This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

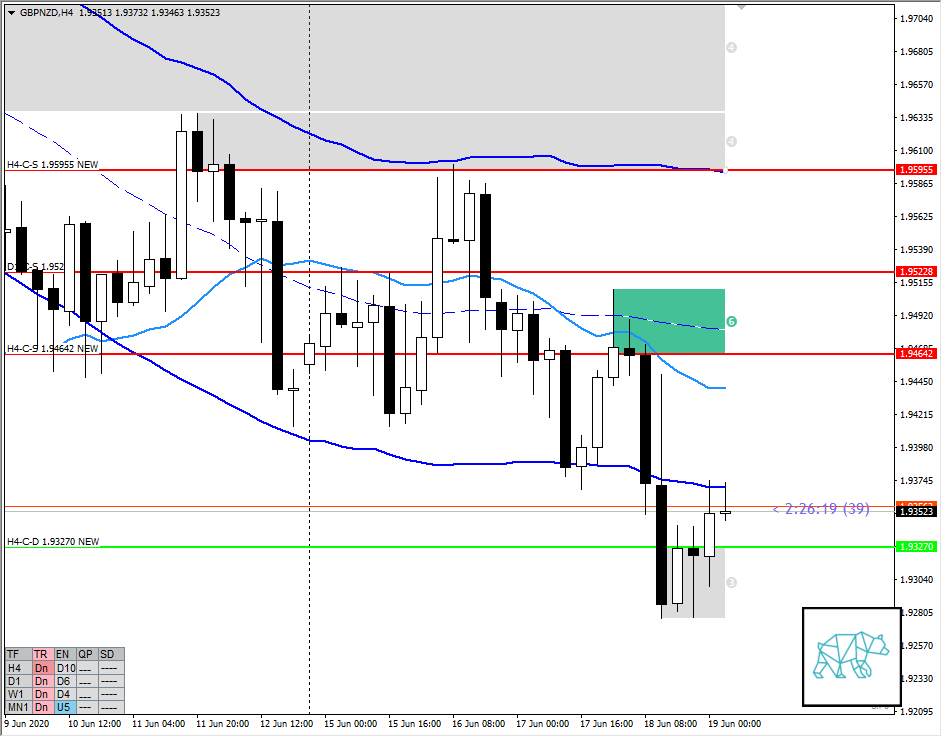

Non-conjecture observations of the market

- Daily (and weekly) demand taken out and no new demand formed (yet)

- New H4 demand formed after a drop (creating new supply H4-C‑S 1.94642 NEW) followed by big inside bar followed by RBR creating H4-C‑D 1.93270 NEW

- Market Profile

- HK session range exhausted

- Price currently within LN value and value is quite tall of 101 pips

- H4-C‑D 1.93270 NEW just below PVAL

Compared against Weekly Trading Plan

- Weekly demand taken out and extended over last week’s range

Sentiment — Neutral

ZOIs for Possible Shorts

- H4-C‑S 1.94642 NEW

ZOIs for Possible Long

- H4-C‑D 1.93270 NEW

Focus Points for trading development

- Exit rules

- Option 1: Time-based stop

- Option 2: Target hit (SL (98/4) 25 pips + spread or x2 TP)

- NO OPTION 3

- UNLESS a trade is entered within 1 hour or half hour before the hard exit rule option 1

- Entry rules

- Cut off looking for trades at 45 min before time-based stop

- Entry on TPO break of IB

- Early entry with price action confirmation at

- H4 conterminous

- Open far from value, anticipating a move back to value using an engulfing + subsequent break of TPO

- Min. X2 R/R

- Use TPO confirmation or invalidation for directional decisions by looking for in conjunction with H4 conterminous lines

- TPO extension with a sustained move (BO from IB)

- TPO extension with failed auction (return to IB)

- How this direction of TPO extension relates to Value Area open sentiment

- Risk Management

- Only take 2 trades a day

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits