This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

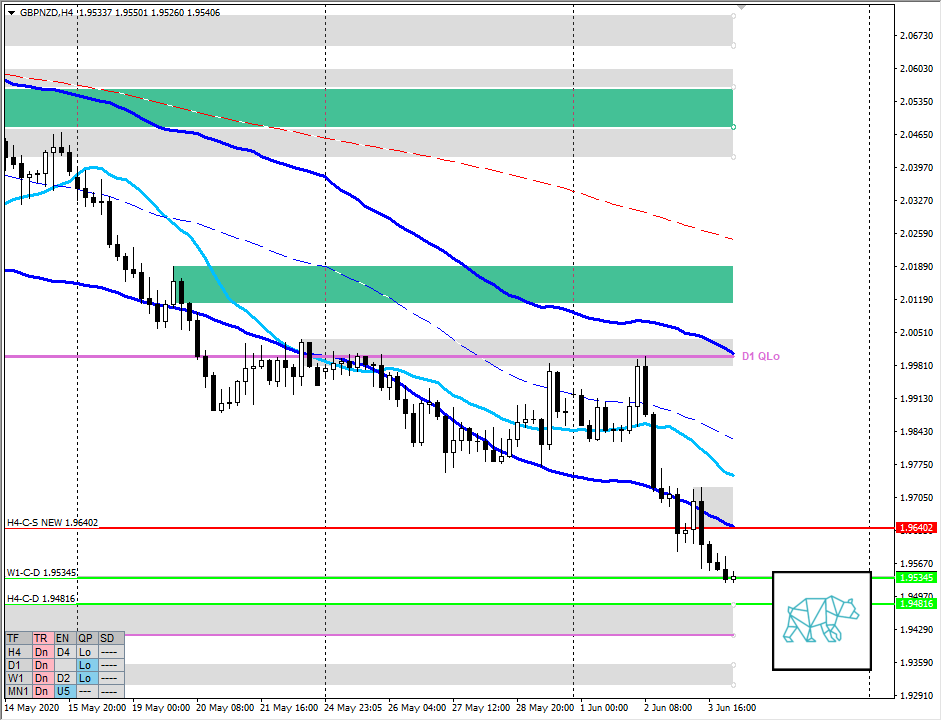

Non-conjecture observations of the market

- Strong 2nd bar down on Daily breaking weekly demand

- H4 Bear Engulf followed with some congestion down to W1-C‑D 1.95345

- Could be some redistribution shown on M30 or potential phase 1

- Market Profile

- Trading below PVAL

- HK within bounds but traded lower, session high only 60 pips to LN PVAL staying below M30-C‑S 1.95769

Compared against Weekly Trading Plan

- Took out W1 demand but still trading within W1/D1 QLo

Sentiment — Slightly Bearish

ZOIs for Possible Shorts

- M30-C‑S 1.95769

- H4-C‑S 1.96402 NEW

ZOIs for Possible Long

- W1-C‑D 1.95345

- H4-C‑D 1.94816

Focus Points for trading development

- Exit rules

- Option 1: Time-based stop

- Option 2: Target hit (SL (103/4) 26 pips + spread or x2 TP)

- NO OPTION 3

- UNLESS a trade is entered within 1 hour or half hour before the hard exit rule option 1

- Entry rules

- Cut off looking for trades at 11:15

- Entry on TPO break of IB

- Early entry with price action confirmation at

- H4 conterminous

- Open far from value, anticipating a move back to value using an engulfing + subsequent break of TPO

- Min. X2 R/R

- Use TPO confirmation or invalidation for directional decisions by looking for in conjunction with H4 conterminous lines

- TPO extension with a sustained move (BO from IB)

- TPO extension with failed auction (return to IB)

- How this direction of TPO extension relates to Value Area open sentiment