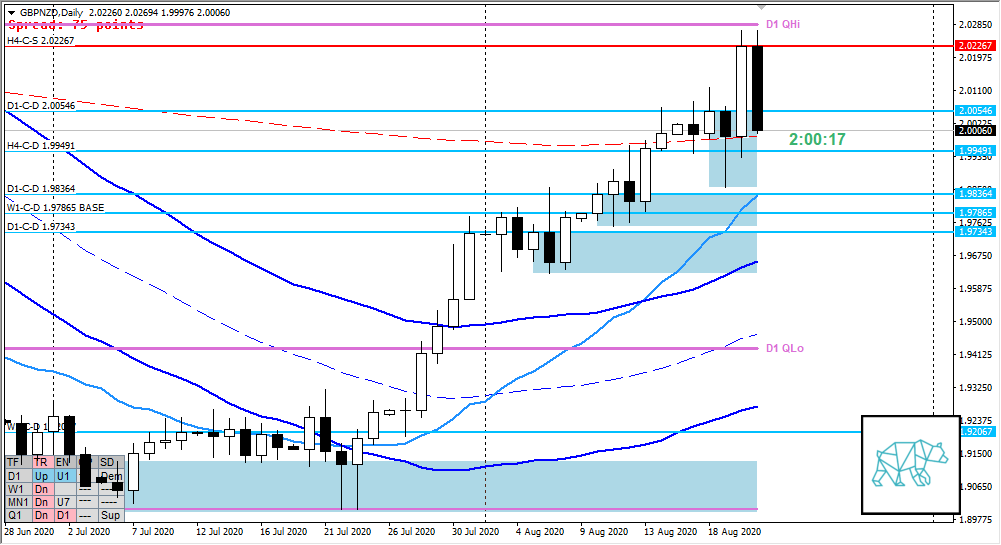

23 Aug GBPNZD Week 35 Trading Plan

#daytrade #daytrading #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD

This is my weekly outlook on the Forex pair GBPNZD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Slightly Bullish

- Developing month pushing higher in line away from preceding month having formed a normal variation at MN-C‑D 1.89659

- Nearing MN QHi but no touch yet (UKC in downtrend proved reactive)

- Little over a week left in the month

Weekly — Neutral

- Consolidation + Bull engulf creating W1-C‑D 1.92067 within W1 QLo

- RBR creating W1-C‑D 1.97865 BASE, if level hit might see a reversal to the current rally

- Last week developed a somewhat indecisive inside bar with slightly longer selling wick with buying wick bouncing off VWAP (sloping down)

- Phase 2, possible transition to 3

- Mid-swing

Daily — Neutral

- D1 Phase 3 through contradicting price action, bull engulf having formed demand at D1-C‑D 2.00546 (weaker within clutter)

- D1 QHi hit and proved reactive retracing Thursday’s move closing within demand

- D1 still above VWAP

H4 — Slightly Bearish

- Consolidation at previous QHi with confident bear engulf forming H4-C‑S 2.02267, consequently forming new Q points

- Price closed below QHi nearing QLo (no touch) creating weak demand through inside bar with longer selling wick (testing VWAP), possible consolidation

- H4-C‑D 1.99491 within QLo

Market Profile — Neutral

- Profiles Bracketing

Sentiment summary — Neutral to slightly Bearish

- Due to possible D1 Phase 3 I am more inclined to the downside but we would need to break down from the current range first. A retracement to W1 base at 1.97865 would strengthen the bearish sentiment into the larger timeframes. Anything above, the larger time frame sentiment remains bullish even though through medium time frame bearish sentiment.

ZOIs for Possible Shorts

- H4-C‑S 2.02267

ZOIs for Possible Long

- D1-C‑D 2.00546 (weaker within clutter)

- H4-C‑D 1.99491

- D1-C‑D 1.98364

- W1-C‑D 1.97865 BASE

- D1-C‑D 1.97343

- MN-C‑D 1.89659

Focus Points for trading development

- Weekly Goal

- Formulate hypos in order of likelihood and track with actual development on the day

- Incorporate profile day type

- Trading Rules

- If Open outside of value consider the placement in relation to ADR/ASR

- FX within value > DAX

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- 2 consecutive days of lack of sleep = NO TRADING

No Comments