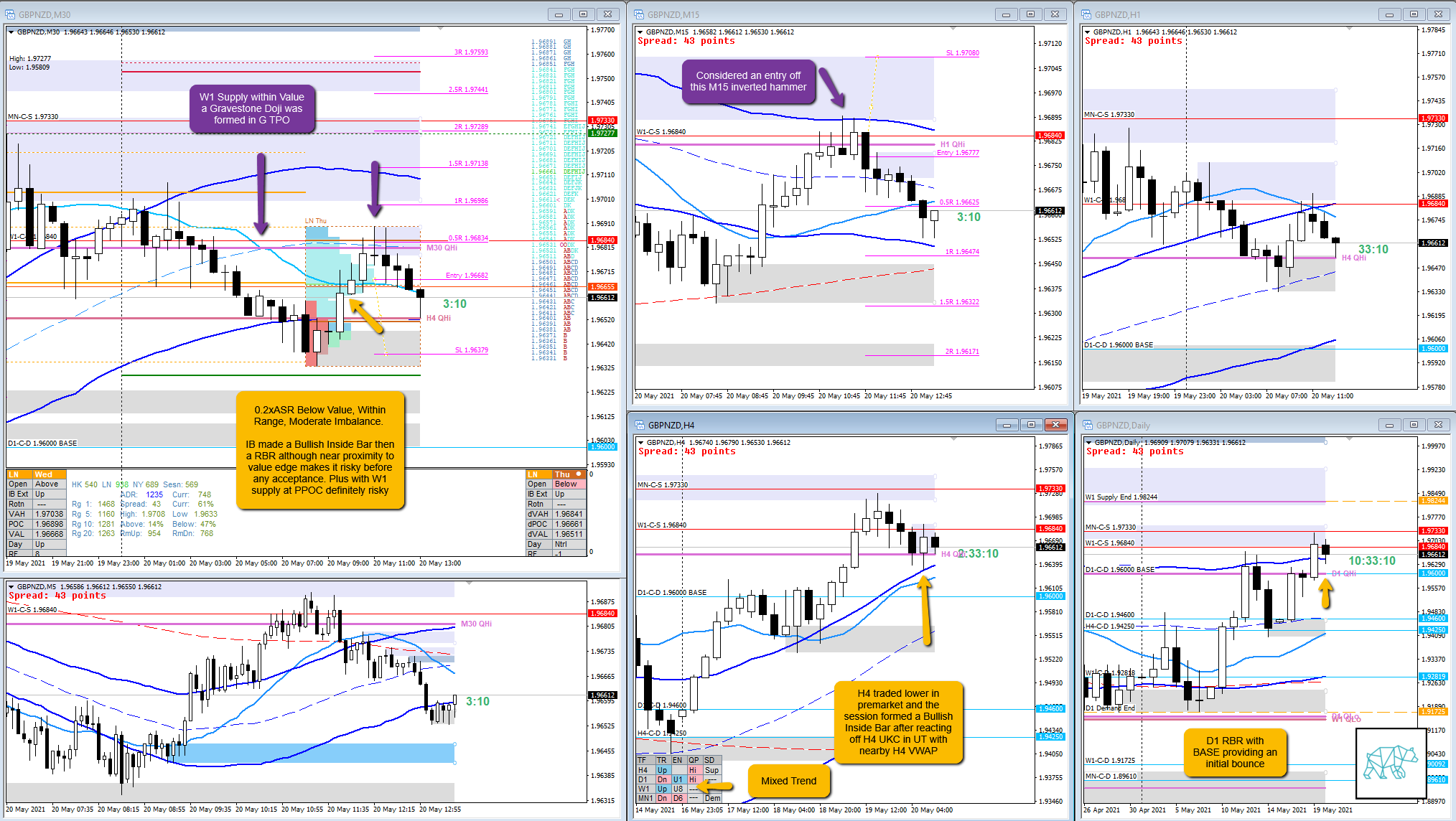

20 May Missed Trade GBPNZD 20210520

Play: Value Acceptance to Return to Value

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD #missedtrade

These are trades I could have taken but for some reason I did not. This could be due to me not paying attention or simply not feeling like trading. This is usually the case when I am not in the right state of mind due to lack of sleep, personal issues, etc.

Reason for missing the trade (explain the narrative)

Price opened with a moderate imbalance below value, within range. Due to the near-proximity to the value edge I did not want to go long without an acceptance. That and W1 supply being within value I decided the better play would be a Return to Value play. This came rather late into the session. G TPO formed a Gravestone Doji and LTF showed a possible reversal. M15 closed unconvincingly so I decided to let it go. This was followed by a M15 Bull Engulf so at first I was happy with not taking the trade. However then price did eventually go down and the trade would have been a good ‘buffer trade’.

TAGS: D1 RBR, D1 Demand BASE, Mixed Trend, H4 UKC in UT, Below Value, Within Range, Moderate Imbalance, Value Acceptance, Return to Value, W1 Supply,

What would have been the Entry?

Trade 1

DTTZ: 2nd

Entry Method: M15 Inverted Hammer / M5 Three Outside Down combo

How was the SL placement and sizing?

Trade 1

SL placement: Standard SL size would have been well above the formation

How was the profit target?

Trade 1

Profit target: I was considering falling the auction to IB high which would have been 0.8R only

PICTURE

What would a price action-based exit have done for the trade?

Trade 1

Exit: 0.8R in overlap noise (K)

What would a time-based exit have done for the trade?

Trade 1

Exit: 0.2R

Extra Observations

Price trading mid M30 swing is risky to play off of

Premarket prep on the day

Daily Report Card on the day

No Comments