#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly goal

- Formulate hypos in order of likelihood and track with actual development on the day

Non-conjecture observations of the market

- Price action

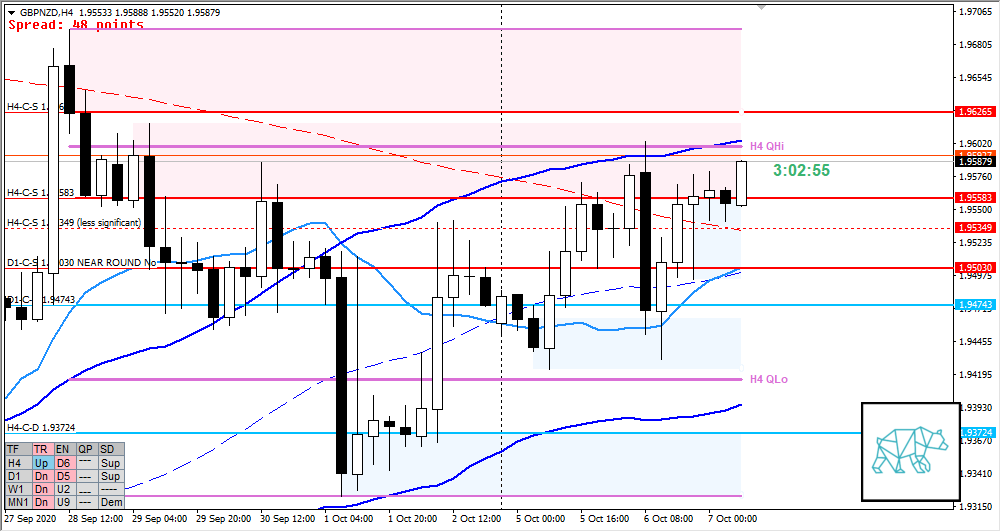

- D1 traded higher into supply above the day prior leaving a longer buying wick behind but still within supply and would need to reach 1.9696 before it’s taken out

- H4 Bear Engulf @ H4-C‑S 1.95583 and H4 QHi with no follow-through and immediate return through inside bar at D1-C‑D 1.94743 nearing H4 QLo, ranging market

- H4 demand formed below supply

- Market Profile

- Profiles still bracketing, yesterday’s value very wide

- ADR: 1447

- ASR: 1479

- 37

- Day

- Yesterday’s High 1.96040

- Yesterday’s Low 1.94312

- Currently price right above VAH within range

Compared against Weekly Trading Plan

- Trading above last week’s body but within range. IF we keep this up (big IF since it’s only Tuesday) we could close as a RBR breaking out from VWAP. Big IF still so could go either way.

Sentiment

- Locations

- ADR 0.5 high at H4-C‑S 1.96265

- H4 QHi at Yesterday’s high

- ADR 0.5 low within Value

- QDR exhaustion at VAL, yesterday’s low

- Sentiment

- LN open

- Above value, within range

- Open distance to value

- Right on top of VAH

- Sentiment

- Moderate Imbalance. Looking for a potential move up but with a lot of medium/higher time frame congestion in the way + H4 QHi this could be a very slow crawl. A better opportunity would be a reversal around ADR 0.5 since we are in a ranging market. Unless Price reverses and accepts value, with value being so wide we could see nice rotation although there is congestion underneath as well.

- LN open

- Clarity (1–5, 5 being best)

- 3

- Hypo 1 — Reversal (short)

- H4 c‑sup, ADR 0.5, H4 QHi

- Preferred: PA reversal within IB, otherwise an extension up followed by reversal and failed auction, value acceptance

- Hypo 2 Return to Value (long)

- Preferred: IB extension up (momentum), taking out H4 supply, late sustained auction entry

Additional notes

- N.A.

ZOIs for Possible Shorts

- H4-C_S 1.95583

- H4-C‑S 1.95349 (less significant)

- D1-C‑S 1.95030 NRN

ZOIs for Possible Long

- H4-C‑D 1.95357

- D1-C‑D 1.94743

- H4-C‑D 1.93724

Mindful Trading

- Feeling okay, slightly tired

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING