This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

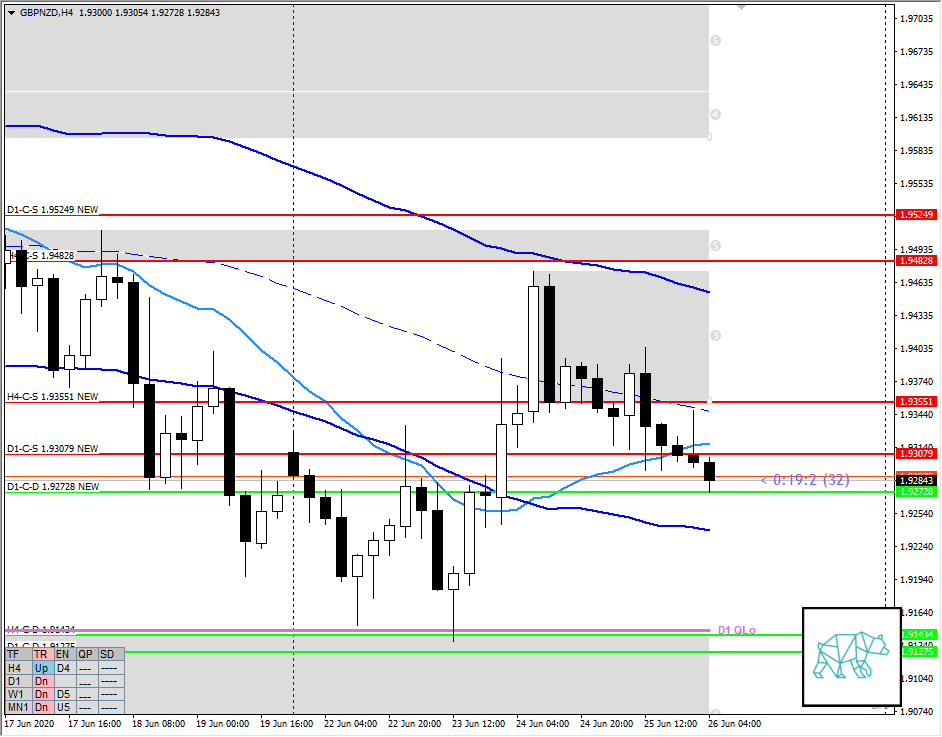

- Daily inside bar fairly strong retracing more than half of previous body creating D1-C‑S 1.93079 NEW

- Supply D1-C‑S 1.93079 NEW and demand D1-C‑D 1.92728 very tight

- H4 Bear Engulf rejection from supply H4-C‑S 1.93551 followed by messy push lower

- Market Profile

- Yesterday value rotation and consequent break below value

- Currently trading below value but still near

Compared against Weekly Trading Plan

- Slightly below previous week’s body

Sentiment — Slightly Bearish

ZOIs for Possible Shorts

- H4-C‑S 1.93551 NEW

- D1-C‑S 1.93079 NEW

ZOIs for Possible Long

- D1-C‑D 1.92728

Focus Points for trading development

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits