03 Dec Gold 2022 Week 49 Trading Plan

#Fintwit #XAUUSD #GOLD #MarketProfile #Orderflow #TradingPlan

This is my weekly outlook on GOLD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, get in touch with me.

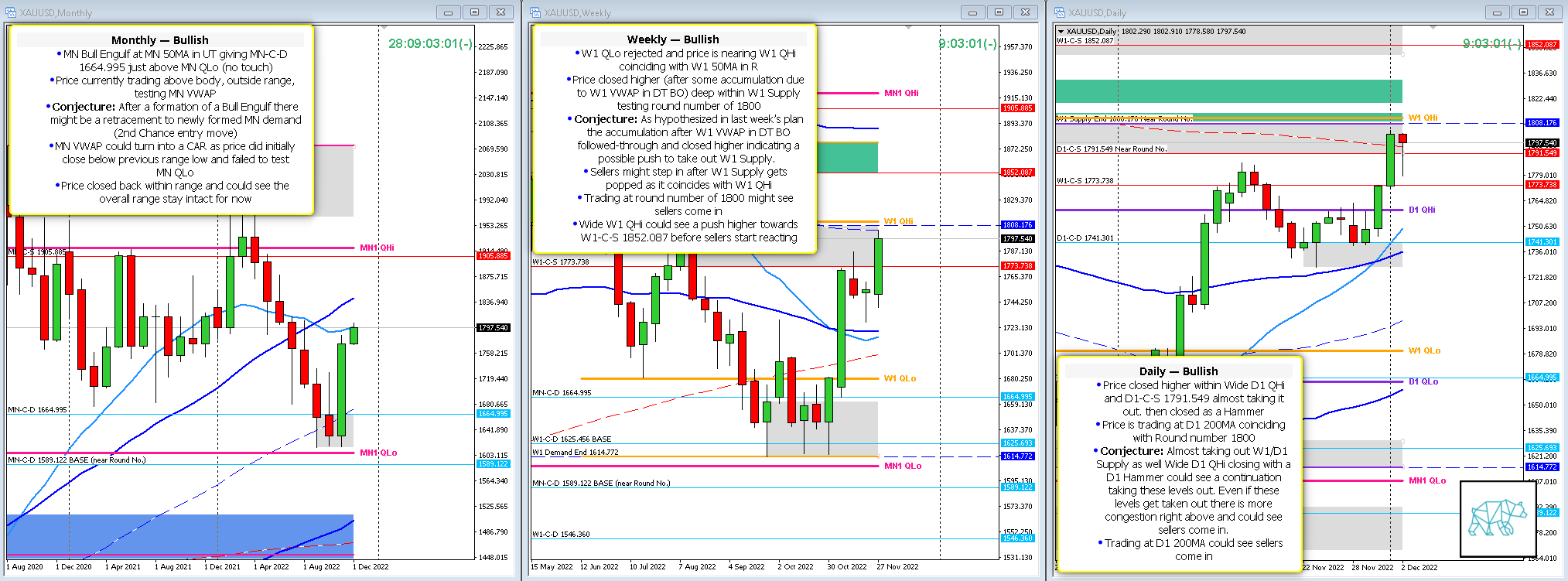

Monthly — Bullish

- MN Bull Engulf at MN 50MA in UT giving MN-C‑D 1664.995 just above MN QLo (no touch)

- Price currently trading above body, outside range, testing MN VWAP

- Conjecture: After a formation of a Bull Engulf there might be a retracement to newly formed MN demand (2nd Chance entry move)

- MN VWAP could turn into a CAR as price did initially close below previous range low and failed to test MN QLo

- Price closed back within range and could see the overall range stay intact for now

Weekly — Bullish

- W1 QLo rejected and price is nearing W1 QHi coinciding with W1 50MA in R

- Price closed higher (after some accumulation due to W1 VWAP in DT BO) deep within W1 Supply testing round number of 1800

- Conjecture: As hypothesized in last week’s plan the accumulation after W1 VWAP in DT BO followed-through and closed higher indicating a possible push to take out W1 Supply.

- Sellers might step in after W1 Supply gets popped as it coincides with W1 QHi

- Trading at round number of 1800 might see sellers come in

- Wide W1 QHi could see a push higher towards W1-C‑S 1852.087 before sellers start reacting

Daily — Bullish

- Price closed higher within Wide D1 QHi and D1-C‑S 1791.549 almost taking it out, then closed as a Hammer

- Price is trading at D1 200MA coinciding with Round number 1800

- Conjecture: Almost taking out W1/D1 Supply as well Wide D1 QHi closing with a D1 Hammer could see a continuation taking these levels out. Even if these levels get taken out there is more congestion right above and could see sellers come in.

- Trading at D1 200MA could see sellers come in

Sentiment summary — Bullish

Additional notes

- N.A.

Focus Points for trading development

- Monthly Goals

- Use SL scaling

- 1st DTTZ Gold

- 2nd DTTZ DAX

juan l.

Posted at 13:25h, 05 Decemberhey T3ch addict, thanks for this blog. I just started the market stalker silverplus program. I’ve been trading for a year and a half. Any suggestions/tips ?

T3chAddict

Posted at 06:41h, 06 DecemberHi Juan, thanks for reaching out and congratz on starting your MS journey with Dee. The best advice I can give you is to not, and I mean NOT, rush through the lectures. You need time to make the concepts your own and that can only come with time. I know we all want instant gratification but seriously try and enjoy the process of learning. And the rest will follow.

Let me know if you have any other questions and I wish you the best!