23 Jan Gold Week 4 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #Gold #XAUUSD

This is my weekly outlook on GOLD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow through market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

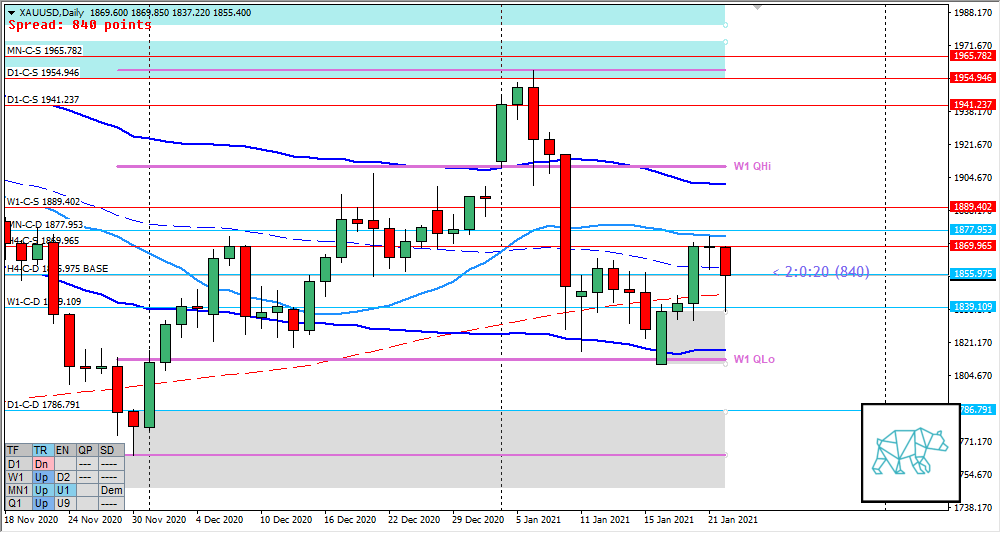

Monthly — Slightly Bullish

- MN Bull Engulf giving MN-C‑D 1877.953 last month with price currently trading within said demand

Weekly — Slightly Bullish to Neutral

- W1 Bull Engulf at W1 50MA in UT with some pushback from W1-C‑S 1889.402 and W1 VWAP CAR

- Mid W1 swing

Daily — Neutral

- Push higher towards D1 VWAP in Range with consequent Dragonfly Doji and transition to Evening Star testing underlying demand at W1-C‑D 1839.109 (plus newly formed D1 demand). Reaction off said demand left a long buying wick behind.

- Mid D1 swing

H4 — Slightly Bullish

- Price returned to H4-C‑D 1855.975 BASE and proceeded to W1-C‑D 1839.109 (could be considered as the originating level for the base) before reacting and formed a H4 Bullish Inside Bar with long buying wick. Consequently no follow-through (yet).

Market Profile — Balancing

- Wide Value created below previous UT but still in overall range

Sentiment summary — Neutral

- Even though W1 formed a bullish engulfing it is retesting VWAP (and overhead supply) after price was in an uptrend, broke down and confirmed VWAP as resistance (VWAP CAR). So unless we take out overhead supply (or W1 demand at 50MA in UT) I believe we might be stuck in a range. Which is perfectly fine for intraday trading. D1 Evening Star with a long buying wick also indicating buyers (as well as sellers) active around these levels. Let price action, profile sentiment guide the trades as always.

Additional notes

- Last week of the month

ZOIs for Possible Shorts

- D1-C‑S 1941.237

- W1-C‑S 1889.402

ZOIs for Possible Long

- MN-C‑D 1877.953

- W1-C‑D 1839.109

- D1-C‑D 1786.791

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym + mandatory cardio

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments