10 Jun Missed Trade Gold 20210609

Play: Auction Fade

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #Gold #XAUUSD #missedtrade

These are trades I could have taken but for some reason I did not. This could be due to me not paying attention or simply not feeling like trading. This is usually the case when I am not in the right state of mind due to lack of sleep, personal issues, etc.

Reason for missing the trade (explain the narrative)

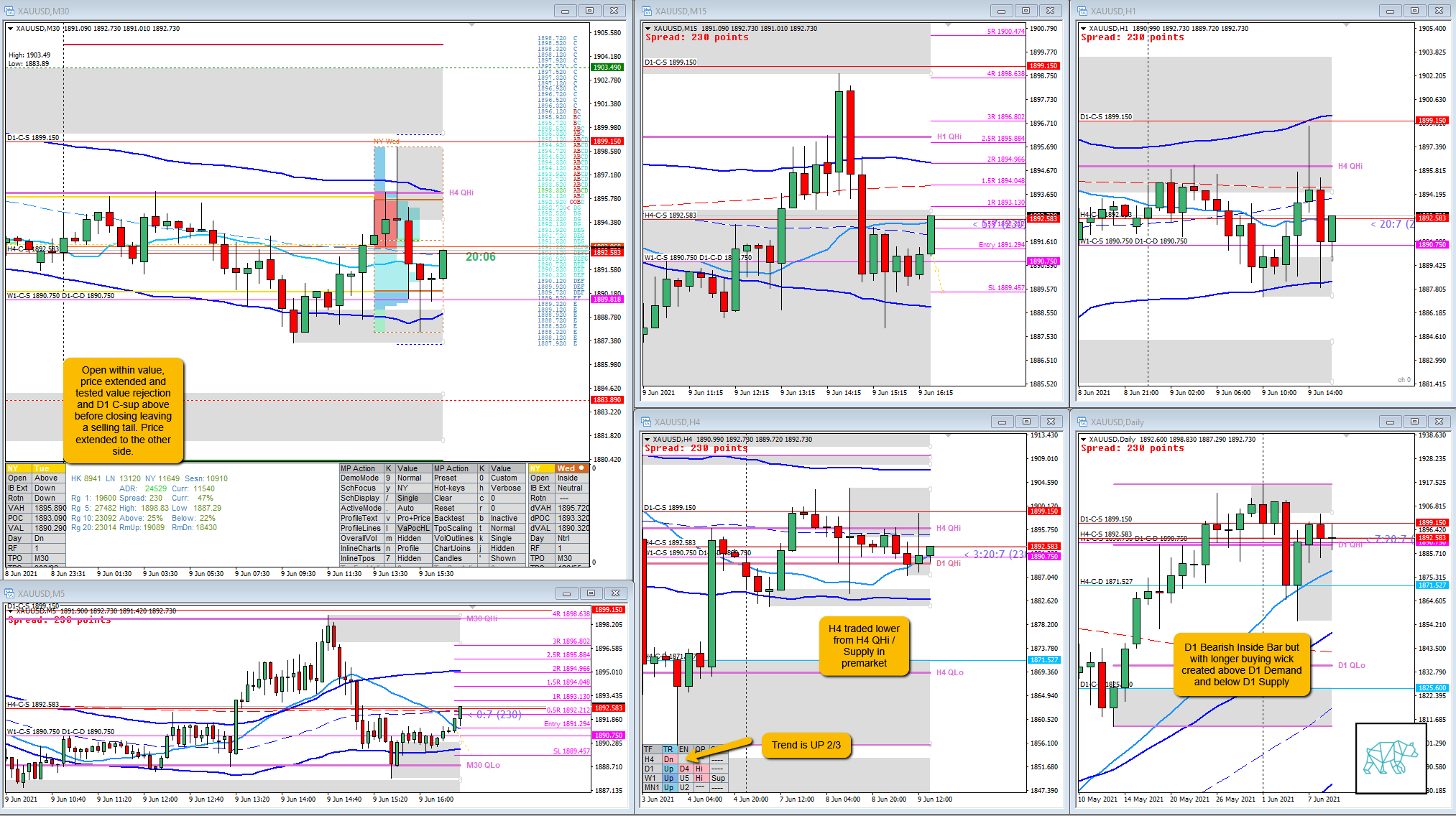

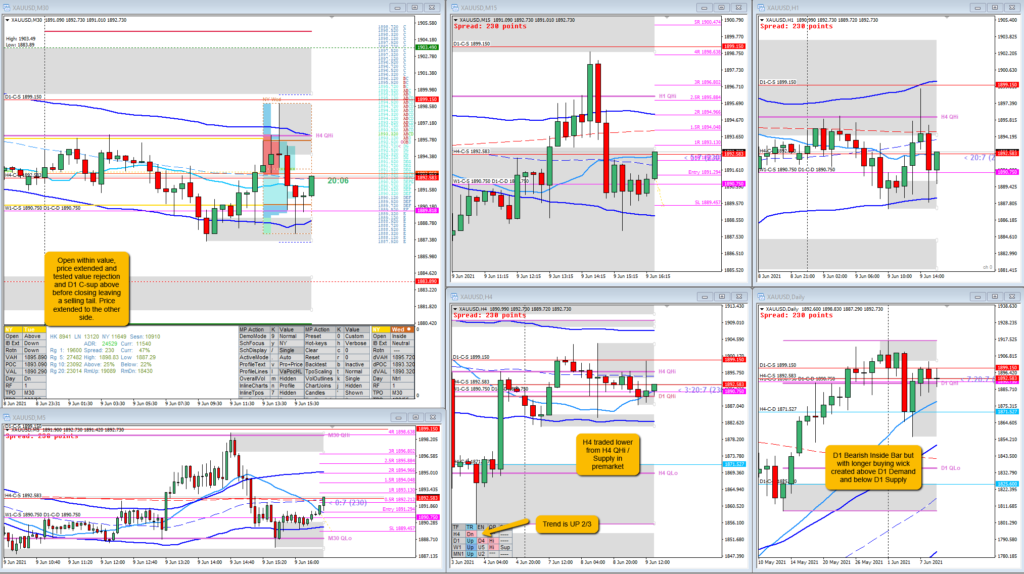

Price opened within value (there was a 3‑day bracketing range although sloping higher) and then proceeded to test a value rejection up. Halted at D1 C‑sup before closing inside IB leaving a selling tail. If there was a retest of M5 supply at IB high there could have been an opportunity for me to jump on but sadly this didn’t come. Price then extended to the other side in D closing below forming a Neutral Day. E made LLs closing as a Hammer and F closing as a Dragonfly Doji. With A neutral Day it is not likely for a continuation to one side. The expectancy favors a return to IB.

What would have been the Entry?

DTTZ: 1st

Entry Method: Consolidation going on M5/M15 that could have been taken as an entry to fade the auction to IB edge.

How was the SL placement and sizing?

Trade 1

SL placement: scaling the SL to be placed below M5 consolidation would have been cutting through the M30 wicks but okay expecting a push

How was the profit target?

Trade 1

Profit target: IB edge would have yielded 0.9R

What would a price action-based exit have done for the trade?

Trade 1

Exit: 0.9R

What would a time-based exit have done for the trade?

N.A.

Extra Observations

N.A.

TAGS: 3‑I day, Trend is UP 3/3, open within value, Neutral Day,

Premarket prep on the day

Daily Report Card on the day

No Comments