13 Mar Gold Week 11 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #Gold #XAUUSD

This is my weekly outlook on GOLD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

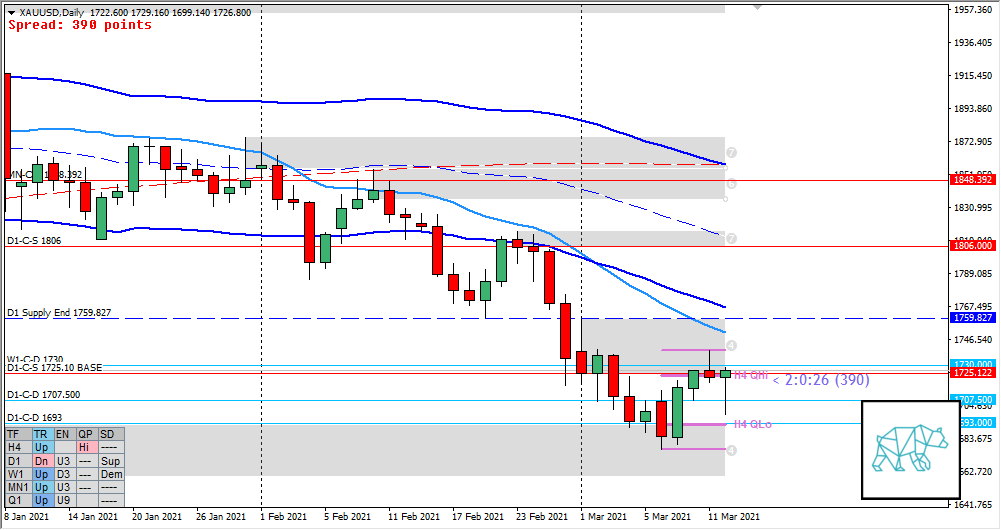

Monthly — Bearish

- Month closed down taking out demand forming a Three Outside Down giving MN-C‑S 1848.392

- Price trading below last month’s body close with some reaction off MN VWAP in UT although still 2.5 weeks left into the close

Weekly — Neutral

- W1 closed as an Inside Bar (although located in the middle of the previous week’s body due to a gap up and closing higher) with longer buying wick after having tested W1 demand end

- Price is still trading within W1 demand

Daily — Neutral to Slightly Bullish

- D1 Bull Engulf giving D1-C‑D 1707.500 with follow-through higher arriving at D1-C‑S 1725.10 BASE level forming a potential Three Outside Down although 3rd candle returned to close as a consolidation (2‑day consolidation) after testing newly formed D1 C‑dem leaving behind a long buying wick.

- Price formed H4 Q points testing QLo before closing higher within consolidation could take out said Q points.

Sentiment summary — Neutral

- MN timeframe nearly arriving at VWAP in UT has seen some reaction (coinciding with trading within W1 demand) indicating a possible change on medium term timeframe. The Daily has furthered that narrative by forming a Bull Engulf only to then consolidate below D1 Base level which because it was reached price could see further continuation upwards to 1806 as that is the originating level. Price still has to deal with D1 VWAP in DT within the current D1 supply of the base level. Price taking out D1 Supply End 1759.827 would further enhance the buying pressure in Gold.

Additional notes

- N.A.

ZOIs for Possible Shorts

- MN-C‑S 1848.392

- D1-C‑S 1806

- D1-C‑S 1725.10 BASE

ZOIs for Possible Long

- D1-C‑D 1707.500

- W1-C‑D 1730

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Take a break from certain components of social media

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym + mandatory cardio

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments