#premarketprep #tradingforex #forex #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

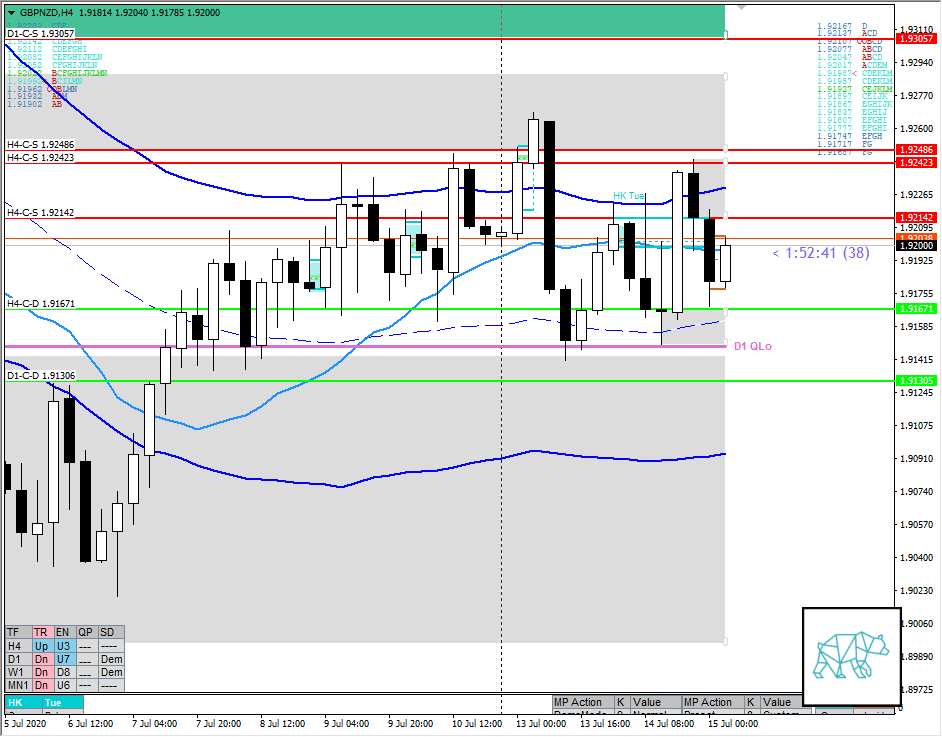

Non-conjecture observations of the market

- D1 QLo tested again with H4 morning star pushing away from H4-C‑D 1.91671

- H4-C‑S 1.92142 created through inside bar and consequent drop back to previous demand

- Market Profile

- Multi-day bracketing

- Price currently trading within value will need to reassess at open

Compared against Weekly Trading Plan

- Possible Daily phase 1 where yesterday’s bar closed slightly higher in the consolidation

- Price still within Weekly consolidation

Sentiment — Neutral

ZOIs for Possible Shorts

- H4-C‑S 1.92142

- H4-C‑S 1.92486

- H4-C‑S 1.92423

- D1-C‑S 1.92116

- H4-C‑S 1.92098

ZOIs for Possible Long

- H4-C‑D 1.91671

- MN-C‑D 1.89577

- D1-C‑D 1.91306

Mindful Trading

- Had a good night’s sleep. Feeling good.

Focus Points for trading development

- Weekly Goal

- Correct position sizing

- Trades priority: 1) let market profile guide 2) M30 confirmation (watch out for ‘Billy No Mates’)

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Only trade off M30 candles

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits

- 2 consecutive days of lack of sleep = NO TRADING