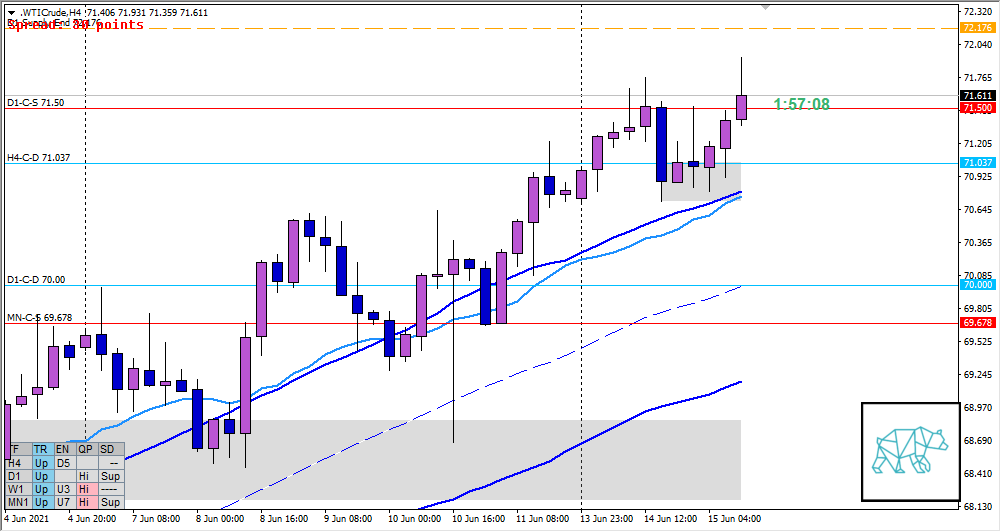

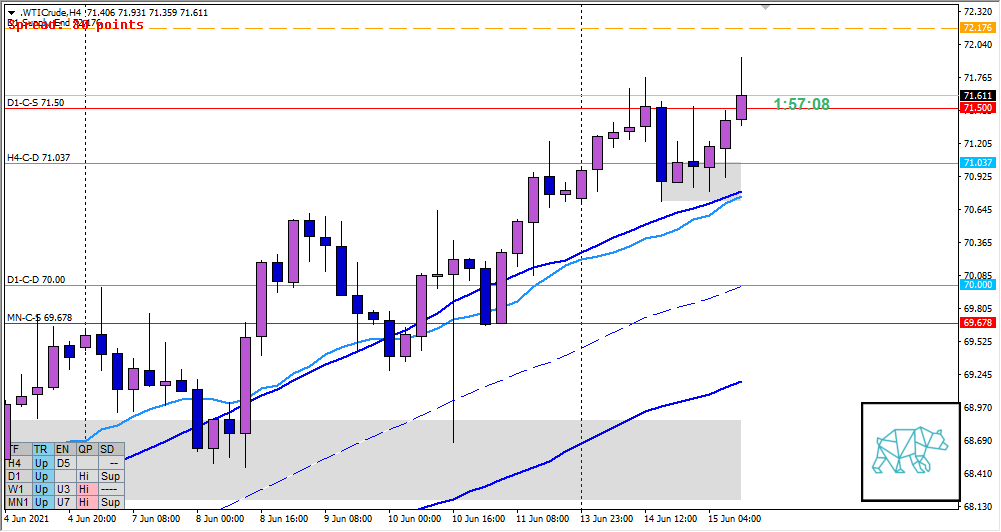

15 Jun NY Premarket Prep WTI Crude 20210615

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #oil #crude #WTI #USoil

This is my premarket prep for today’s European session for WTI Crude. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Compared against Weekly Trading Plan

- Price trading above last week’s body and range nearing W1-C‑S 73.340

Non-conjecture observations of the market

- Price action

- Yesterday closed as a doji with longer selling wick but London already made a HH trading within D1-C‑S 71.50.

- H4 RBR at H4 VWAP in UT giving H4-C‑D 71.037

- Trend: H4 Up, D1 Up, W1 Up

- Prevailing trend: Trend is UP 3/3

- Market Profile

- 2 overlapping values

- Daily Range

- ADR: 1193

- ASR: 1172

- 29

- Day

- Yesterday’s High 71.762

- Yesterday’s Low 70.712

Sentiment

- Locations

- H4-C‑D 71.037 at VAL

- D1-C‑S 71.50 within value

- Sentiment

- NY open

- Open within value at VAH

- Open distance to value

- N.A.

- Premarket

- H4 closed higher from H4 demand

- Narrative

- Balancing Market. However, H4 Continued closing higher from H4 demand and made HH during London. A M30 Three Inside Down before NY open (which was right at VAH)

- NY open

- Clarity (1–5, 5 being best)

- 3

- Hypo 1 — Sustained Auction Down

- Narrative: D1 Supply, M30 Three Inside Down permarket,

- Preferred: IB extension down, sustained auction (taper profit target due to a wide value)

- Con: D1 Bullish narrative

- Hypo 2 — Value Rejection Up / Sustained Auction Up

- Narrative: D1/W1 Bullish narrative

- Preferred: IB extension UP, sustained auction taking out D1 demand

- Con: Open within value, ADR nearly exhausted

- Hypo 3 — Value Rejection Failure / Failed Auction

- Preferred: price extends above and fails to find business. ADR exhaustion right above.

- Hypo 4 — Auction Fade

- Narrative: Hypo 2 plays out, D1 Supply Pop gives an LTF reaction. Exhausts ADR

- Preferred: TPO structure and PA reversal, target to IB edge

- Con: D1 Bullish narrative

- Hypo 5 — Auction Fade

- Variation to Hypo 1, possible reversal at H4 demand at VAL

Additional notes

- Capital Preservation Rule in effect

ZOIs for Possible Shorts

- W1-C‑S 73.340

- D1-C‑S 71.500

ZOIs for Possible Long

- H4-C‑D 71.037

- D1-C‑D 70

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Min. 3 times working out at home + mandatory cardio

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments