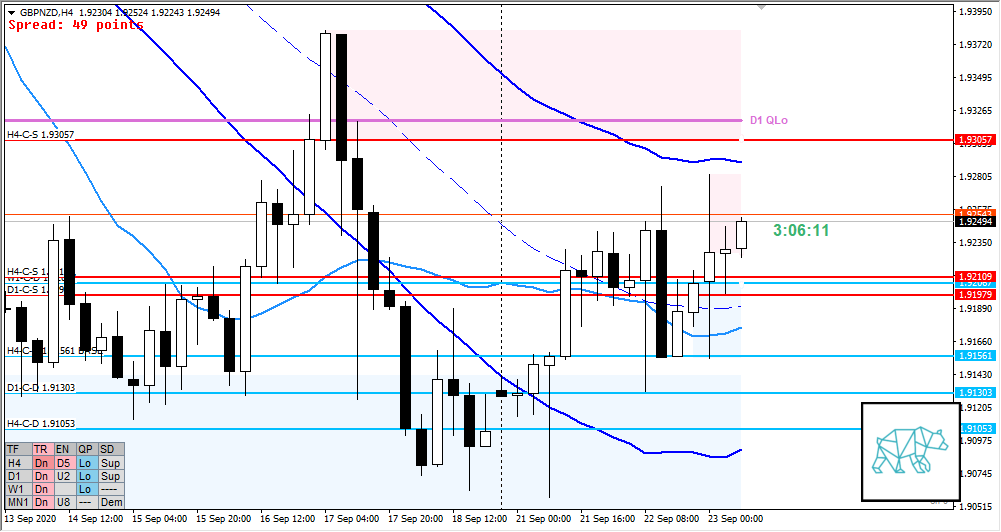

23 Sep Premarket Prep GBPNZD 09232020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly goal

- Formulate hypos in order of likelihood and track with actual development on the day

Non-conjecture observations of the market

- Unclean arrival at D1-C‑S 1.91979, inside bar with long buying and selling wicks although buying slightly longer. Still a long way to go to take out D1 supply with high at 1.938.

- 2nd H4 Bear Engulf at H4-C‑S 1.92109 but no follow-through, possible phase 1

- Market Profile

- 2 days bracketing at the bottom of the range, yesterday above the brackets

- ADR: 1386

- ASR: 1459

- 365

- Day

- Yesterday’s High 1.92738

- Yesterday’s Low 1.91316

- Price within value

Compared against Weekly Trading Plan

- Trading slightly above W1 Demand

Sentiment

- Locations

- ADR 0.5 and exhaustion at yesterday’s high and LTF supply

- ADR exhaustion Low and 0.5 at D1-C‑D 1.91303

- Sentiment

- LN open

- Within value

- Open distance to value

- N.A.

- Sentiment

- Balanced market.

- LN open

- Clarity (1–5, 5 being best)

- 3

- Hypo 1 — Value Rejection Up Fake out

- ADR 0.5 at LTF supply

- Price action reversal, single print fade, failed auction,

- Hypo 2 — Responsive Activity

- Hypo 3 — Value Rejection Down Fake out

- Same as Hypo 1

- Hypo 4 Value Rejection up

- ADR exhaustion hit early on in the session, sustained auction.

Additional notes

- N.A.

ZOIs for Possible Shorts

- H4-C‑S 1.94717

- H4-C‑S 1.92109

- D1-C‑S 1.91979

ZOIs for Possible Long

- H4-C‑D 1.91561 BASE

- D1-C‑D 1.91303

- H4-C‑D 1.91053

Mindful Trading

- Feeling okay

Focus Points for trading development

- Weekly Goal

- Formulate hypos in order of likelihood and track with actual development on the day

- Incorporate profile day type

- Trading Rules

- If Open outside of value consider the placement in relation to ADR

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- OK to take 1R when in DD

- 2 consecutive days of lack of sleep = NO TRADING