#fintwit #orderflow #daytrading #premarketprep #GBPNZD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Don’t take trades where SL placement is suboptimal. Instead, reassess for a better entry if possible. Unless there is a momentum play.

Compared against Weekly Trading Plan

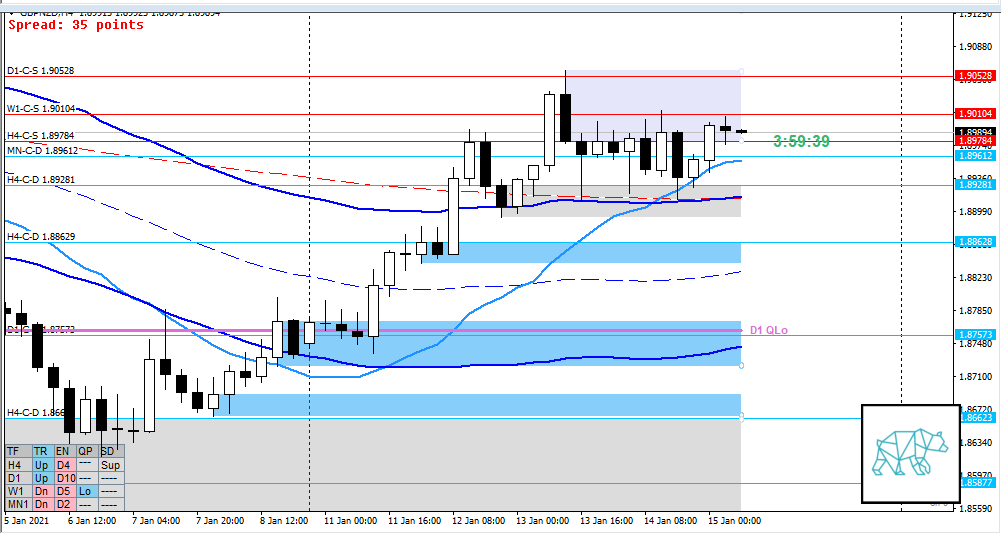

- Retracing previous week’s move down testing W1 supply

Non-conjecture observations of the market

- Price action

- D1 Inside bar with slightly longer buying wick. Mid D1 Q swing

- H4 consolidation with Bear Engulf and no follow-through. Instead Three Inside Up closing within overhead supply H4-C‑S 1.89784 near W1-C‑S 1.90104 and H4 QHi.

- Possible H4 Phase 3 or redistribution (less likely although still possible)

- Premarket: H4 closed as an Inside Bar

- Market Profile

- Value created below previous day’s value (kinda like a head and shoulders 🙂

- ADR: 1303

- ASR: 937

- 25

- Day

- Yesterday’s High 1.90140

- Yesterday’s Low 1.89126

Sentiment

- Locations

- H4-C‑S 1.89784 at VAH

- W1-C‑S 1.90104 just above range

- H4-C‑D 1.89281 below session range

- Sentiment

- LN open

- Moderate Imbalance. Due to near proximity to value edge plus overhead supply we might see a move down. Although H4 VWAP is still in UT so we might run into some pushback. Also no confirmed reversal on D1 either. Let profile and price action guide as always.

- Open distance to value

- 0.2xASR

- Sentiment

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Value Acceptance

- Preferred: Early acceptance with quick follow-through

- Hypo 2 — Return to Value

- Preferred: Strong bullish price action formed at VAH, IB extension up with sustained auction possibly taking out H4 supply. Probably low/medium initiative day due to overhead supply.

- Hypo 3 — Single Print Fade / Failed Auction

- Preferred: Move higher into supply failing to sustain auction (LTF faltering) followed by possible TPO structure buildup and price action reversal. Possibly taking out a single print although trading directly into supply I consider less likely for sinlge prints to get formed. Possible too wide IB range and fake out extension.

Additional notes

- N.A.

ZOIs for Possible Shorts

- W1-C‑S 1.90104

- H4-C‑S 1.89786

ZOIs for Possible Long

- H4-C‑D 1.89281

- D1-C‑D 1.87573

- W1-C‑D 1.85877

Mindful Trading

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING