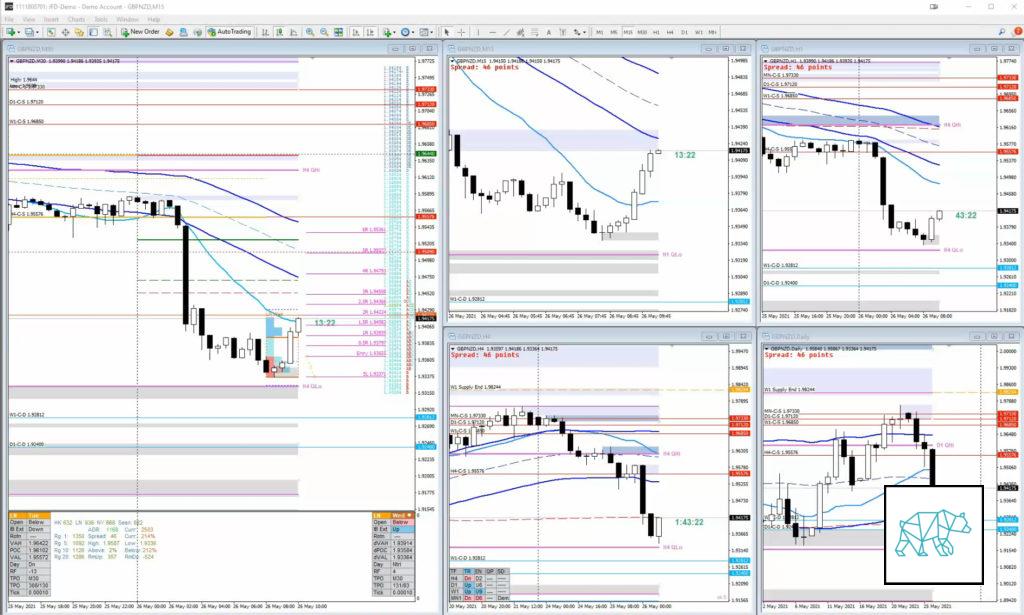

26 May Missed Trade GBPNZD 20210526

Play: Mean Reversion

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD #missedtrade

These are trades I could have taken but for some reason I did not. This could be due to me not paying attention or simply not feeling like trading. This is usually the case when I am not in the right state of mind due to lack of sleep, personal issues, etc.

Reason for missing the trade (explain the narrative)

Due to the huge imbalance and ADR getting exhausted during Asia I expected strength behind the move. A continuation to the H4 phase 4 with ‘D1 back to originating level’ narrative. Instead there was a bit of a mean reversion. I hesitated going in on an IB break to the upside due to this. Then visualized if there is a sustained auction I could get in perhaps on a pullback to IB edge for a late-sustained auction entry. This did not come.

(EDIT) Notes:

- Reviewing this the next day. H4 had dropped to H4 200MA (price usually pulls back and rarely crashing right through) so a pullback could be expected.

- Plus H4 PA down didn’t have much of a pullback yet. With arrival at H4 QLo there is a higher probability of price slowing down, possibly forming a Base / Inside Bar.

TAGS: D1 Demand Base, Return to Base, Trend is UP, Developing H4 Base, Huge Imbalance, Below Value, Outside Range, ADR got exhausted, momentum trade, Single Print Fade,

What would have been the Entry?

Trade 1

DTTZ: 1st

Entry Method: IB extension

How was the SL placement and sizing?

Trade 1

SL placement: standard size SL placement would have been good. In the screenshot I used a little too wide SL placement this should have been 25 instead of 30 pips.

How was the profit target?

Trade 1

Profit target: 2R was reached off extension

What would a price action-based exit have done for the trade?

Trade 1

Exit: 2R was reached before a PA exit rule

What would a time-based exit have done for the trade?

Trade 1

Exit: 2R was reached before a time-based exit rule applied

Extra Observations

Developing H4 Base through a mean reversion to Single Print Fade

Premarket prep on the day

Daily Report Card on the day

No Comments