26 Mar How did I trade today? 20210326

Summary: Easy to fool yourself when you are making money. Process is king.

#fintwit #orderflow #daytrading #dailyreportcard #tradinglifestyle #daytraderlife #grasshoppersanonymous #tradingforex #tradingcommodities #NEXT

Every trading day I recap my trades, including more than entries and exits. Why did I take the trade? How did I manage the trade, my emotions and cognitive function? All the good stuff as well as all the ugly of being a day trader. As always, feel free to reach out to me.

My weekly goal:

- Only trade the main account

- Done

- Focus on time-based exits

- Failed this one

- Don’t look at M5 chart unless within the last half hour of trading window

- I did look at the M5 but it was after I had closed the trade

Good Pre-market routines

Good Session PECS

Fair Trade selection

Fair Trade sizing or SL placement

Fair Trade Execution & Mgmt.

Good Risk Adjusted Returns

Yes Daily review

Muppet meter (1 being best — 5 being worst): 2

Summary

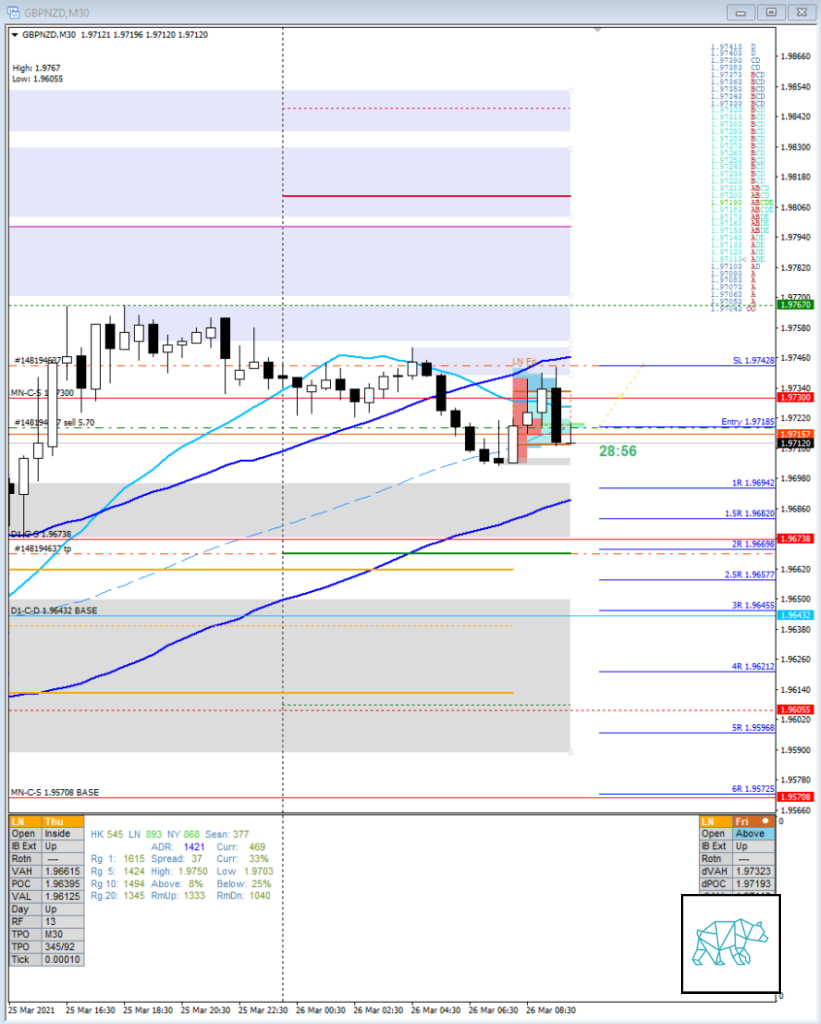

- GBPNZD

- IB: Traded higher

- C: Extended but closed within IB with no reversal pattern (yet)

- D: Closed as a Bear Engulf with a weak selling tail

- E: Short through sell limit order at 1.97180 SL 1.97430 TP 1.96680 although I will take 1R if needed. Price pulled back a bit and triggered it.

- Reasons: hypo 2, failed auction, weak selling tail not the best, TPO D closing as a bear engulf, Friday profit-taking

- Monitoring for an extension to the downside forming a Neutral Day.

- M15 bull engulf formed

- Closed as a M30 spinning top with longer selling wick / M15 consolidation, giving it another TPO to try and extend below IB

- F: Tested IB low, 1 TPO below previous low, LTF supply still intact

- On 2nd retest of IB low I was on alert and waited for supply to get taken out. When price started popping slightly higher after reaching LTF demand low I gathered the M15 consolidation might hold for another period and pocketed some profits 0.4R.

- M15 closed as a consolidation (above LTF demand) with long buying wick. I will monitor the remainder of the session for any improvements I can learn from.

- F closed as a M30 Three Inside Up, M15 broke up from consolidation

- G: Closed as a bear engulf

- H: closed as an Inside Bar, H4 inside bar with long selling wick

- GOLD

- IB: Traded lower although with buying wick

- C: Extended above IB but then closed as a long-wicked doji

- D: closed as consolidation within IB

- E: Closed trading slightly lower but still within IB

- F: Shot up and is testing value, M15 44 pip bull engulf is crazy

- Closed at VAL without accepting, price extended 1xIB

- G: Closed as a bearish inside bar

- H: Closed as a Three Inside Down, H4 Bearish Inside bar with selling wick

GBPNZD

- Which hypo played out and how did I hypothesize it playing out? How did it actually play out? What did the profile and price action show?

- Hypo 2 — Swing Reversal (unconfirmed swing) / Value Acceptance

- Narrative: Price hitting MN supply level, Friday profit-taking, D1 supply

- Preferred: Strong bearish price action (although probably not as strong, or price can be slow due to FPT). IB extension down.

- Con: Lots of demand within value

- 80% correct

- Instead of an IB extension down there was an extension up in TPOs C and D before D closed as a Bear Engulf failing auction leaving behind a weak selling tail.

How accurate was my assessment of market context? What were the circumstances of the developing narrative? How did they develop according to DTTZ?

I did well to wait for for more information in D. C had extended above IB but with price slowing down on H4 and potentially reversing a move upwards was not going to be a good one. Also after the moderate imbalance at the open price traversed higher to mean reversion distance to value edge. When D closed as a bear engulf I went short.

What was the play of the day?

A mean reversion play at MN C‑sup, within D1 supply, after a failed auction there was a bear engulfing although a neutral day was not formed during my trading window.

Was I right on the outcome? Which Hypo played out and why was it not Hypo 1 (if any)?

I was right on my 2nd Hypo. I should not have called it a swing reversal, rather a mean reversion trade. The reason it wasn’t my first was because of the moderate imbalance at the open and large LTF demand at VAH. In hindsight I guess I could have given more weight to the supply, as well as trading on a Friday. In these moderate to large imbalance days one of the factors I will consider from this day forth is the fact that price can easily traverse to mean reversion distance before reversing. Lesson learned.

Was there an opportunity and did I take it?

I did take an entry short based off D TPO closing as a bear engulf failing auction within a D1 supply near a MN supply.

DTTZ: Reversal to Franky Fakeout

Entry: Sell Limit Order 3 pips below newly formed conterminous and DPOC. Order got triggered on a slight pullback. Did well here.

Profit Margin (ADR or congestion): price had only traversed 38 pips leaving slightly more than 50 pips on the range which could have been enough. There was no immediate H4 demand underneath although a larger LTF demand was present at VAH which would have given a 1R at best. So not the best profit target. However, with no H4 demand underneath I hypothesized a possible return to value edge which gave a 2R profit target.

What would a price action exit rule have done?

A price action based exit would have netted ‑0.3R

How was SL placement and Sizing?

SL placement was good as it was located above the formation. Although I had not accounted for the spread in my SL so I moved it up slightly to account for this. This altered my sizing, not too bad as it was still acceptable.

What would time-based have done?

It would have scratched the trade for 0R

What could I have done better?

I want to say that I did well to pocket the 0.4R when I did. However this was not rule-based. This was me observing a failure to break LTF demand and price taking a long time before actually doing so. Thus on the next retest of LTF demand I waited and when price started ‘popping’ a few pips above I decided it was enough and cut the trade.

How did I feel before, during, and after the trade?

I felt exceptionally calm to begin with. Then when price reversed I got a little jumpy but nothing too bad. I kept calm accepting the 1R loss if it would come. Although I kept telling myself that it wasn’t likely to hit a full stop as SL placement was good and price wasn’t staying within newly formed supply much. It was mostly trading below coinciding with DPOC.

GOLD

- Which hypo played out and how did I hypothesize it playing out? How did it actually play out? What did the profile and price action show?

- Hypo 1 — Return to Value

- Narrative: Larger timeframe bearish sentiment, open sentiment, arrival at D1 base demand

- Preferred: Strong bearish price action with IB extension down, sustained auction

- Con: trading right into demand

- 80% correct

- Price slightly extended above IB during C after which it closed within IB. Price continued to trade within IB until a big bull engulf was formed in F closing at VAL not accepting it. G formed a Bearish Inside Bar and then continued down.

How accurate was my assessment of market context? What were the circumstances of the developing narrative? How did they develop according to DTTZ?

I did fairly well even though I did not mention a potential failed auction. They say Gold is a beast and we definitely saw that as price made a strong move and then an even stronger countermove. I am gaining more and more conformation of the DTTZs and how they play out. This is something I will reaffirm in my trading rules.

What was the play of the day?

Return to Value play. Price tested VAL (without accepting) before forming a Bearish Inside Bar and reversed.

Was I right on the outcome? Which Hypo played out and why was it not Hypo 1 (if any)?

I was right.

Was there an opportunity and did I take it?

There was an opportunity but I did not take it as price had just made a strong move up before reversing. I saw LTF faltering and reversing but as the ‘best’ entry was gone I decided to let it go as this would be more out of FOMO then I actually stalked the opportunity properly, visualized, then acted. THAT IS ONE HARD RULE I CANNOT BREAK.

What would a price action exit rule have done?

Entry short off the M30 Bearish Inside Bar the exit would have coincided with a time-based exit and netted 0.5R. Entry off the M15 Three Inside Down would have netted 0.8R.

How was SL placement and Sizing?

Based on the M30 Bearish Inside Bar not the best as it would have cut through the wick on the previous candle. Entry off the M15 Three Inside Down would have had great SL placement as it would have been above the formation.

What would time-based have done?

0.5R. Overlap noise would have netted 1.5R on the close. Entry off M15 would have netted 0.8R and 1.8 at the close of the overlap noise.

What could I have done better?

I could have actually taken the trade as it was something that I was just going through the lectures again. Specifically on a return to value play. Ah well, next time.

How did I feel before, during, and after the trade?

No trades taken.

How well did I manage my physical, emotional and cognitive states?

I did well actually. Cognitively speaking I was pretty good. Same with emotions.

What did I learn today?

My ego would like to think there was a good reason to cut the trade off when I did. I believe this is a slippery slope as my nature is to grasshopper. I believe acting on cold hard trading rules is what is sustainable and consistently profitable. Although, I do need to give myself some space to be intuitive in the markets. I did not just start out trading. Having said that. I have a good process in place to 1) catch myself if I do it too often 2) the willpower and honesty to actually address and do something about it.

What’s one thing I need to do more often?

Keep following my process.

What’s one thing I need to do less often?

Worry about making mistakes. The mistakes are what teach us the most.

Under the circumstances, did I perform at my best?

I did okay today.

For my trade plan(s) on this particular day, go here:

No Comments