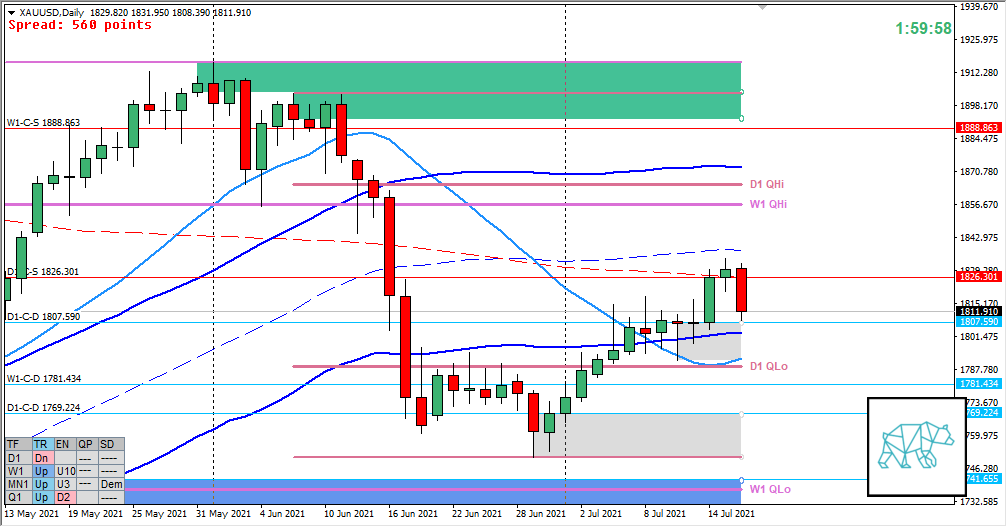

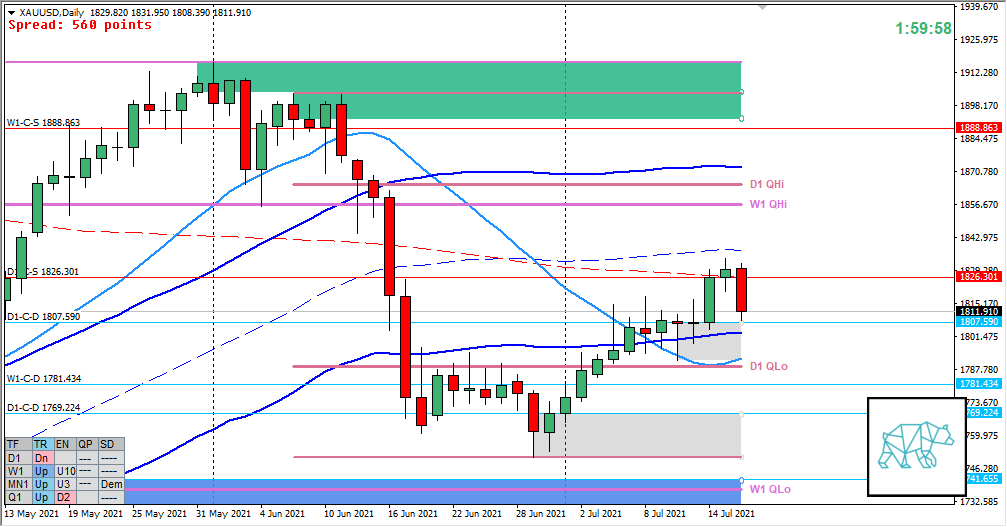

17 Jul Gold 2021 Week 29 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #Gold #XAUUSD

This is my weekly outlook on GOLD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Bearish

- June closed retracing all of May not within demand formed in April

- Trading above MN VWAP in UT

- Price rejected MN QHi although closed as a consolidation last month

- Price currently trading within last month’s body

Weekly — Slightly Bullish

- Price closed higher although as a Neutral spinning top

- Price rejected W1 QHi and has not arrived at QLo, instead reacted off W1 LKC in UT and made an Inside Bar and price trading higher giving W1-C‑D 1781.434

Daily — Bearish

- Price activated D1 swing by retracing more than 50% from swing low and is currently trading mid swing

- Some consolidation and break higher giving D1-C‑D 1807.590 followed by a Bear Engulf (exceeding 1.25x ADR) at D1 200MA giving D1-C‑S 1826.301

Sentiment summary — Bearish

- MN QHi has been rejected so longer term bearish sentiment is still in play

- W1 has traded higher after not having reached QLo

- D1 created a bear engulf although exceeded ADR so there might be some short term buying pressure in line with a possible D1 2nd Chance Entry play testing D1-C‑S 1826.301

Additional notes

- Jul 19, 18:00, GBP, BoE’s Haskel speech

- Jul 22, 19:45, EUR, ECB Interest Rate Decision

- Jul 22, 20:30, EUR, ECB Monetary Policy Statement and Press Conference

- Jul 22, 20:30, USD, Initial Jobless Claims

ZOIs for Possible Shorts

- W1-C‑S 1888.863

- D1-C‑S 1826.301

ZOIs for Possible Long

- D1-C‑D 1807.590

- W1-C‑D 1781.434

- D1-C‑D 1769.224

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Weekly Focus Points

- Min. 3 times working out at home + mandatory cardio

- Trading rules

- Focus on taking ONE trade a day. If I missed the first DTTZ then a trade needs to be taken on the 2nd DTTZ unless there is a high/medium initiative activity day.

- Only price-action based exit rules (or if hit time stop comes earlier)

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Buffer trades (profit target >1R) are allowed and encouraged

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- No social media / messenger apps / phone calls allowed during the trading window

- Weekly Focus Points

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments