12 Jul Gold XAUUSD — Week 29 Trading Plan

#daytrade #daytrading #forex #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #Gold #XAUUSD

This is my weekly outlook on Gold (XAUUSD). Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Bullish

- Price above last month’s bar but in the middle of retracing developing bar (still have 3 weeks in the month left) after making a HH exceeding October 2012’s high

- Price still within MN supply and within MN1/ Q1 QHi

Weekly — Bullish

- New Demand formed at MN1 QHi with conterminous W1-C‑D 1729.488

- Price extending higher with no supply overhead until that of last September 2011 with conterminous W1-C‑S 1855.184

- Price still above UKC and VWAP

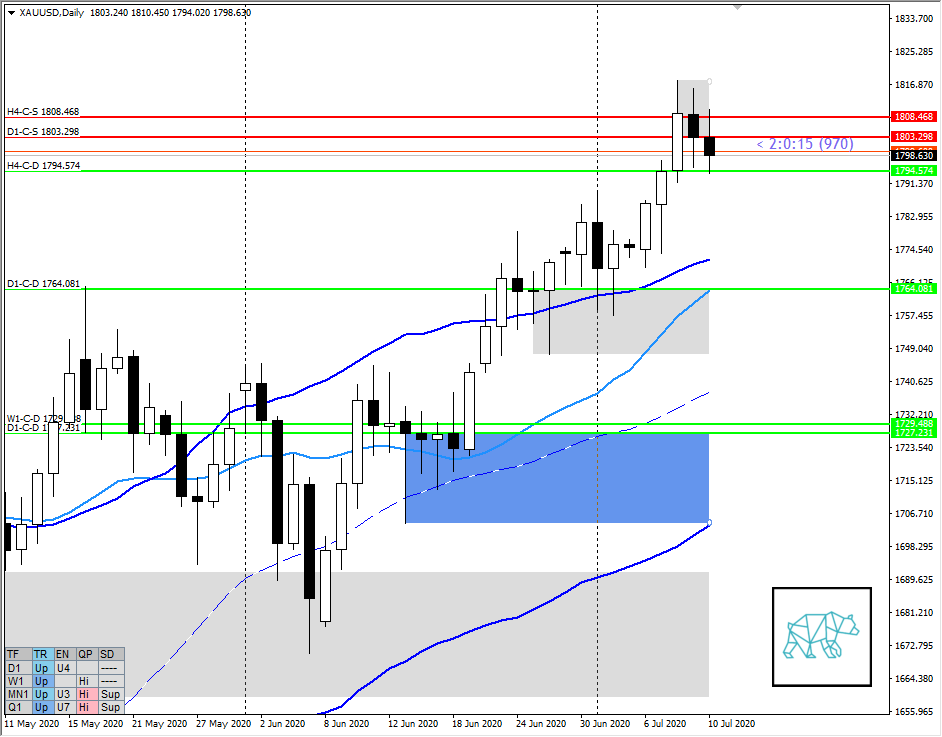

Daily — Slightly Bearish

- New Daily demand formed with D1-C‑D 1764.081

- Supply formed with D1-C‑S 1803.298 through inside bar and consequent push slightly lower

- Price above VWAP and UKC

H4 — Neutral

- Supply formed with H4-C‑S 1808.468 with a move away to previous H4-C‑D 1794.574

- Followed by a big bull engulf testing the supply (and H4 QHi) with consequent push back down

- Underlying demand has been tested 3 times now

Market Profile — Neutral

- Profile started bracketing

Sentiment summary — Neutral to Slightly Bullish

- Larger time frames still very much bullish due to previous supply ZOIs being taken out however medium time frames indicating a possible shift in distribution or perhaps a redistribution. Need more confirmation on profile before increasing sentiment on a general direction.

ZOIs for Possible Shorts

- W1-C‑S 1855.184

- H4-C‑S 1808.468

- D1-C‑S 1803.298

ZOIs for Possible Long

- H4-C‑D 1794.574

- D1-C‑D 1764.081

- W1-C‑D 1729.488

- D1-C‑D 1727.231

Focus Points for trading development

- Weekly Goal

- Correct position sizing

- Trades priority: 1) let market profile guide 2) M30 confirmation (watch out for ‘Billy No Mates’)

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Only trade off M30 candles

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits

- 2 consecutive days of lack of sleep = NO TRADING

No Comments