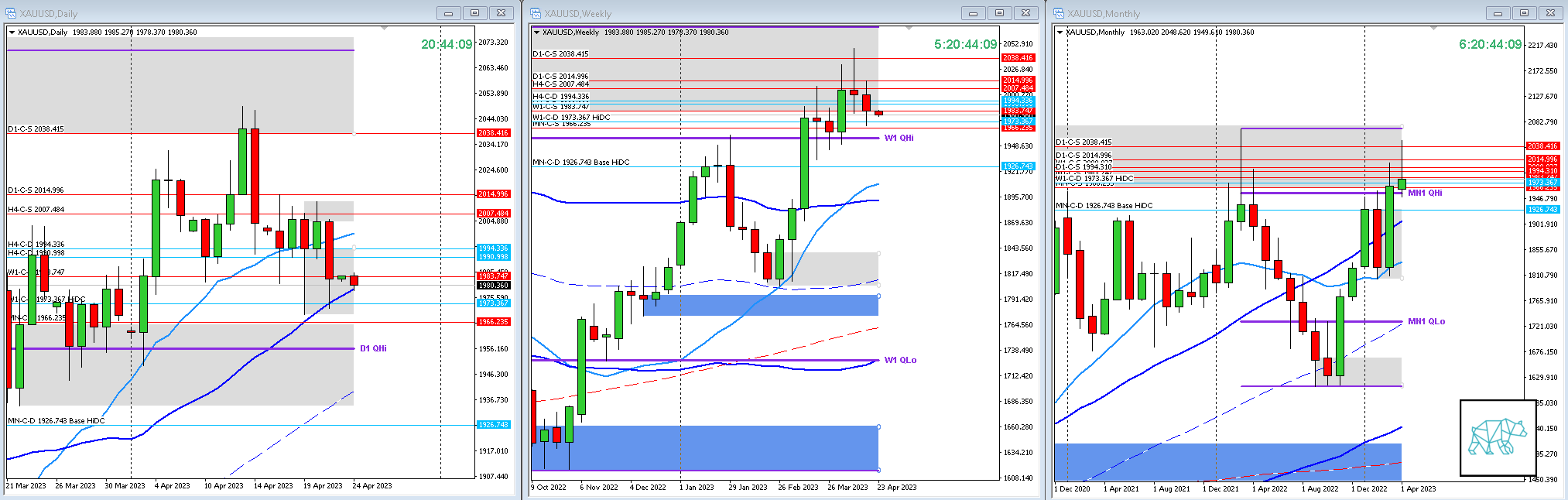

24 Apr Gold 2023 Week 17 Trading Plan

#Fintwit #XAUUSD #GOLD #MarketProfile #Orderflow #TradingPlan

This is my weekly outlook on GOLD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, get in touch with me.

Monthly — Bullish

- Last month closed slightly within MN-C‑S 1966.235, and MN QHi giving demand at MN-C‑D 1926.743 Base HiDC

- Conjecture: Trading at these levels can see a reaction and set up a reversal

Weekly — Bearish

- W1 Evening Star within previous supply giving new supply at W1-C‑S 2000.827, at round number. Price failed to close below W1 Supply.

- Price trading within W1 QHi

- Conjecture: Due to price failing to close there might be some pushback. However, the Evening Star formation could warrant momentum coming in. The W1 Demand in the way being HiDC could be reactive at first although prone to get taken out.

Daily — Bearish

- D1 Consolidation at D1 VWAP in UT with break down giving D1-C‑S 1994.310

- Price broke down at round number of 2000

- Price trading within Wide D1 QHi

- Conjecture: Price is still trading within Wide D1 QHi and there is still D1 demand and could see a reaction.

Sentiment summary — Bearish

Additional notes

- N.A.

Focus Points for trading development

- Monthly Goals

- Use SL scaling

No Comments