Hypo 2 — VAA

- Although value is too tight and opposing c‑lines make for a riskier trade. Although the D1 phase 2 might still be in play.

Additional notes

- N.A.

ZOIs for Possible Shorts

- H4-C‑S 1.97415

- H4-C‑S 1.97059

ZOIs for Possible Long

- D1-C‑D 1.95422

- H4-C‑D 1.96000 BASE

Mindful Trading

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments