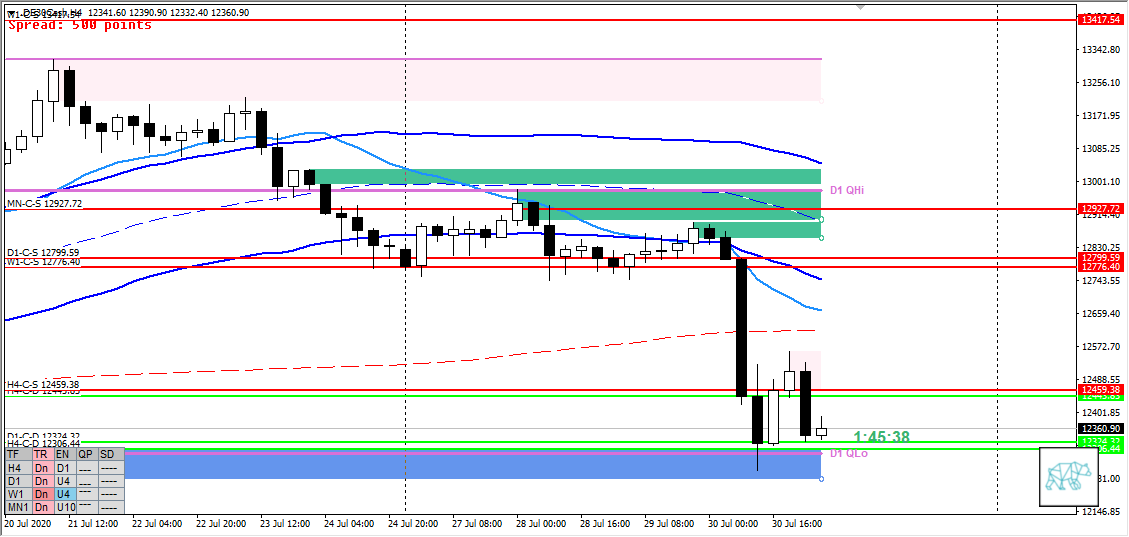

31 Jul Premarket Prep DE30 DAX 07312020

#daytrade #daytrading #forex #FX #INDEX #INDICES #DAX #DE30 #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #tradingforex #daytrading

This is my premarket prep for today’s European session for DE30 DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

- D1 DBD formed D1-C‑S 12799.59 but no close below W1 QHi (yet) testing D1-C‑D 12324.32

- Price dropped hard towards H4-C‑D 12306.44 and formed a bull engulf H4-C‑D 12443.83 but then proceeded to test underlying demand again through a bear engulf H4-C‑S 12459.38

- No close below D1 QLo (yet)

- Market Profile

- Currently price below VAL

- Have to reassess ADR position after LN open

Compared against Weekly Trading Plan

- MN-C‑S 13417.54 proved reactive and we have today left to close the candle off

- Move away from W1-C‑S 13417.54 forming new W! Supply with W1-C‑S 12776.40 however still trading within MN QHi after ducking slightly belowreachign for W1-C‑D 12103.96

Sentiment — Slightly Bearish

Additional notes

- N.A.

ZOIs for Possible Shorts

- W1-C‑S 13417.54

- MN-C‑S 12927.72

- W1-C‑S 12776.40

- D1-C‑S 12799.59

- H4-C‑S 12459.38

ZOIs for Possible Long

- W1-C‑D 12103.96

- D1-C‑D 12324.32

- H4-C‑D 12306.44

- H4-C‑D 12443.83

Mindful Trading

- I slept okay last night.

Focus Points for trading development

- Weekly Goal

- Have correct SL placement and position sizing

- Risk Management

- 3 allowed products

- Crude

- GBPNZD

- DAX

- 2 active opened positions — not on the same product

- 2% daily loss limit

- 3 trades allowed if ‘in the zone’

- Only trade off M30 candles or momentum plays

- After 4 losing trades in a week reduce TP to 1.5R but after 1R can consider taking profits

- 2 consecutive days of lack of sleep = NO TRADING

- 3 allowed products

No Comments