20 Sep GBPNZD Week 39 Trading Plan

#daytrade #daytrading #forex #FX #Forextrader #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD

This is my weekly outlook on the Forex pair GBPNZD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

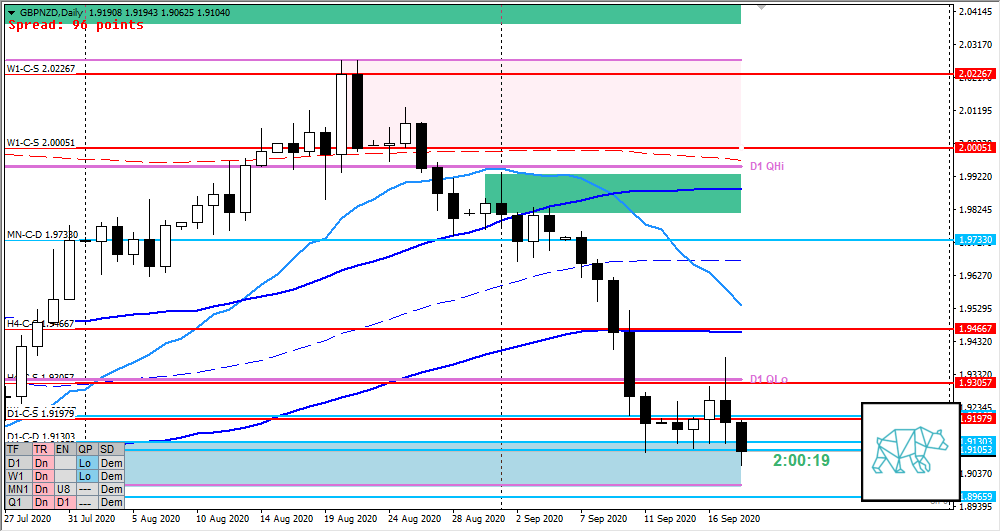

Monthly — Slightly Bearish

- Trading near MN-C‑D 1.89659

- Still week and half left

Weekly — Slightly Bearish

- Closed with longer selling wick within originating demand (W1-C‑D 1.92067) after a clean arrival but demand has not been taken out yet

Daily — Slightly Bearish

- Clean Arrival at D1-C-D1.91303 followed by a possible transition to Phase 1 however Friday closed lower within demand after having created a Bear Engulf (D1-C‑S 1.91979) with longer selling wick closing within D1 QLo

H4 — Slightly Bearish

- Price trading below the range after trying to break out from H4 QLo

- H4 Bull Engulf formed with no follow-through trading within demand

Market Profile — Neutral to Slightly Bearish

- Multi-day bracketing with Friday’s VA below

Sentiment summary — Neutral to Slightly Bearish

- Due to price failing to stay above H4 VWAP in DT and currently trading below the recent range I am more inclined to go with a bearish sentiment for the moment. Although messy price action on D1 could be an indication we are nearing the end of the move down so will need to gauge intraday sentiment for further clues.

ZOIs for Possible Shorts

- H4-C‑S 1.94667

- H4-C‑S 1.93057

- D1-C‑S 1.91979

ZOIs for Possible Long

- W1-C‑D 1.92067

- D1-C-D1.91303

- MN-C‑D 1.89659

Focus Points for trading development

- Weekly Goal

- Formulate hypos in order of likelihood and track with actual development on the day

- Incorporate profile day type

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments