24 Oct GBPNZD Week 44 Trading Plan

#daytrade #daytrading #forex #FX #Forextrader #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD

This is my weekly outlook on the Forex pair GBPNZD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

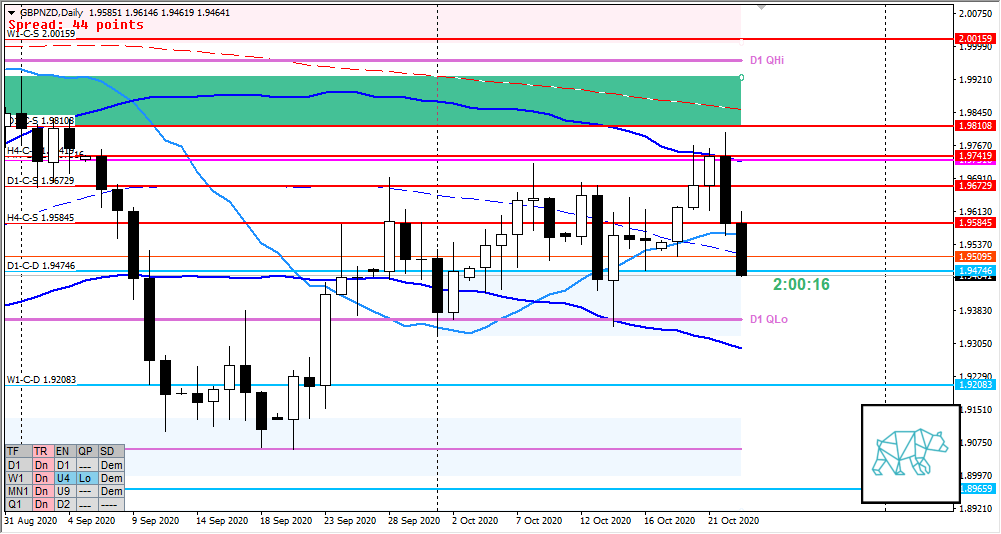

Monthly — Slightly Bearish

- MN C‑Sup proved reactive multiple times and is currently trading below previous month’s body

- 1 week left in the month

Weekly — Bearish

- W1 Phase 1 / 3, possible transition to 4

- Consolidation with longer selling wicks and last week closing as pinbar with long selling wick and closing at its low below previous Base

Daily — Slightly Bearish

- D1 Bear Engulf giving D1-C‑S 1.96729 returning to D1 VWAP with Friday continuing the move down closing below D1 VWAP arriving clean at D1-C‑D 1.94746

H4 — Slightly Bearish

- Consolidation within H4 Phase 4 created some supply at H4-C‑S 1.95845 (mid swing) and continued down arriving at H4 QLo (although a speed bump on the way after break away from supply due to taking out previous demands) with no reaction (yet)

Market Profile — Imbalance

- 2 days bracketing followed by a wider VA just below bracketing range and Friday even wider and lower from range exhausting ADR

Sentiment summary — Slightly Bearish

- Although there is an obvious imbalance to the downside price has arrived at a D1 demand and H4 QLo so we could see some reaction here. Due to the somewhat forceful nature of the move down, the sentiment is more enhanced due to W1 transition to Phase 4 possibility and proximity to a possible test of D1 QLo suggest (even though within D1 demand) we could potentially see a continuation on the low/medium timeframes.

Additional notes

- Daylight Saving Time Shift

- Monday — NZD bank holiday

- Thursday — EU monetary Policy statement

ZOIs for Possible Shorts

- MN-C-SD 1.97316

- D1-C‑S 1.96729

- H4-C‑S 1.95845

ZOIs for Possible Long

- D1-C‑D 1.94746

- W1-C‑D 1.92083

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments