19 Sep Leverage in trading

Why do brokers offer leverage?

When looking to trade Forex or commodities like I am, you’ll find many brokers offering a leveraged account. Promotions on how you can trade 40.000 dollars with only 100 dollars in your account. What’s up with that, right?! The way they do that is by offering you this thing called leverage. In the case of the example, 400:1. That means 400 to your 1 dollar. Sounds great right?! SPOILER ALERT! The answer is: ‘not necessarily’.

DISCLAIMER

Here it goes…

The little guy

One reason I believe these brokers offer ‘leverage’ is because it makes trading accessible to a larger audience. Especially those without sufficient funds to trade big quantities of stocks, commodities, etc. On top of this, brokers, make their money by collecting something that is called the ‘spread’. The spread is the difference between the ask and bid price. Ask being the lowest ask price (the sellers) and the highest bid price (the buyers). So if the ‘ask’ is 50 dollars and the ‘bid’ is 49 the difference is 1 dollar. This is the amount the broker get’s per unit per lot. The lot sizes change according to the financial instrument that you are trading. For me trading WTI crude oil, one lot is 1000 barrels. Meaning if I had bought 1 lot in this example 1000 dollars would have gone to the broker. Not too shabby huh?! Although spreads are usually very small of only a few cents. Still, of course, it remains a lucrative business.

Breaking down the spread

Let’s keep it simple and stick with the 1 dollar spread. When I take a long position (meaning that I think prices will go up) and the current ‘actual’ price (not the ask or bid) is 50 dollars. I will be down that 1 dollar spread per unit per lot. So it’s kinda like buying it at 51 dollars. Meaning I am down 1 dollar a unit from the get go. Now keep in mind that this is just an example and the spreads are usually just a few cents. If I would have gone short (betting that prices are going down( with the current price being 50 dollars, I basically place my position at 49 dollars. So either way, by default, I start off in a deficit. In this case 1 dollar per unit deficit. The bottom line for the spread being, and I’m quoting Investopedia here, ‘The bid-ask spread is essentially a negotiation in progress’.

Let’s leverage some stuff

So the broker makes money off the spread. Obviously the more units we trade, the better for the broker. So let’s take my account as an example. I have read about the ‘dangers’ of having an over-leveraged account so when I saw that the lowest my broker offered was 50:1, I took that. Meaning that for every one of my Euros I can trade 50 times that. In my account, keep in mind this is the paper trading account I speak of. Not sure what that is? Click here. My initial account size is 10.000 Euros. Meaning I could buy or sell up to 500.000 Euros. Neat, right?! I know I know. I’m getting there.

Break it down, baby!

In my example, I am trading 1 lot of WTI crude oil. That means 1000 barrels of that black ‘good’ stuff. Black gold. The sticky icky! Pretty sure that last one was no referral to crude oil. Anyway, with my account I have taken many positions going long or short. But when a trade went against me (meaning I was losing on the trade) I simply kept the position open. In a matter of days price action would turn around and I’d could close the position on a profit. Now, I know what most ‘pros’ on the internet say: ‘Cut your losses short’. But it was working. Prices went against me. I waited. They turned around and I was rocking and rolling to the fake bank. Until, of course, it stopped working. This is where the leverage comes in. So maybe these ‘pros’ were right?… Nahhh! 🙂

On margin

When you have a leveraged account. It means that you have a margin account. So your losses are calculated based on the margin that you have left. This is what my broker says on how my account is build up.

Balance: Your account’s value excluding P/L from open positions — it equals the funds you deposited into your account and your P/L from closed positions. P/L being Profit and Loss.

Equity: Your current account’s value — it equals your balance, plus any P/L from open positions.

Open P/L: The sum of profit and loss from all your open positions.

Free Margin: The sum of funds you have available to use as initial margin for new positions. Calculated by subtracting the margin user by your current open positions from your equity.

Used Margin: Indicates the sum of margin being used by your current open positions. Calculated by adding the initial margins of all your open positions.

Maintenance Margin: The minimum amount of equity required to maintain your current open positions. If your equity level drops below this number, your open positions will be automatically closed.

Margin Level: Indicates how close your account is to a margin call. Calculated as Equity/ Initial Margin and shown in %. When Margin level drops below 100% you will not be able to open new positions. And if it drops to 50% all your open positions will be closed and working orders will be canceled automatically.

Available for withdrawal: Amount of money you are able to withdraw after closing all your open positions. It equals to your current equity, minus any non-trading related incentives as stated in our T&Cs for Incentives and Loyalty Awards.

Say what now?!

Let’s look at it by using an example. For my example I will use one long position open (long or short doesn’t matter) of 1 lot. This lot I purchased at 47 dollars. Let’s do the math.

- 1 lot = 1000 barrels, 1 barrels costs 47 dollars, so that makes 47.000 dollars

- my leverage is 50:1 that would mean that to take the 1 lot position my account gets charged 47.000 divided by 50 = 940 dollars margin used

- let’s say the current price went down (i’m at a loss) 25 cents per barrel at 46.75.

- 0.25 times 1000 barrels = 250 dollars loss

Filling in the blanks

Balance: 10.000

Equity: 9.750

Open P/L: -250

Free margin: 9.750 (equity) — 940 (used margin) = 8810

Used Margin: 940

Maintenance Margin: 940 (used margin) / 2 = 470

Margin Level: 9.750 (equity) / 940 (initial margin) x 100 = 1.037%

Available for withdrawal: 9750 (equity)

Getting to the nitty gritty

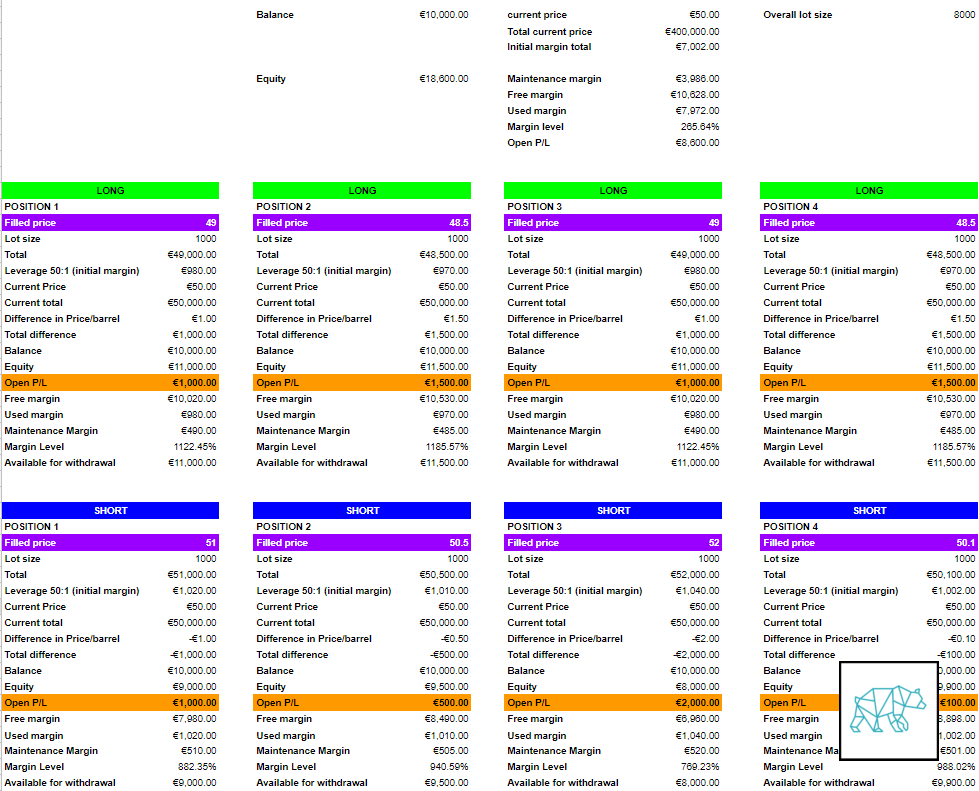

So what blew up my account?! In this part we’re gonna dive deeper into the belly of the beast that is ‘leverage’. But first, let’s get one thing straight. If I had cut my losses short I wouldn’t have blown my account. I get that. My aim here is to find out how many positions with how much losses I can have before I hit a margin level of 100%. Because that’s when I can’t open new positions anymore. Then how much do I have left until I hit 50%. Because then my open positions get closed out, one by one, starting with the biggest loss. This then alleviates the margin level but you’re most likely to stay in the ‘dangerzone’ (50% to 100%). You could either close positions yourself to get you out of it so that you can take new positions. Hopefully with these you could get a profit from whichever way it’s going at the moment and build more margin.

The nitty gritty

So we have to come up with a way to understand the ratio between the amount of positions open and the losses that they have incurred up until a certain point. By doing this we can better guess how many positions we can have open/ How much percentage loss each position can have. How much percentage that position will take away from our margin level. Thus, in the end, tell us how much ‘buffer’ or margin we have before we blow up our account.

First we are going to understand how one position open affects our account. Afterwards, we will add positions open and play around a bit with losses and wins of those positions. To see how it affects the bottom line.

Conclusion

When trading with a 10.000 Euro account. Taking 1 lot (1.000 barrels) positions each time. At a leverage of 50:1. I don’t have much room for error if taking too many positions. After playing around a bit I can assume that I can have 5 losing positions open with a losing margin of 1 to 2 Euros. Or I could trade smaller lots but more of them. This way I can still take positions without getting into the danger zone too quick. So what have I learned really?

Lesson 1

Don’t take too many positions because that raises the risk of having trades go against you.

Lesson 2

Set an amount you are willing to lose on each trade. This I will base on the average profit I took from the trades that did go my way. To test this I will explore these trades a bit more in a future article.

Thank you for reading

If you’d like to get my Excel sheet on how to calculate the margin levels of your trades, please drop me an email or subscribe. And as always. Please leave a comment. Troll me. Tell me how stupid I am and show me how it’s done.

No Comments