#tradingforex #forex #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

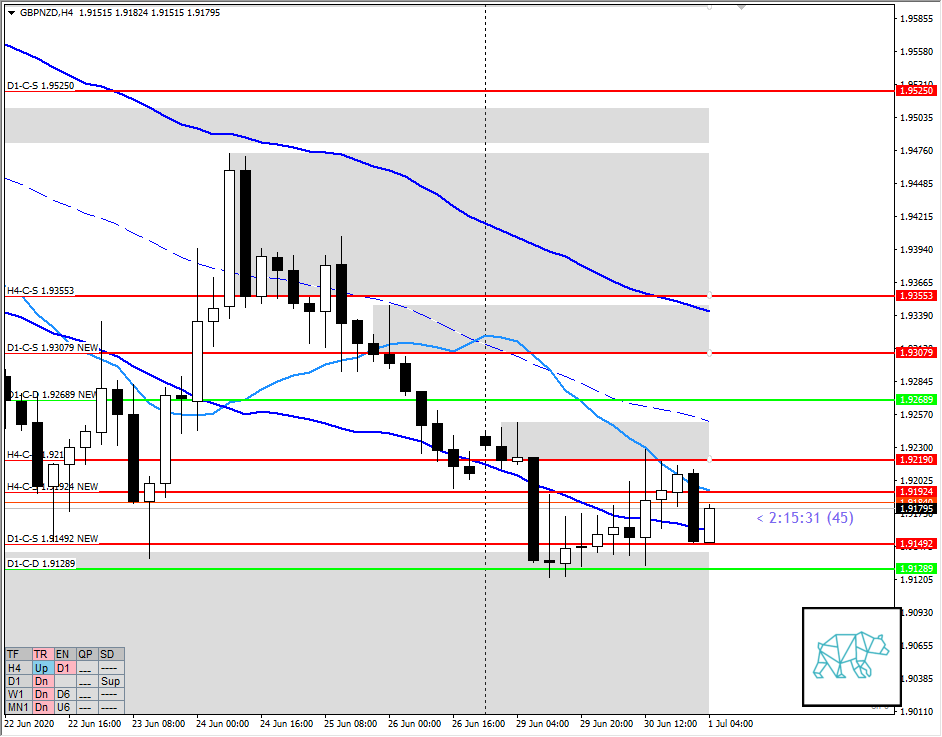

- Daily is showing a big inside bar at W1 QLo after testing D1-C‑D 1.91289 with 3rd bar printing today. However supply was created and has D1-C‑S 1.91492 NEW at W1 QLo and just above existing Daily demand

- Daily still below VWAP and tests of said level are getting slightly more frequent

- H4 Phase 1/3 followed by a sell off in the last day by a H4 Bear Engulf at VWAP forming H4-C‑S 1.91924 NEW

- Market Profile

- For the last two days the market has been balancing and is currently trading within value

Compared against Weekly Trading Plan

- Price at W1 QLo and W1 LKC

- Price in the middle of the MN swing, currently nearing MN demand MN-C‑D 1.89592

Sentiment — Neutral

ZOIs for Possible Shorts

- H4-C‑S 1.91924 NEW

- D1-C‑S 1.93079 NEW

- H4-C‑S 1.93553 NEW

ZOIs for Possible Long

- D1-C‑D 1.92689 NEW

- D1-C‑D 1.91289

- H4-C‑D 1.92139

- H4-C‑D 1.91438

Focus Points for trading development

- Weekly Goal

- Correct position sizing

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits