19 Oct GBPNZD Week 43 Trading Plan

#daytrade #daytrading #forex #FX #Forextrader #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD

This is my weekly outlook on the Forex pair GBPNZD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

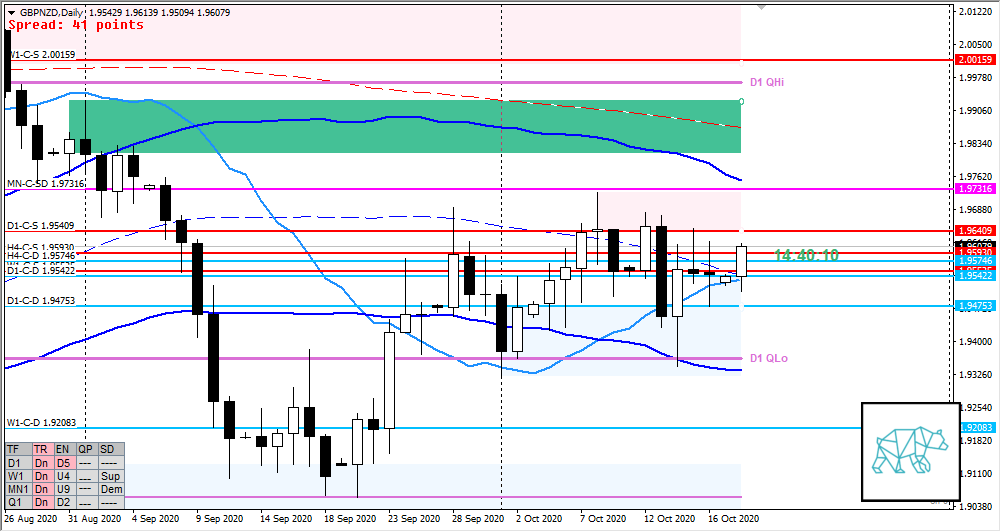

Monthly — Slightly Bearish

- MN-C-SD 1.97316 was created through a Bear Engulf that now divides MN Supply and Demand areas.

- Price traversed back to test the MN C‑Sup but has not been able to push higher (yet)

- Still two weeks left in the month

Weekly — Slightly Bullish

- After price returned to W1-C‑D 1.92083 we saw a push away higher to eventually close above W1 QLo. We ran into some congestion due to W1 VWAP and nearby MN C‑sup but price still closed higher forming RBRs.

- Last week closed as an inside bar with slightly longer buying wick

- We had 3 weeks of testing the MN C‑sup leaving long selling wicks behind

- Some supply was created just above W1 QLo giving W1-C‑S 1.95525

Daily — Neutral

- Price ranging between D1-C‑S 1.95409 and D1-C‑D 1.94753 with new demand created on previous demand giving D1-C‑D 1.95422

- Phase 1 / 3

- Mid D1 swing

H4 — Slightly Bullish

- H4-C‑S 1.95930 got tested several times

- H4-C‑D 1.95746 created through consolidation

- H4 Bull Engulf created on D1-C‑D 1.95422

Market Profile — Possibility start imbalance

- Wide bracketing range with Friday having created a wider than usual VA

Sentiment summary — Neutral

- Price has been ranging for a while now on the daily and there is no clear indication on which way it wants to go. However, due to a widening bracket last week and wider VA on Friday we might want to make a move in a direction.

Additional notes

- BOE Gov Bailey Speaks on Thursday

ZOIs for Possible Shorts

- W1-C‑S 2.00159

- MN-C-SD 1.97316

- W1-C‑S 1.95525

- D1-C‑S 1.95409

ZOIs for Possible Long

- D1-C‑D 1.95422

- D1-C‑D 1.94753

- W1-C‑D 1.92083

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments