#premarketprep #tradingforex #forex #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

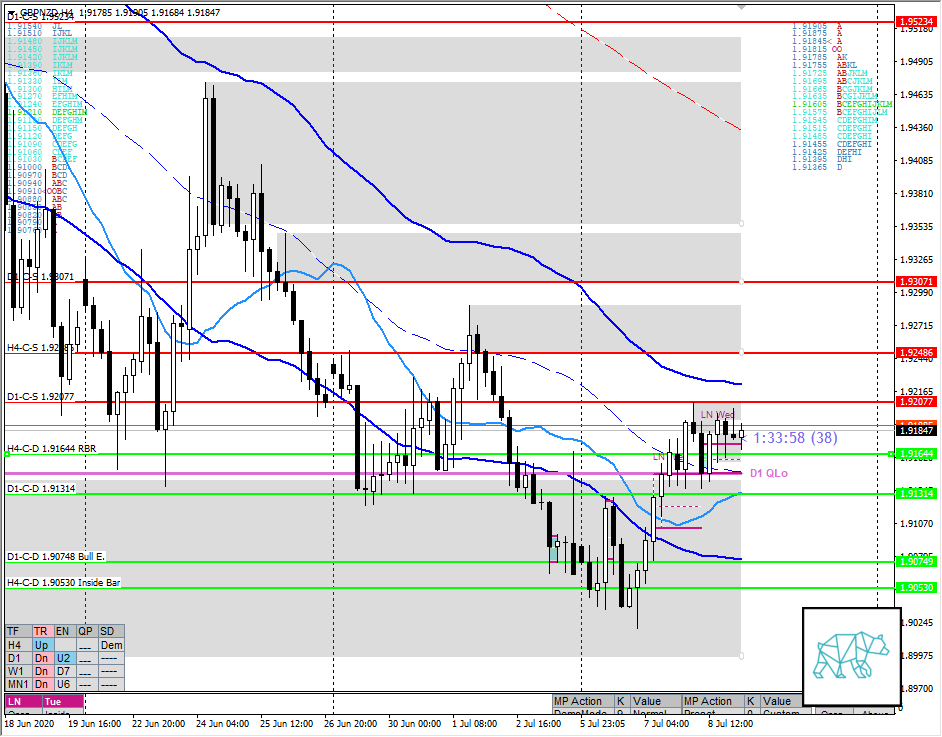

Non-conjecture observations of the market

- Slight push higher on D1 but still below D1-C‑S 1.92077

- H4 consolidation (phase 1/3) above D1/W1 QLo with new tightly formed H4 supply and demand

- Market Profile

- Profile in slight uptrend with price currently trading above value

Compared against Weekly Trading Plan

- Below W1 LKC and extended away from VWAP but retracing preceding week’s body

- Moving away from MN demand

Sentiment — Slightly Bullish

ZOIs for Possible Shorts

- D1-C‑S 1.92077

- H4-C‑S 1.92486

- D1-C‑S 1.93071

- D1-C‑S 1.95234

ZOIs for Possible Long

- H4-C‑D 1.91644 RBR

- D1-C‑D 1.91314

- H4-C‑D 1.90530 Inside Bar

- MN-C‑D 1.89650

- W1-C‑D 1.85887

Mindful Trading

- Still not feeling well. Feeling imbalanced and not myself. Hope this goes by quick while my body adapts to my new diet. Quit smoking I am doing okay with. Nonetheless, I will still trade. Making trades at this early stage of my development in the mentorship program allows me to learn more. Also, it will help me embed the rules in my mind regardless of what state I am in. This is not advisable with a lot of money on the line.

Focus Points for trading development

- Weekly Goal

- Correct position sizing

- Trades priority: 1) let market profile guide 2) M30 confirmation (watch out for ‘Billy No Mates’)

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Only trade off M30 candles

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits