12 Dec GBPNZD Week 51 Trading Plan

This is my weekly outlook on the Forex pair GBPNZD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

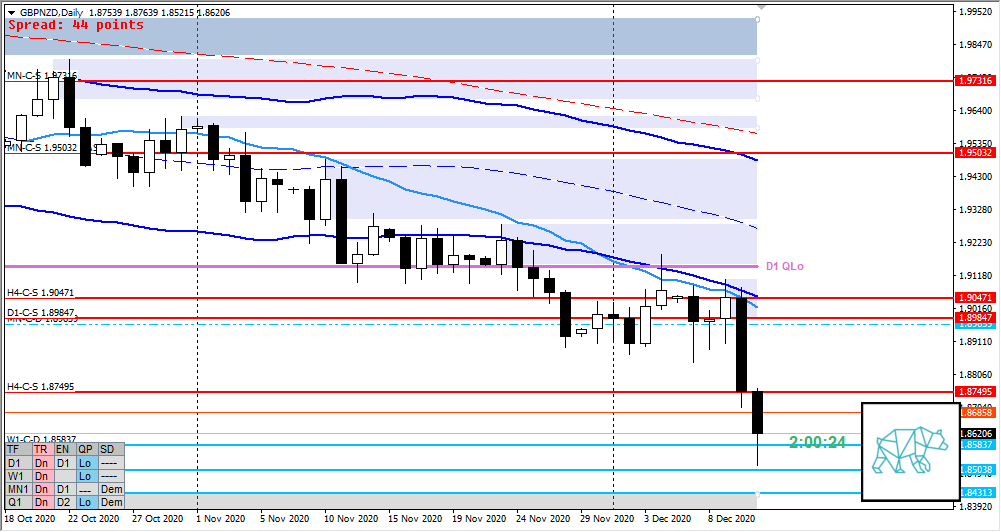

Monthly — Slightly Bearish to Neutral

- Moving deeper into underlying demand MN-C‑D 1.89659

Weekly — Slightly Bearish to Neutral

- Price forming a DBD arriving clean at W1-C‑D 1.85837 (tested once before in July 2019 and was created December 2018) with little reaction

Daily — Bearish

- D1 Bear Engulf (@D1 VWAP) giving D1-C‑S 1.89847 with follow-through down with some reaction at W1 C‑Dem

- Within D1 QLo

H4 — Slightly Bearish to Neutral

- Consolidation (with long buying wicks) within H4 Phase 4 breaking down giving H4-C‑S 1.87495 with follow-through. Inside bar with longer buying wick created at W1 C‑Dem followed by some consolidation.

Market Profile — Imbalance

- Profiles in DT with Friday having created a wider value area

Sentiment summary — Neutral

- With an accelerated move down from D1 VWAP after a Phase 1 / 3 (which turned out to be a Phase 3) taking out underlying demands and hitting W1 C‑Dem (2nd time testing) we could see a bounce and some reaction from this level although medium time frames could show a continuation on the short to medium term.

Additional notes

- Brexit talks on-going (1 more day). Will update Monday in Premarket Prep.

ZOIs for Possible Shorts

- MN-C‑S 1.97316

- MN-C‑S 1.95032 BASE

- H4-C‑S 1.91275

ZOIs for Possible Long

- MN-C‑D 1.89659

- D1-C‑D 1.89128

- W1-C‑D 1.85922

- H4-C‑D 1.85038

- D1-C‑D 1.84313

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym + mandatory cardio

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments