05 Aug Premarket Prep GBPNZD 08052020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

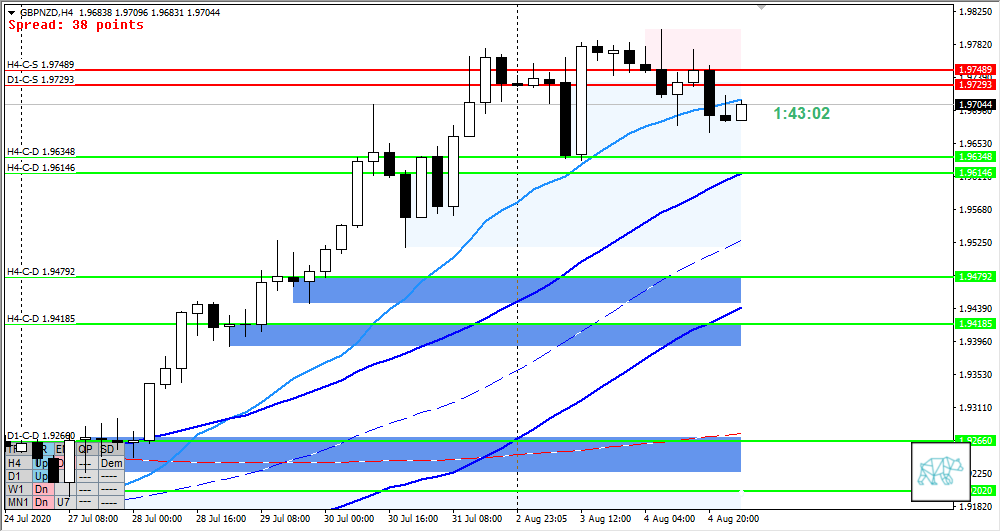

Non-conjecture observations of the market

- D1-C‑S 1.97293 was formed through D1 Bear Engulf coinciding with H4 Bear Engulf after rejecting overhead supply H4-C‑S 1.97489

- H4 closed below VWAP with drop and base for the first time but still trading within demand ZOI and need AS to close to see if we have another drop

- Market Profile

- Since Friday value has been wider than usual and has been overlapping

- Currently price is trading below just VAL but will need to reassess at LN open

- ASR 109.8

- MAX SL (including/excluding spread)

- Short 33 pips

- Long 23

- MAX SL (including/excluding spread)

- ADR 137

Compared against Weekly Trading Plan

- Mid MN, W1, and D1 swing

- W1 trading within previous week’s body looking like an inside bar however the week is not finished yet

- H4, D1 trend is up, W1 is down

Hypos

- Short:

- Bouncing off newly formed H4-C‑S 1.97489 coinciding with current ADR 0.5 location

- Short:

- Open below value within range, failed value acceptance bouncing of D1-C‑S 1.97293

- Long:

- Drop to H4-C‑D 1.96348 or H4-C‑D 1.96146 coinciding with ADR and 4+ TPO structure for a possible reversal

Sentiment — Slightly Bearish

Additional notes

- Thursday

- BOE Gov Bailey Speaks

ZOIs for Possible Shorts

- D1-C‑S 1.99731

- D1-C‑S 1.97293

- H4-C‑S 1.97489

ZOIs for Possible Long

- D1-C‑D 1.97311

- H4-C‑D 1.96348

- H4-C‑D 1.96146

Mindful Trading

- Slept okay

Focus Points for trading development

- Weekly Goal

- Have correct SL placement and position sizing

- Trade idea considering market context based on larger time frame analysis

- Risk Management

- 1 allowed products, no rules under active experimentation

- GBPNZD

- 1 active opened positions

- 3 trades with 1% risk

- 2 consecutive days of lack of sleep = NO TRADING

- 1 allowed products, no rules under active experimentation

No Comments