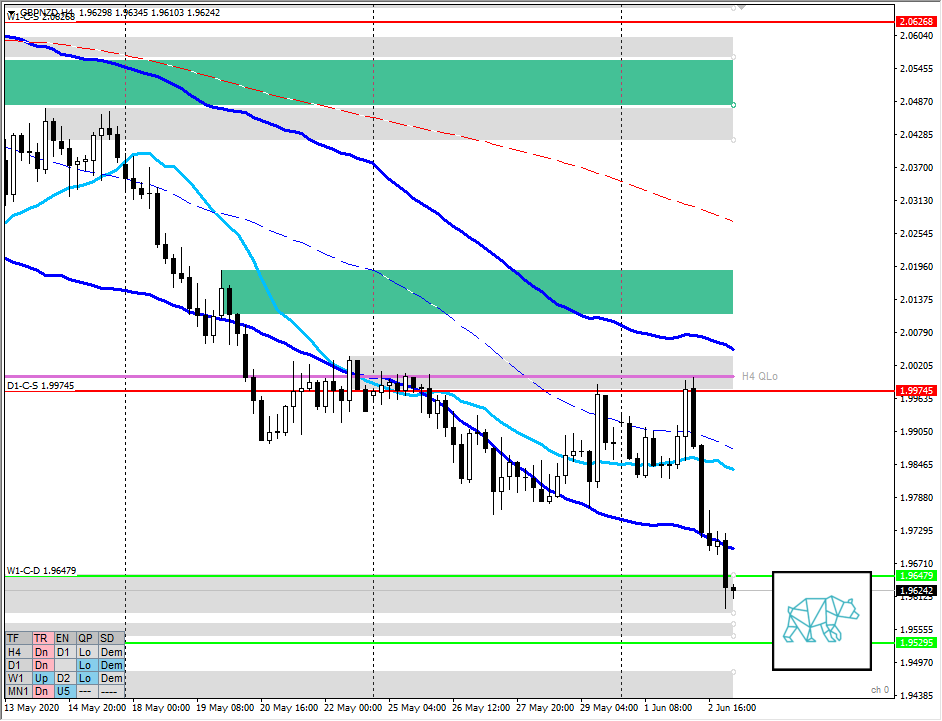

03 Jun GBPNZD — Week 23 Trading Plan

Because of entering the summer months I am switching to something more liquid: GBPNZD

This is my weekly outlook on the Forex pair GBPNZD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Slightly Bearish

- Bear Engulf at MN Supply ZOI and MN1 QHi with good reactive move away

Weekly — Slightly Bearish

- After weeks of phase 3 there was a bear engulf creating supply (C‑2.06268) followed by DBD and ladder and price is now trading within W1 QLo at W1-C‑D 1.96479

- Another W1 demand ZOI underneath W1-C‑D 1.95295

- We are midweek into the developing candle

Daily — Slightly Bearish

- Same conterminous demand with weekly ZOIs

- Supply ZOI at D1 QLo with D1-C‑S 1.99745

- Price is trading at W1-C‑D 1.96479 within D1 QLo

H4 — Neutral

- 2 big rejections of D1-C‑S 1.99745, 2nd being a bear engulf with consequent DBD into demand

- No phase 1 yet so phase 4 is still in effect unless price starts to react at this demand.

Market Profile

- AS opened 100 pips away from London PVAL and has continued down exhausting AS range 730 with a total of 1316 at this moment. Already 87% of ADR.

Sentiment summary — Neutral

- Monthly being in the middle of a swing and around VWAP I would normally suggest a slightly bullish sentiment. This combined with weekly demand ZOIs that take precedence over VWAP. Weekly showing a range that is slightly sloping up taking VWAP closer to price and the consequent break down I am slightly bearish. However with demand in the way we could see bullish sentiment in the short term. The Daily showing a move below LKC into demand at this point could be conducive for a mean reversion to VWAP but also a continuation. H4 is showing slightly more bullish sentiment due to accelerated move down but no phase 1 yet so a continuation is more likely (for now). The abnormality of the session range we could see a continuation of the move or a reversion to mean but will need London open and IB to give me a better picture.

ZOIs for Possible Shorts

- D1-C‑S 1.99745

ZOIs for Possible Long

- W1-C‑D 1.96479

- W1-C‑D 1.95295

Focus Points for trading development

- Exit rules

- Option 1: Time-based stop (under special circumstances extend by half an hour)

- Option 2: Target hit (SL 20 pips + spread or x2 TP)

- NO OPTION 3

- UNLESS a trade is entered within 1 hour or half hour before the hard exit rule option 1

- Entry rules

- Entry on TPO break of IB

- Early entry with price action confirmation at

- H4 conterminous

- Open far from value, anticipating a move back to value using an engulfing + subsequent break of TPO

- Min. X2 R/R

- Use TPO confirmation or invalidation for directional decisions by looking for in conjunction with H4 conterminous lines

- TPO extension with a sustained move (BO from IB)

- TPO extension with failed auction (return to IB)

- How this direction of TPO extension relates to Value Area open sentiment

- I will post trades including:

- Trade location

- Price action entry condition

- What were TPOs doing at the time

- With screenshot

- Keep own approach of KC, VWAP as odd enhancers instead of hard trade locations

No Comments