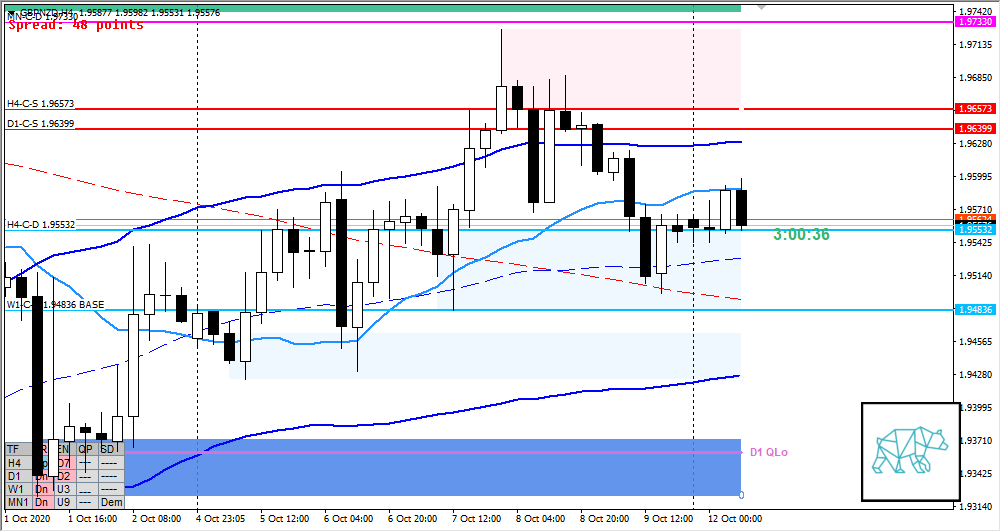

12 Oct Premarket Prep GBPNZD 10122020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Only trade off M30/M15 for entries. M30, time-based, or look for exits after 2 hours (4 TPOs). Unless the entry is really late.

- SL placement

- Add spread for shorts, subtract for longs

Compared against Weekly Trading Plan

- Price trading above W1-C‑D 1.94836 Base

Non-conjecture observations of the market

- Price action

- Price consolidating right on top of H4 demand H4-C‑D 1.95532

- Market Profile

- Trading back within bracketing range

- ADR: 1375

- ASR: 1431

- 36

- Day

- Yesterday’s High 1.96466

- Yesterday’s Low 1.94985

- Currently within value

Sentiment

- Locations

- D1-C‑S 1.96399 within H4 QHi, near ADR 0.5

- H4-C‑D 1.95532 within value

- H4 VWAP within range at LTF supply below H4 QHi

- Sentiment

- LN open

- Above value, within range

- Open distance to value

- Very near

- Sentiment

- Open above within range (H4 move higher breaking out from consolidation) could indicate the intent to move price higher again. The worrying factor in this regard is the H4 VWAP right above it and seems to be reactive during IB. So unless VWAP gets broken I am expecting more phase 1/3.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Value Acceptance

- Preferred: if deep within value wait for a test of value edge, taking out of LTF demands, value rotation

- Hypo 2 — Return to Value (long)

Additional notes

- N.A.

ZOIs for Possible Shorts

- D1-C‑S 1.96399

ZOIs for Possible Long

- H4-C‑D 1.95532

Mindful Trading

- Feeling okay. Busy with work outside of trading.

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments