03 Sep Premarket Prep GBPNZD 09032020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly goal

- Formulate hypos in order of likelihood and track with actual development on the day

Non-conjecture observations of the market

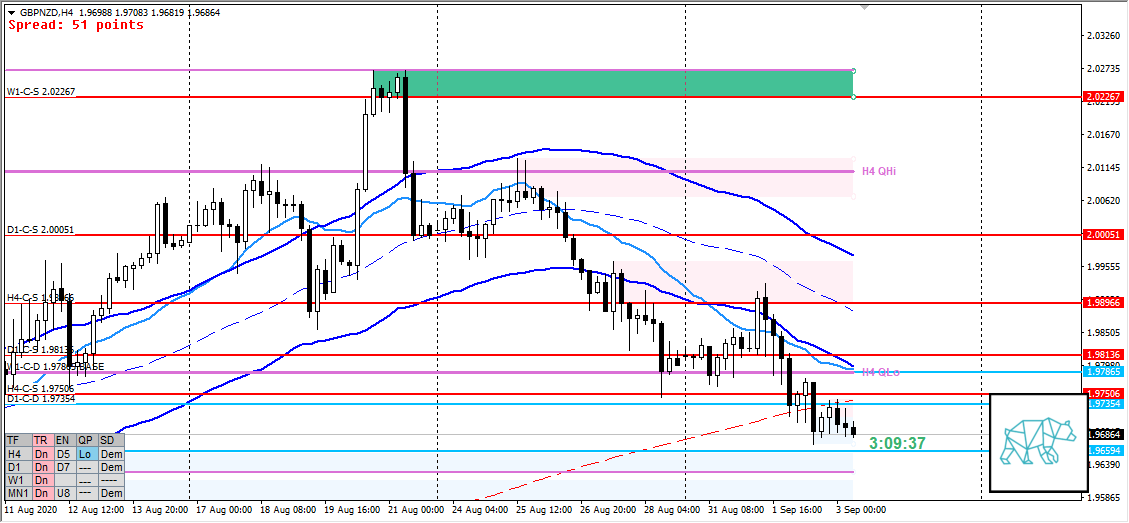

- D1 phase 4 continuation after bear engulf the preceding day closing slightly within demand with longer buying wick

- H4 phase 4 (forming H4-C‑S 1.97506) but some consolidation now creating some demand (even though bear engulf within consolidation no follow-through yet) possible transition to Phase 1 or just a speed bump

- Market Profile

- Yesterday was an open below the bracketing range

- ADR: 1248

- ASR: 1166

- Day

- Day High 1.98170

- Day Low 1.96701

- Price within day range

- Locations

- ADR 0.5 at day low

- H4-C‑S 1.97506 at VAH (weaker due to coming from the inside)

- H4-C‑D 1.96594 (weak) at ADR 0.5

Compared against Weekly Trading Plan

- Below Last month’s body, within range

- Below last week’s range in line with evening star

Sentiment

- Sentiment

- LN open

- Below value, slightly outside range

- Open distance to value

- 0.4xASR

- Sentiment

- No mean reversion criteria fulfilled due to open still near VAL by 0.4 ASR. H4 printing a Bear Engulf and then potentially forming a DBD.Slightly Short.

- LN open

- Clarity (1–5, 5 being best)

- 2

- Hypo 1 — Short

- Medium and large time frame bearish sentiment. Slightly outside range (0.4xASR)

- Preferred: 2nd Chance Entry. IB extension down. Sustained auction. ADR exhaustion.

- Cons: H4-C-dem (older) within H4 QLo

- Hypo 2 — Long

- Unsafe due to large time bearish sentiment and no large imbalance, plus very tight value and lower time frame supplies

- ADR 0.5 at H4-C‑D 1.96594

- Preferred: Value Acceptance

Additional notes

- N.A.

ZOIs for Possible Shorts

- H4-C‑S 1.98966

- D1-C‑S 1.98136

- H4-C‑S 1.97506

ZOIs for Possible Long

- D1-C‑D 1.98128

- H4-C‑D 1.96594

Mindful Trading

- Slept okay

Focus Points for trading development

- Weekly Goal

- Formulate hypos in order of likelihood and track with actual development on the day

- Incorporate profile day type

- Trading Rules

- If Open outside of value consider the placement in relation to ADR

- Don’t take into consideration medium time frame c‑lines past 24 hours

- FX within value > DAX

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- OK to take 1R when in DD

- 2 consecutive days of lack of sleep = NO TRADING

No Comments