#premarketprep #tradingforex #forex #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

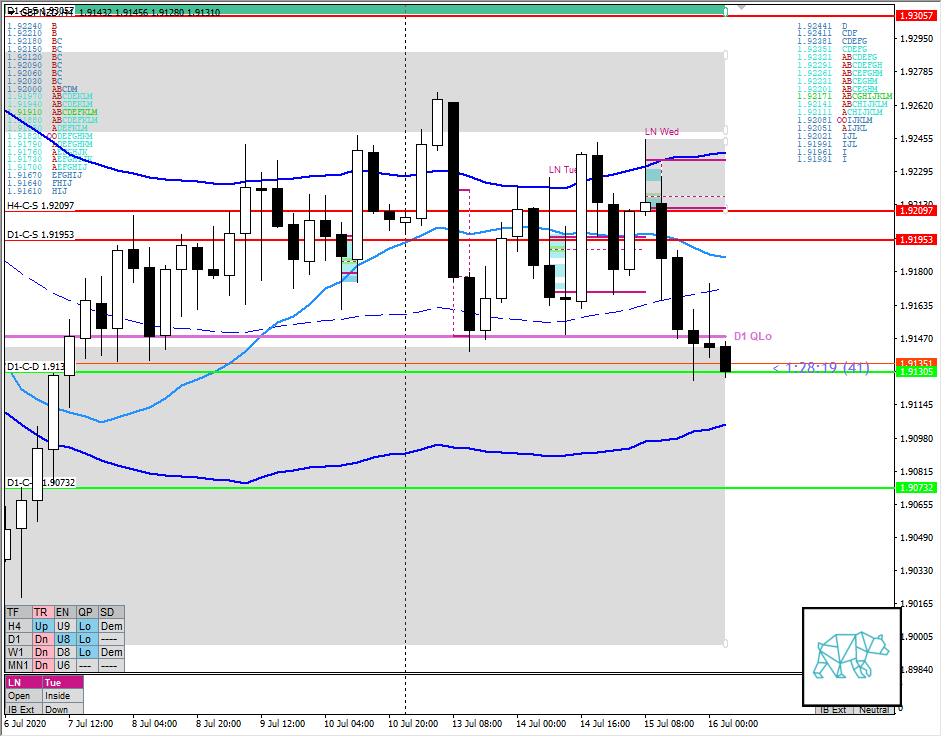

- D1-C‑S 1.91953 Bear Engulf closing slightly below W1 QLo and into demand

- D1-C‑D 1.90732 from previous bull engulf might be cause for congestion

- New H4 supply created through bear engulf H4-C‑S 1.92097 with some congestion after arriving at D1 QLo

- Market Profile

- Multi-day bracketing but we might have broken down from range

- Currently trading 70+ pips below from VAL @ H4 Qlo

Compared against Weekly Trading Plan

- Price still within Weekly consolidation

Sentiment — Slightly Bearish

ZOIs for Possible Shorts

- H4-C‑S 1.92097

- D1-C‑S 1.91953

ZOIs for Possible Long

- D1-C‑D 1.91306

- D1-C‑D 1.90732

- MN-C‑D 1.89577

Mindful Trading

- Sleep got interrupted but took a nap midday. Feeling okay.

Focus Points for trading development

- Weekly Goal

- Correct position sizing

- Trades priority: 1) let market profile guide 2) M30 confirmation (watch out for ‘Billy No Mates’)

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Only trade off M30 candles

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits

- 2 consecutive days of lack of sleep = NO TRADING