#daytrade #daytrading #forex #FX #Forextrader #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD

This is my weekly outlook on the Forex pair GBPNZD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

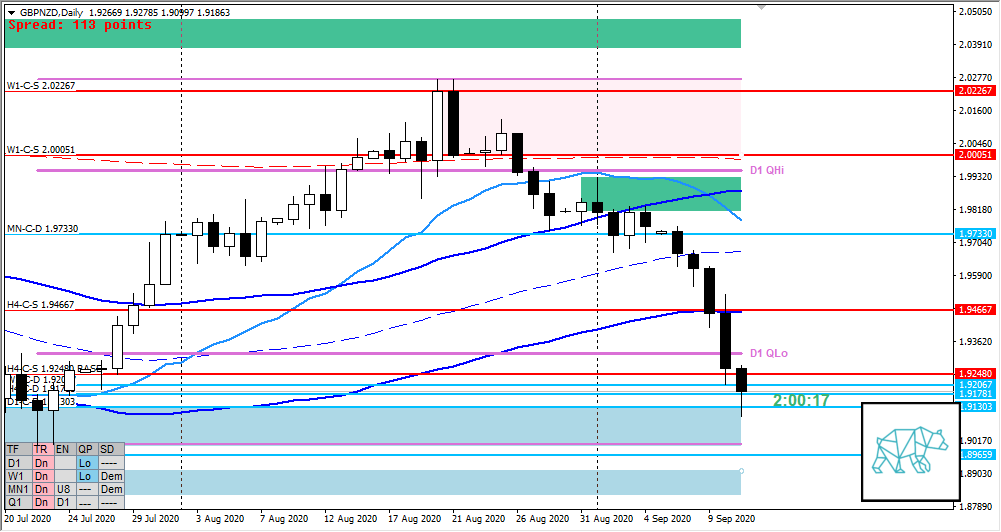

Monthly — Slightly Bearish

- Almost entirely retraced July’s move (thus trading at the lower range) but we still have over 2 weeks left in the bar

Weekly — Slightly Bearish

- Arrived back at the originating level from week of July 19th with W1-C‑D 1.92067

- Within W1 QLo

Daily — Bearish

- Clean arrival at D1-C‑D 1.91303 within D1 QLo

H4 — Neutral

- Some congestion on the way down at W1-C‑D 1.92067 before proceeding down to D1-C‑D 1.91303 and ending with a Bull Engulf giving H4-C‑D 1.91781 but no follow-through yet. Plus price hasn’t closed within H4 demand.

- H4-C‑S 1.92480 BASE formed on the way down.

- Possible phase 1 or even transition to 2 if there is a follow-through reacting to underlying demand

- Price trading within H4 QLo

Market Profile — Neutral

- Profiles still in DT.

Sentiment summary — Neutral to Slightly Bearish

- We could see some range bound trading due to a possible H4 phase 1 or it might be a speed bump on the way down. Another reason for a phase 1 could be the ‘exhausted’ move on Friday and the consequent lack of follow-through. Could be a sign of covering of selling in the market. A bullish sign would be if we would take out H4-C‑S 1.92480 BASE. As always will need to monitor profile to further gauge the change in sentiment (if any).

ZOIs for Possible Shorts

- H4-C‑S 1.94667

- H4-C‑S 1.92480 BASE

ZOIs for Possible Long

- W1-C‑D 1.92067

- D1-C‑D 1.91303

Focus Points for trading development

- Weekly Goal

- Formulate hypos in order of likelihood and track with actual development on the day

- Incorporate profile day type

- Trading Rules

- If Open outside of value consider the placement in relation to ADR/ASR

- FX within value > DAX

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING