#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #Gold #XAUUSD

This is my weekly outlook on GOLD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

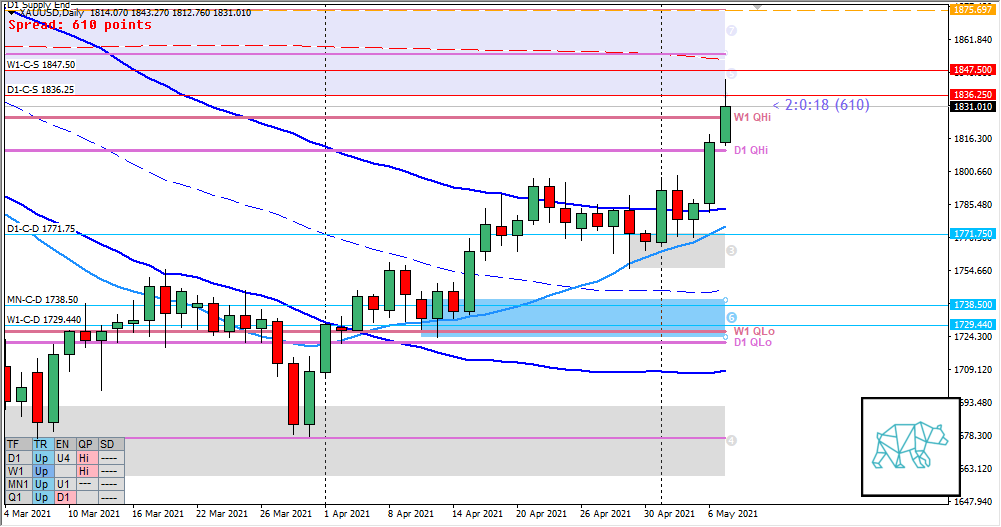

Monthly — Bullish

- MN Bull Engulf at MN VWAP in UT TC giving MN-C‑D 1738.50

- Price has traded higher continuing on the Bull Engulf

Weekly — Slightly Bullish

- Price has traded higher from W1-C‑D 1729.440 (coinciding with W1 LKC in UT after a VWAP BD) with last week breaking out from W1 VWAP in DT (and closing above previous flimsy W1 Evening Star formation) activating W1 swing

- Price arrived at W1 QHi and a near-touch of W1-C‑S 1847.50

Daily — Slightly Bullish

- D1 Phase 1 (reaccumulation) above D1 VWAP in UT closing within D1 QHi with slight reaction off D1-C‑S 1836.25 nearing D1 200MA in R

Sentiment summary — Neutral

- Even though price has traded higher it has also arrived at D1/W1 QHi as well as D1/W1 Supply. Price has only reacted a little off these levels so on the short to medium term there might be a continuation to the move higher. If price takes out D1 Supply End 1875.70 there could be a continuation to the move. However due to trading at D1/W1 supply and D1 200MA in R as well there might be a lot of engagement from the sell side coming in but would need PA on D1 to confirm a possible short term reversal.

Additional notes

- N.A.

ZOIs for Possible Shorts

- W1-C‑S 1847.50

- D1-C‑S 1836.25

ZOIs for Possible Long

- D1-C‑D 1771.75

- W1-C‑D 1729.440

- MN-C‑D 1738.5

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym + mandatory cardio

- Aim to have a minimum of ONE TRADE per trading day

- Trading Rules

- Be mindful of DTTZs

- Only price-action based exit rules (or hit time stop)

- IF NOT… I will do a Bart Simpsons exercise of 7 days, 50 sentences of: “I will trust my trading skills and take my exits accordingly”.

- M15/M30 combination at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- At least 1 trade with 1% risk, 2nd trade only if first one worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING