12 Jul GBPNZD — Week 29 Trading Plan

#daytrade #daytrading #forex #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD

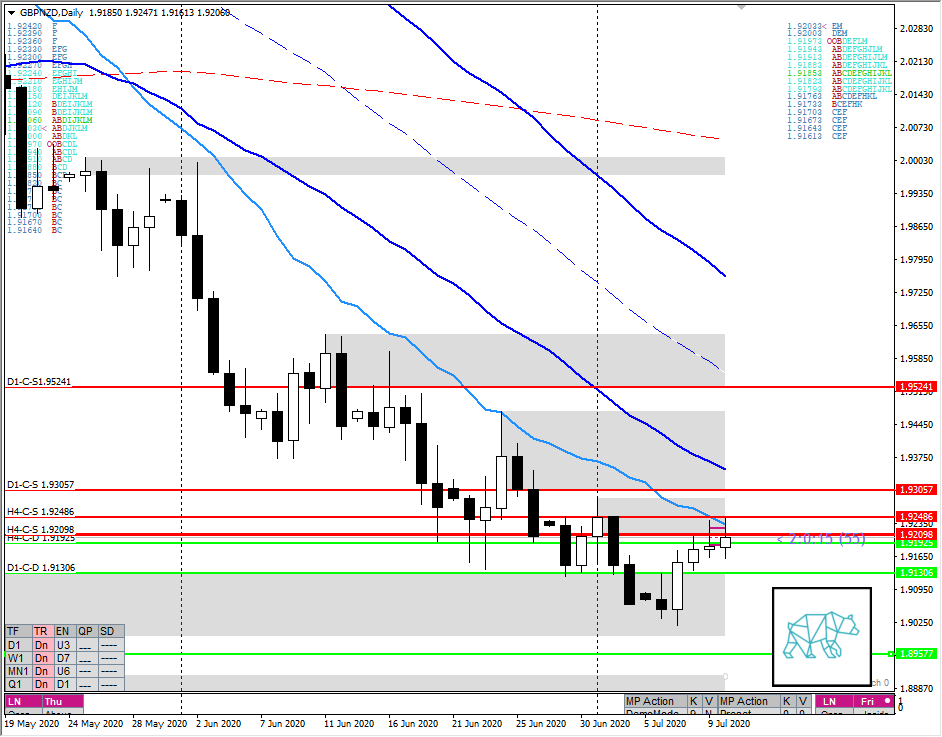

This is my weekly outlook on the Forex pair GBPNZD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Slightly Bearish

- Initial reactive move away from MN-C‑D 1.89577

- No touch of Q1 QLo yet

- Possible pullback on last month’s candle in progress

- In the middle of MN1 swing

Weekly — Neutral

- Price below LKC with last week retracing the preceding week and retesting LKC

Daily — Slightly Bearish

- Bull Engulf within Demand ZOI with conterminous D1-C‑D 1.91306

- Price still below VWAP and has tested D1-C‑S 1.92116 multiple times

H4 — Bearish

- H4 Phase 1/3 with price trading above VWAP

- Big H4 Bull Engulf with H4-C‑D 1.91925 with immediate pushback after testing H4-C‑S 1.92486 multiple times creating new supply through an inside bar retracing more than 50% (closing slightly below D1-C‑S 1.92116) giving conterminous H4-C‑S 1.92098

Market Profile — Neutral

- Profiles bracketing

Sentiment summary — Slightly Bearish

The retracement on the weekly could potentially be the start of a consolidation near Monthly levels of interest. Larger time frames still look bearish although for the short to medium term we could see more balancing before continuing or reversing. Also need to account for being deeper into the summer months and liquidity drying up.

ZOIs for Possible Shorts

- D1-C‑D 1.91306

- D1-C‑S 1.93057

- D1-C-S1.95241

- H4-C‑S 1.92486

- H4-C‑S 1.92098

ZOIs for Possible Long

- MN-C‑D 1.89577

- D1-C‑D 1.91306

- H4-C‑D 1.91925

Focus Points for trading development

- Weekly Goal

- Correct position sizing

- Trades priority: 1) let market profile guide 2) M30 confirmation (watch out for ‘Billy No Mates’)

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Only trade off M30 candles

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits

- 2 consecutive days of lack of sleep = NO TRADING

No Comments