20 Feb Gold Week 8 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #Gold #XAUUSD

This is my weekly outlook on GOLD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

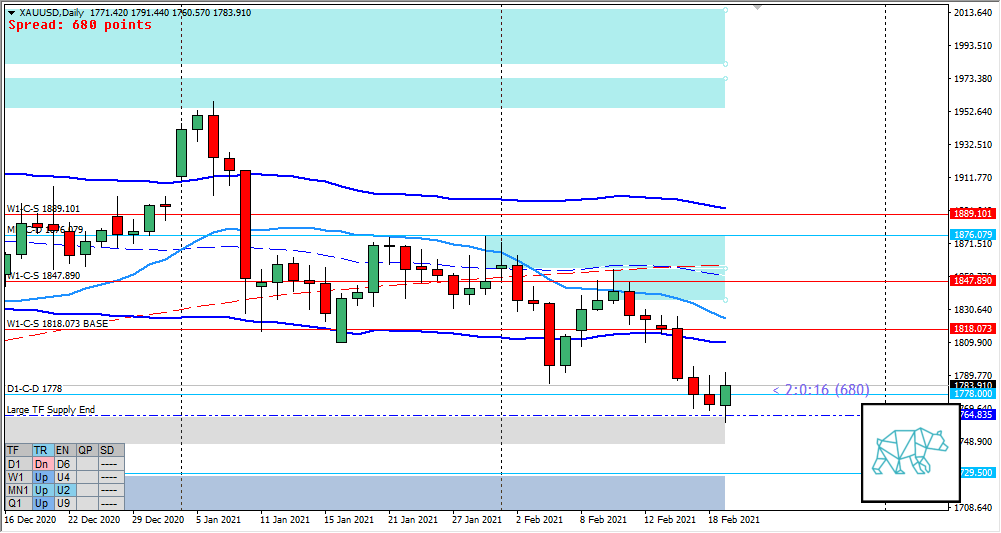

Monthly — Slightly Bearish

- MN-C‑D 1876.079 formed through Bull Engulf in December with no follow-through. Instead a test and reaction off MN-C‑S 1965.605 (2nd test, first in November). Month of January closing down within MN demand although not retracing more than 50% with price currently trading lower although still 3 weeks to go into the candle close.

- Possible Phase 3

- Price took out underlying demand at 1764.835

Weekly — Bearish

- Price broke below W1 50MA in UT through a DBD (giving W1-C‑S 1818.073 BASE) reacting off W1 VWAP CAR although some retracement leaving some buying wick behind

Daily — Slightly Bullish

- After taking out larger timeframe demand price formed a Bull Engulf creating new demand D1-C‑D 1778 above previous demand

H4 — Slightly Bullish

- Consolidation with strong Bear Engulf finisher with no direct follow-through instead some consolidation.

Sentiment summary — Slightly Bearish

- Due to larger timeframe demand being taken out and a break below W1 50MA in UT sentiment is shifted to bearish. Although due to the same demand being taken out we could see more buyers coming in as that tends to happen at huge SD ZOIs. This could translate into a retracement before continuing down or transition into forming a new demand around these levels. Although the next larger timeframe demand is at 1729.5 so we might set out to test that. Will need more intraday price action to guide sentiment.

Additional notes

- Last week of the month so extra caution is advised

ZOIs for Possible Shorts

- W1-C‑S 1847.890

- W1-C‑S 1818.073 BASE

ZOIs for Possible Long

- D1-C‑D 1778

- W1-C‑D 1729.500

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Take a break from certain components of social media

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym + mandatory cardio

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments