29 Jul Premarket Prep DE30 DAX 07292020

#daytrade #daytrading #forex #FX #INDEX #INDICES #DAX #DE30 #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #tradingforex #daytrading

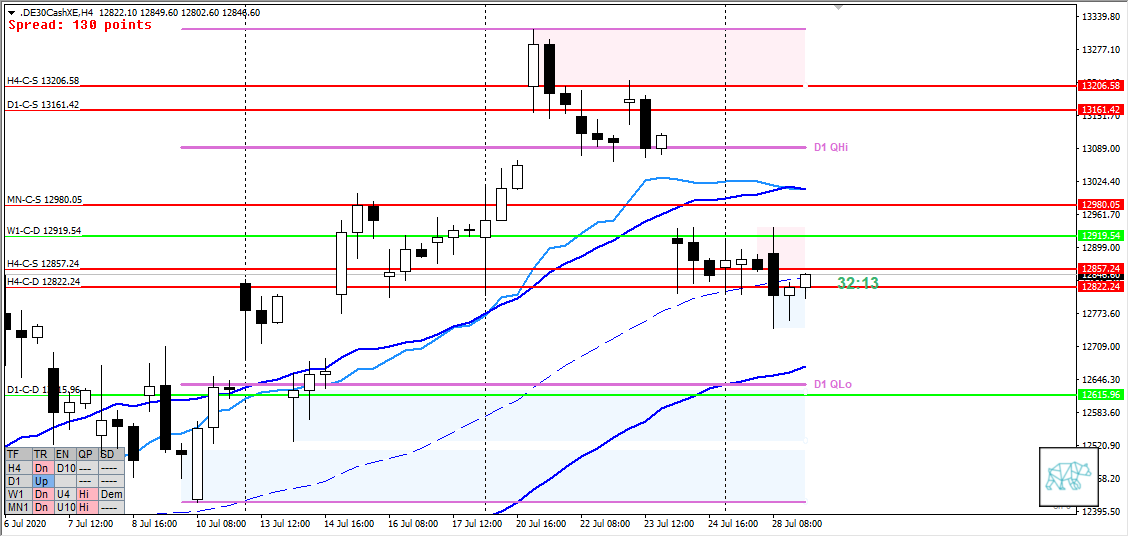

This is my premarket prep for today’s European session for DE30 DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

- D1 doji formed continuing consolidation or perhaps forming a DBD although today already touched the VWAP in an uptrend once

- H4 break down from consolidation forming supply through H4-C‑S 12857.24 but then an inside bar was formed giving H4-C‑D 12822.24 and we are currently retracing back to supply

- Market Profile

- Price is currently trading within value which happens to wider than usual

- Price was trading below ADR 0.5 and at ADR exhaustion (thus being exhausted) and is now moving higher, possibly breaking out from VWAP. Will have to reassess after LN opens.

Compared against Weekly Trading Plan

- First touch of D1 VWAP in UT

Sentiment — Neutral to slightly bullish

Additional notes

- FOMC rate decision today

ZOIs for Possible Shorts

- MN-C‑S 12980.05

- W1-C‑S 13550.48

- D1-C‑S 13161.42

- H4-C‑S 12857.24

ZOIs for Possible Long

- MN-C‑D 10825.85

- W1-C‑D 12189.63

- W1-C‑D 12919.54

- D1-C‑D 12615.96

- H4-C‑D 12822.24

Mindful Trading

- I slept well last night. Went swimming again. Took a nap.

Focus Points for trading development

- Weekly Goal

- Have correct SL placement and position sizing

- Due to summer time I will focus on trading off newly formed SD ZOIs for intraday plays. Keeping in mind that due to lack of liquidity 2nd chance entries can give better R/R using the M30/M15 rule.

- Momentum plays are allowed on DE30 DAX and WTI Crude oil

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Only trade off M30 candles

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits

- 2 consecutive days of lack of sleep = NO TRADING

No Comments