#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD

This is my weekly outlook on GBPNZD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

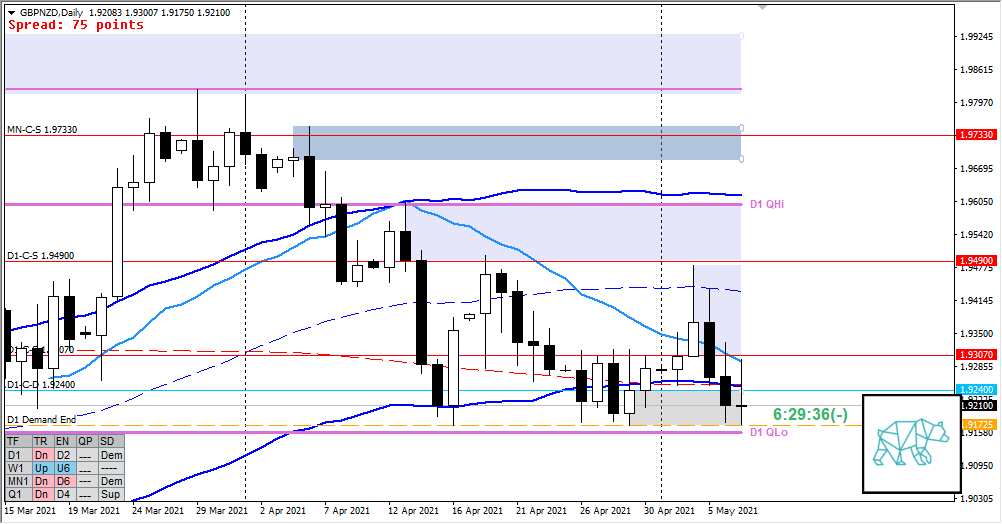

Monthly — Bearish

- April closed as a Strong Bearish Inside Bar after reacting off MN-C‑S 1.97330

- Price is currently trading below last month’s body although currently still within in range

Weekly — Bearish

- W1 Phase 4 continuation through DBD with last week closing lower (although within previous week’s range) after having created a long selling wick

Daily — Slightly Bearish

- D1 Bear Engulf at D1 VWAP in DT after a BO attempt followed by a continuation lower closing within D1-C‑D 1.92400 after testing W1/D1 Demand End twice. Friday closed as a doji with longer selling wick

- Price trading above D1/W1 QLo (got tested multiple times)

Sentiment summary — Slightly Bearish

- With W1 closing lower there could be continuation to the move. Although D1 Demand End has been tested it has not been taken out.

- If price takes out demand there could be a continuation to the move although there was some strong W1 Accumulation around these levels before.

- Although due to price trading above D1/W1 QLo and a possible MN consolidation and having rejected W1 QLo without rotating to QHi there might be a move higher but price has not supported this thesis yet.

Additional notes

- N.A.

ZOIs for Possible Shorts

- D1-C‑S 1.94900

- D1-C‑S 1.93070

ZOIs for Possible Long

- D1-C‑D 1.92400

- W1-C‑D 1.90092

- MN-C‑D 1.89610

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym + mandatory cardio

- Aim to have a minimum of ONE TRADE per trading day

- Trading Rules

- Be mindful of DTTZs

- Only price-action based exit rules (or hit time stop)

- IF NOT… I will do a Bart Simpsons exercise of 7 days, 50 sentences of: “I will trust my trading skills and take my exits accordingly”.

- M15/M30 combination at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- At least 1 trade with 1% risk, 2nd trade only if first one worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING