21 Jul Premarket Prep GBPNZD 07212020

#premarketprep #tradingforex #forex #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

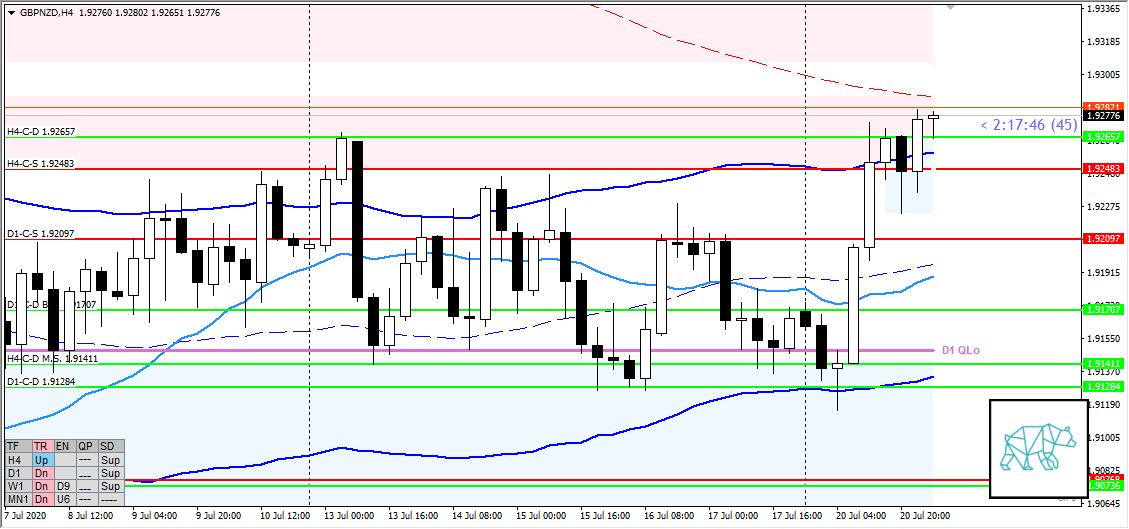

- D1 Bull Engulf D1-C‑D B.E. 1.91707 move away from VWAP (after consolidating around VWAP and now entering KC for the first time) into overhead supply (D1-C‑S 1.92097) breaking slightly the range

- Overhead supply not yet taken out

- H4 Morning Star H4-C‑D M.S. 1.91411 with big push away from D1 QLo taking out overhead supplies and clean arrival at H4-C‑S 1.92483. Followed by some consolidation ending with a ‘weaker’ bull engulf (outside RTH) H4-C‑D 1.92657 since we just had a bear engulf preceding it.

- H4-C‑D 1.92657 tested once

- Market Profile

- Yesterday value very wide

- Today’s price moving above VAH about 40 pips nearing ADR 0.5

Compared against Weekly Trading Plan

- Price above weekly consolidation

Sentiment — Slightly Bullish

ZOIs for Possible Shorts

- H4-C‑S 1.92483

- D1-C‑S 1.92097

ZOIs for Possible Long

- H4-C‑D 1.92657

- D1-C‑D B.E. 1.91707

- H4-C‑D M.S. 1.91411

Mindful Trading

- Sleep was good. No nap.

Focus Points for trading development

- Weekly Goal

- Correct position sizing

- Have correct SL placement

- Due to summer time I will focus on trading off newly formed SD ZOIs for intraday plays. Keeping in mind that due to lack of liquidity 2nd chance entries can give better R/R using the M30/M15 rule.

- NO IB extension trades

- NO value acceptance trades

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Only trade off M30 candles

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits

- 2 consecutive days of lack of sleep = NO TRADING

No Comments