25 Apr Missed Trade GBPNZD 20210419

Play: Mean Reversion to Return to Value play

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD #missedtrade

These are trades I could have taken but for some reason I did not. This could be due to me not paying attention or simply not feeling like trading. This is usually the case when I am not in the right state of mind due to lack of sleep, personal issues, etc.

Reason for missing the trade

I was not feeling my best due to lack of sleep. So I decided to stay out and just observe. Too bad since this would have been a home-run day.

What would have been the Entry?

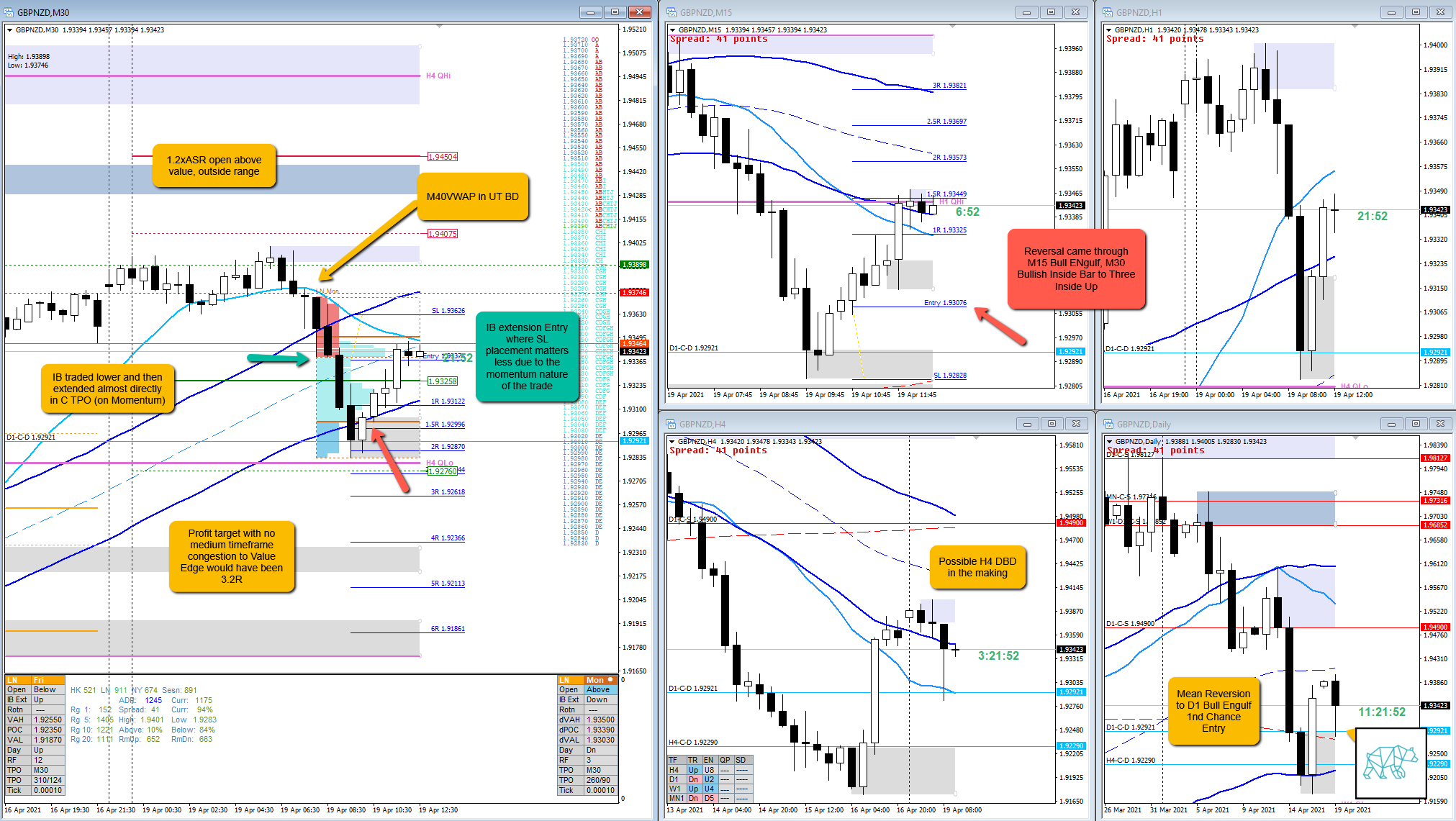

Large Imbalance at the open, 1.2xASR above value, outside range coinciding with a M30 VWAP in UT BD and possible H4 DBD in the making.

Then when the move traded down to D1 demand, near H4 QLo it reversed leaving only an okay buying tail on the profile. Reversal came through M30 Bullish Inside Bar, M15 Bull Engulf. The profile started fading the auction back up to IB edge low and eventually closed within failing the auction

Trade 1

DTTZ: 1st DTTZ

Entry Method: IB extension

Trade 2

DTTZ: 2nd DTTZ although a bit early as reversal started in E

Entry Method: M30 Bullish Inside Bar, M15 Bull Engulf

Tags: Large Imbalance, above value, outside range, M30 VWAP in UT BD, H4 DBD, IB extension entry, M30 Bullish Inside Bar, M15 Bull Engulf, auction fade, failed auction, D1 2nd chance entry

How was the SL placement and sizing?

Trade 1

SL placement: Due to the momentum nature of the IB extension entry SL placement can be suboptimal. So it was okay.

Trade 2

SL placement: The SL placement was slightly below the price action formation so that is good plus it was located at x.xx82 with entry aroun x.xx07

How was the profit target?

Trade 1

Congestion: There was a D1 demand at 1.8R

Profit target: Value Edge would have been 3.2R

Trade 2

Congestion: None

Profit target: IB Edge Low would have made for 1.3R

What would a price action-based exit have done for the trade?

Trade 1

Exit: So my standard 2R profit target would have been hit if I had chosen to wait for an actual reversal pattern the trade would have netted 1.3R.

Trade 2

Exit: Since there was no price action reversal a time-based exit would have netted 1.4R

What would a time-based exit have done for the trade?

Trade 1

Exit: ‑0.2R

Trade 2

Exit: 1.4R

Extra Observations

Return to Value play (after a mean reversion down) formed a H4 DBD with long buying wick. The return to value play was a D1 2nd chance entry.

Premarket prep on the day

Daily Report Card on the day

No Comments