#daytrade #daytrading #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD

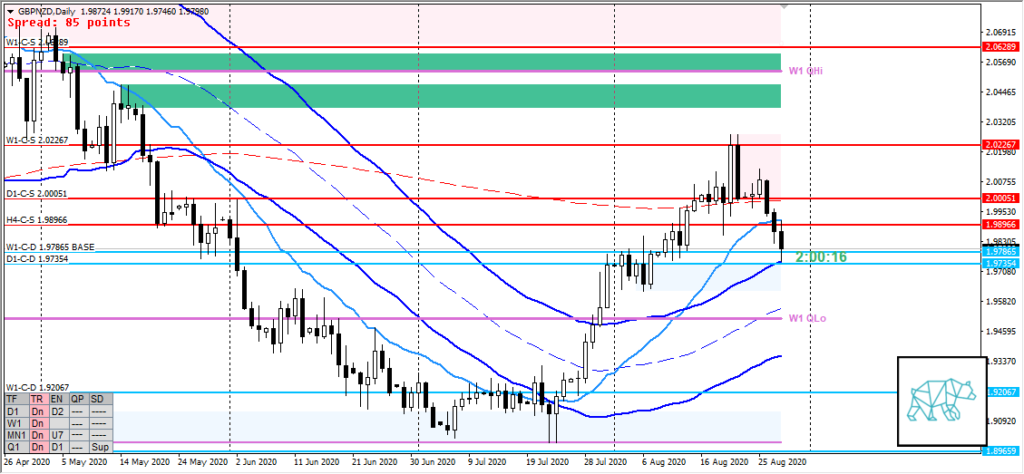

This is my weekly outlook on the Forex pair GBPNZD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Neutral

- Only one trading left

- Possible base or evening star (would need another month) forming after UKC (in sideways market) proved reactive.

Weekly — Bearish

- Evening star formed at W1 VWAP after W1-C‑S 2.02267 proved reactive

- No significant close below VWAP (yet)

- Price returned to W1-C‑D 1.97865 BASE

- Mid W1 swing

- Trend change down

Daily — Bearish

- Phase 3 with exhausted move to W1-C‑S 2.02267 followed by retracement forming D1-C‑S 2.00051

- Phase 3 to 4 transition through Bear Engulf breaking down from phase 3 range (and 200MA) and eventually crossing down VWAP in UT reaching D1-C‑D 1.97354 (slightly reactive)

- Mid D1 swing

- Trend down

H4 — Slightly Bearish

- Price below LKC and VWAP DT new supply formed at H4-C‑S 1.98966

- Inside bar formed at W1-C‑D 1.97865 BASE

- Bounced off H4 QLo failure to break out from VWAP

- Trend down

Market Profile — Bearish

- DT

Sentiment summary — Bearish

- W1 evening star retracing back to the base of the rally we made earlier indicating a possible continuation on the short side. D1 Phase 3 transitioned to 4 plus closing below 200MA and VWAP further increases this sentiment.

ZOIs for Possible Shorts

- W1-C‑S 2.02267

- D1-C‑S 2.00051

- H4-C‑S 1.98966

ZOIs for Possible Long

- W1-C‑D 1.97865 BASE

- D1-C‑D 1.97354

Focus Points for trading development

- Weekly Goal

- Formulate hypos in order of likelihood and track with actual development on the day

- Incorporate profile day type

- Trading Rules

- If Open outside of value consider the placement in relation to ADR/ASR

- FX within value > DAX

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- 2 consecutive days of lack of sleep = NO TRADING