27 Jun GBPNZD — Week 27 Trading Plan

This is my weekly outlook on the Forex pair GBPNZD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

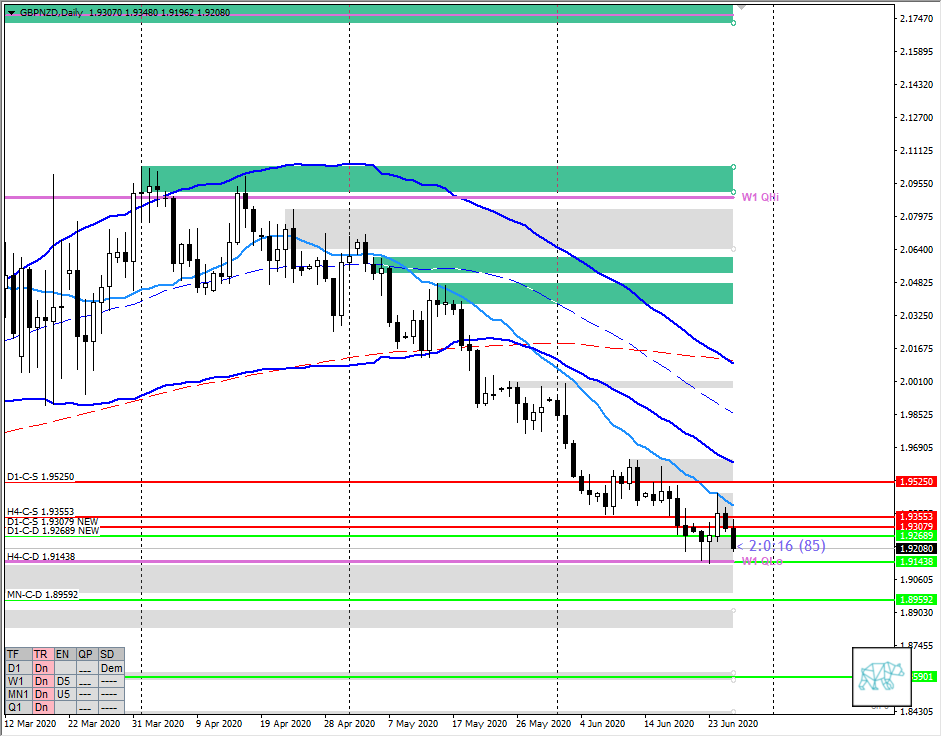

Monthly — Bearish

- After a continued drop, price reaching for MN-C‑D 1.89592 just above Q1 QLo. However, still have 2 trading days left in the month.

- Still mid-swing to MN1 QLo

Weekly — Slightly Bearish

- Fading momentum in the move down (also consider now being summer months). Price has reached W1 QLo with no attempt below (yet)

- Last week’s price did close down

- No weekly demand until W1-C‑D 1.85901

Daily — Slightly Bearish

- Continued supplies created and price below VWAP and LKC

- VWAP still being rejected with supply D1-C‑S 1.95250 and then again with D1-C‑S 1.93079 NEW.

- Price is getting closer to VWAP

- Newly formed demand D1-C‑D 1.92689 NEW and Friday closed well within it after bouncing off D1 QLo initially with a weaker inside bar

H4 — Slightly Bearish

- No reaction to H4 QLO and price trader lower although fading in size

- No demand between price and H4-C‑D 1.91438

Market Profile

- In downtrend for now

Sentiment summary — Slightly Bearish

- Due to new supplies being created and rejecting D1 VWAP I am still bearish on the pair. Cons are D1/W1 QLo as well as W1 Being overextended from VWAP.

ZOIs for Possible Shorts

- D1-C‑S 1.95250

- D1-C‑S 1.93079 NEW

- H4-C‑S 1.93553

ZOIs for Possible Long

- MN-C‑D 1.8959

- W1-C‑D 1.85901

- D1-C‑D 1.92689 NEW

- H4-C‑D 1.91438

Focus Points for trading development

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits

No Comments