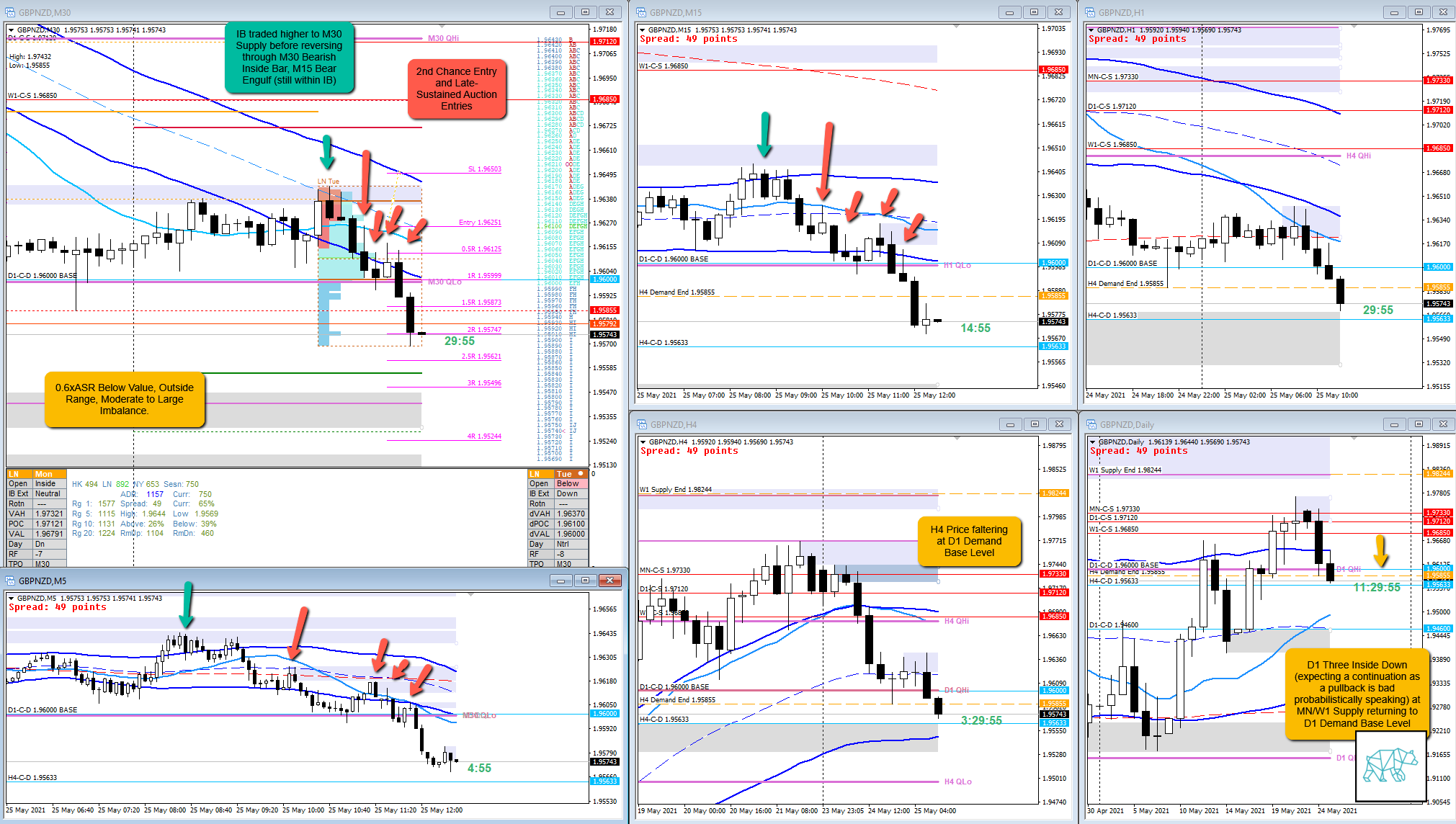

25 May Missed Trade GBPNZD 20210525

Play: Trend Continuation / Return to Value

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD #missedtrade

These are trades I could have taken but for some reason I did not. This could be due to me not paying attention or simply not feeling like trading. This is usually the case when I am not in the right state of mind due to lack of sleep, personal issues, etc.

Reason for missing the trade (explain the narrative)

I initially was stalking the trade but then didn’t want to take it from inside IB and waited for more orderflow confluence. When that finally came through an extension down in D I could have gone with the trade based on the extension alone. I considered a pullback to DPOC and near newly developed M30 supply would be a good entry point for a 2nd Chance Entry and almost put a Sell Limit Order. Sadly, I hesitated due to the price being mid swing on M30/H4. Then I got disturbed by a phone call and when coming back I saw a potentially late-sustained auction entry but again I hesitated.

‘Reasons’ for hesitating:

- Price being mid swing

- Got disturbed by a work call

- Expecting (and got biased most likely) to see a bit more of a bounce from D1 Demand Base level, especially after some H4 supply got taken out, before continuing down (would have also been in line with H4 VWAP in UT BD to CAR)

- Wide M30 Demand underneath kinda made me less eager to trade right into

Even though my reading of price action and orderflow was in line with D1 returning to a D1 Demand Base level (suggesting a potential continuation). H4 was not showing a great effort to reverse either. Missed out on a great trade here. The D1 Three Inside Down also suggested a quicker follow-through to the move as a test of newly developed supply could suggest a possible failure to continue the move.

TAGS: D1 Three Inside Down, Return to Base, D1 Demand Base, Moderate to Large Imbalance, Reversal within IB, 2nd Chance Entry, Late-Sustained Auction Entry, Below Value, Outside Range, H4 Demand Popped,

What would have been the Entry?

Trade 1a

DTTZ: 1st

Entry Method: M30 Bearish Inside Bar from within IB without extension then monitor for a continuation (in this case DBD)

Trade 1b

DTTZ: 1st

Entry Method: 2nd Chance Entry after D TPO had extended below there was a pullback to DPOC and newly formed M30 supply

Trade 2c

DTTZ: 2nd DTTZ

Entry Method: Late-Sustained Auction Entries

How was the SL placement and sizing?

Trade 1a

SL placement: Perfect as a standard sized SL would have been way above the formation

Trade 1b

SL placement: Perfect as a standard sized SL would have been way above the formation

Trade 1c

SL placement: not the worst but it is cutting through the formation. I think with using IB edge a return and close within IB would have negated this trade so it was okay.

How was the profit target?

Trade 1a, 1b

Profit target: Expecting a continuation taking out H4 demand in a sustained auction the profit target would have been good.

Trade 1c

Profit target: Buffer trade would have been enough

What would a price action-based exit have done for the trade?

Trade 1a

Exit: 0.8R on M30/M15 Bull Engulf, although due to the D1 narrative and H4 Demand getting popped I could have let it go on longer. Trade hit 2R in overlap noise

Trade 1b

Exit: 0.6R and the rest same as 1a

Trade 1c

Exit: 0.8R to over 1R in overlap noise

What would a time-based exit have done for the trade?

Trade 1a

Exit: 1.5R, Overlap noise 2.2R

Trade 1b

Exit: 1.3R, overlap noise 2R

Trade 1c

Exit: 0.8R, overlap noise 1.5R

Extra Observations

Again, when H4 demand got popped there was a M30 reversal (albeit flimsy) before continuing the move down.

Premarket prep on the day

Daily Report Card on the day

No Comments