22 May GBPNZD Week 21 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD

This is my weekly outlook on GBPNZD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

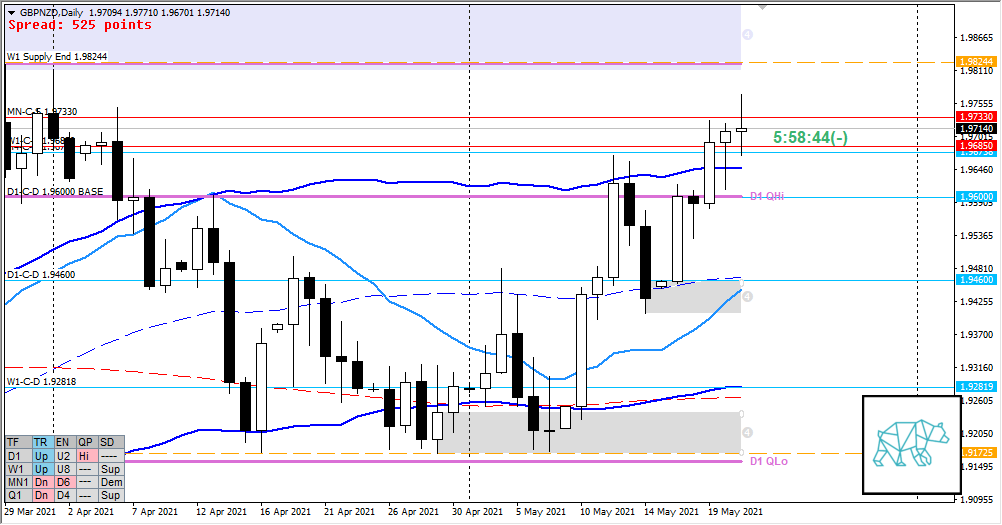

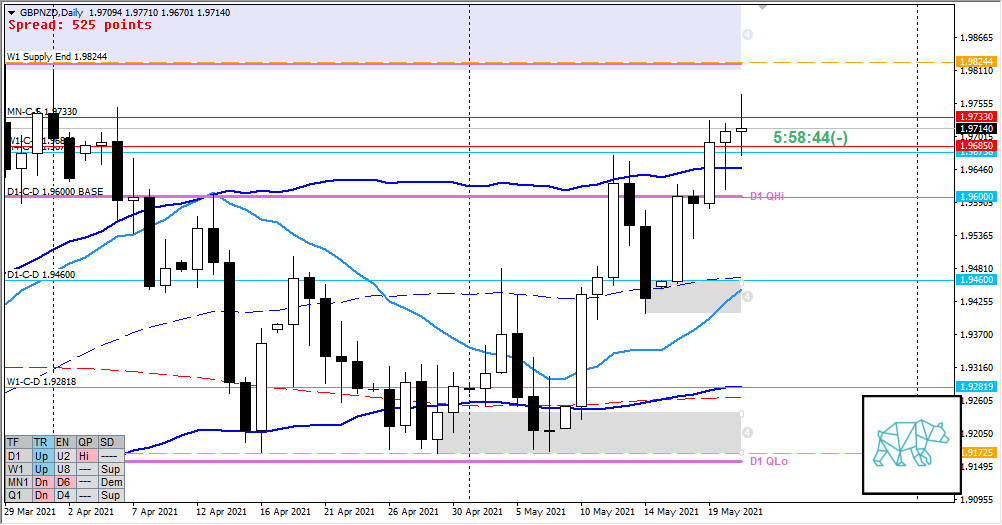

Monthly — Bearish

- April closed as a Strong Bearish Inside Bar after reacting off MN-C‑S 1.97330

- Price is currently trading within last month’s body at the high of last month’s bar

Weekly — Slightly Bullish

- Continuation to the W1 Bull Engulf closing within W1-C‑S 1.96850 reacting slightly off MN-C‑S 1.97330

- Mid W1 Swing coming from QLo

Daily — Neutral

- D1 RBR followed by a Doji closing higher above D1 UKC in R

- Trading within D1 QHi

Sentiment summary — Slightly Bearish

- Price is consolidating on the Monthly and is currently trading at its high. Although coming from MN demand this could be Phase 1 indicating more upside. W1 closed higher and within W1 Supply although below the Monthly supply. D1 is struggling to climb higher after taking out D1 Supply although it has still closed slightly higher as a Doji. Unless price can take out W1 Supply End 1.98244 price could be reversing here. If price reverses to D1-C‑D 1.96000 BASE level there could be a continuation down to D1-C‑D 1.94900.

Additional notes

- N.A.

ZOIs for Possible Shorts

- MN-C‑S 1.97330

- W1-C‑S 1.96850

ZOIs for Possible Long

- D1-C‑D 1.96000 BASE

- D1-C‑D 1.94900

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym + mandatory cardio

- Aim to have a minimum of ONE TRADE per trading day

- Trading Rules

- Be mindful of DTTZs

- Only price-action based exit rules (or hit time stop)

- IF NOT… I will do a Bart Simpsons exercise of 7 days, 50 sentences of: “I will trust my trading skills and take my exits accordingly”.

- M15/M30 combination at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- At least 1 trade with 1% risk, 2nd trade only if first one worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments